Jake Ridley, CFP®

Table of Contents

Intro

Have you recently run across investments labeled as “Biblically Responsible” or “Faith-Based” and are wondering whether your investment portfolio is aligned with your faith?

Or maybe you’re past the point of wondering and the wondering has turned into full blown guilt?

If so, then this article is for you.

I have been tracking these funds for some time now and after examining them critically, I’ve observed 3 common fundamental flaws.

Let’s take a look.

Fundamental Flaw 1: They Overpromise and Underdeliver

Most of these funds make lofty promises.

Many will promise to ‘ensure’ your funds are going to be invested only in wholesome companies and will exclude companies found to be in the Alcohol, Gambling, Tobacco, or Abortion industries.

The problem is promising that ‘not a penny’ of your funds are going to those industries is hard (impossible?) to deliver.

For example, many of the funds examined claimed to screen out companies that manufacture, distill, or distribute alcoholic beverages. Sounds straightforward, right?

The problem is when you look at the actual underlying investments (companies) of the funds, some pretty obvious ‘alcoholic’ companies show up – Costco as an example.

Now, Lauren can confirm I have NOTHING against Costco. I could spend $1,000 in that place every time I go.

Anybody who’s stepped in a Costco, though, knows a substantial portion of the building is dedicated to alcohol – and then there’s that little liquor store off to the side just in case you forgot!

This is just a quick example, as there are many more in each fund.

The problem, though, is not that the fund’s processes are bad and a company slipped through the screens. It’s just impossible to scrub a portfolio clean of ‘sin’, even in areas that are specifically targeted to