Jake Ridley, CFP®

Table of Contents

Intro

Have you been scouring Zillow looking to buy your first house?

Or maybe you’ve been driving around on evenings and weekends looking to upgrade your digs?

In today’s housing market, most people spend more time picking out a new pair of shoes than they do making the biggest purchase of their lives.

Before you get too hot and heavy with your new favorite house, make sure you go in confident and prepared with these 3 home buying principles.

Understanding these will help make your future home the true blessing you envision.

Homebuying Principle 1: Why Buy a House?

What’s the point of buying a house? It’s a good investment? It’s a stop on the way towards your forever home? You’ve been told renting is throwing away money?

Answering this question honestly is an important step in making a good, informed home-buying decision.

I suggest the best reason to purchase a house is not investment related.

The best reasons to purchase a house are home related, meaning you can see this house as your actual home; you like the neighbors, your children’s friends live there, you like the schools, its where your church community lives, you like its proximity to restaurants, etc.

These are all great reasons to purchase a home. In fact, these types of factors are really what make owning a home most enjoyable.

Seeing your home primarily as an investment will likely set yourself up for heartache.

Now, there is nothing wrong if your house increases in value but see this as the icing and not the cake.

You want to buy a house because it’s in a place you can see yourself living for the long-term.

If you bought it because of the neighbors, schools, location, etc., and the housing market declines, it doesn’t bother you, that’s not why you bought it.

If it increases in value, that’s just gravy.

So, the first principle is to look for the qualities that make your house a good home and not from an investment standpoint.

Homebuying Principle 2: Don’t Get Over Your Financial Skis!

It is so easy to get swept away in the emotion of purchasing a home.

When home prices are rising rapidly, like they have recently, it’s even harder.

Please be aware, though, purchasing a home before you’re ready can have long-lasting negative consequences.

What does it look like to be ready?

First, make sure you are buying for the reasons mentioned above (you like the area, you like the schools, location, etc.).

As an aside, getting to know an area is actually a very good reason to rent. So don’t get caught up in the ‘renting is throwing away money’ line. Renting to get a better feel for an area is actually a very wise use of your money.

Second, make sure you have a sufficient down-payment. Generally, at least 20% is preferred to avoid PMI (Private Mortgage Insurance).

This also gives you some equity in the home if home prices do stagnate and you must move.

Third, make sure your housing costs – mortgage, insurance, property taxes, HOA fees – don’t exceed 25% of your gross income.

If you can keep it lower than that, even better.

25% and below gives you some buffer to be able to do other things besides pay your mortgage and eat.

Just using rough math, if 10% of your income is going towards retirement, 15% towards taxes, 10% towards giving, and 30% towards your house, that only gives you 35% of your income for everything else.

Your house will quickly feel like a burden at those levels.

Realistically, if your mortgage is a large percentage of your income, things like retirement savings and giving are usually neglected.

This is pretty much the definition of ‘mortgaging your future’. Keeping your housing costs within your means will give you the breathing room to make it a blessing.

Homebuying Principle 3: Understand How a Mortgage Works (Amortization)

This one may feel a little in the weeds initially but stick with me because it’s important.

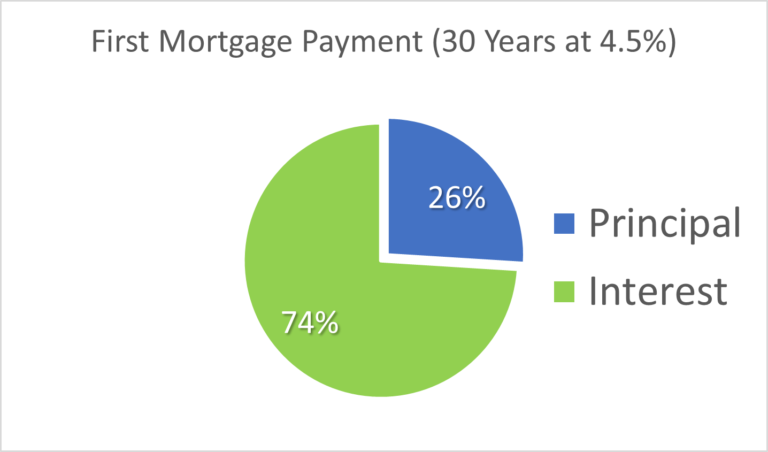

Without googling (or reading ahead!), what percentage of your first mortgage payment goes to paying down principal and how much goes to paying interest?

Half and half? 25% to interest? I have no idea what you are even talking about?

On a 30-year mortgage at today’s rates of 4.5%, your first payment is 74% interest and 26% principal!

Surprised? I certainly was when I first started looking into this thing called amortization.

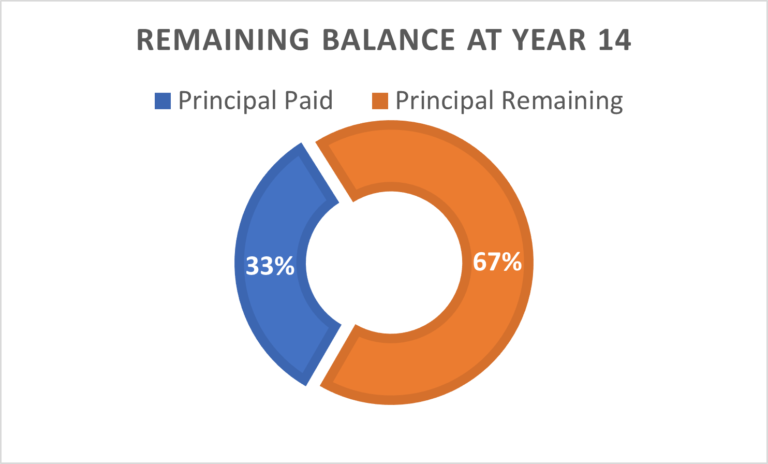

But that’s just the first payment, you start paying down principal pretty quickly, right?

Actually, using the facts above (4.5%/30 Years), your payments don’t flip to paying majority principal until Year 14. And by Year 14, you’ve only paid down about 1/3rd of the mortgage.

So, outside of being an interesting fact, why does this matter? And why did I title this section ‘Amortization’?

Amortization is the fancy finance term that just means you are spreading out a loan into a series of fixed payments.

Amortizing your mortgage is helpful because it keeps your monthly payment fixed for the life of the loan (this is what makes buying a home a hedge against inflation).

Importantly though, the total payment is fixed but the principal and interest payments are different each month.

As we just pointed out, the payments are heavily skewed towards interest at the beginning of the loan and the higher the interest rate, the greater the skew.

What does this mean practically?

You should plan on staying in your house long-term.

On a 30-year mortgage, if you are like most homeowners and live in your house about 10 years (about 5-7 years for first-time homebuyers) and decide to sell, most of your equity will be tied to your home’s appreciation in value, which is risky.

Remember the point about not buying a house for investment reasons?

If you are buying your house as a means to get to your next home (i.e., an investment) you can set yourself up for some serious trouble. And the shorter the duration you stay in your home, the riskier this becomes because of how a mortgage is structured.

The best way to protect yourself from this risk gets back to points #1 and #2.

Buy a house that you can see yourself enjoying long-term and fits within your budget.

Also, reducing your mortgage term will reduce this risk.

A 15-year mortgage is recommended for someone likely to retire around in the next 15 or so years. Ideally, you do not have a mortgage as you enter retirement.

Conclusion

To close, the home-buying process can be exciting, depressing, frustrating, exhausting, and pretty much every other face on the ‘feelings face chart’ all within the same day in this environment.

But stepping back and making sure you are buying for the right reasons, you have the money, and understand how your mortgage works, you can set yourself up to enjoy your home.

There are certainly exceptions to these 3 rules, especially recently with home prices increasing rapidly.

But understanding the actual risks of owning a home can go a long way in making a truly informed decision and truly enjoying your home.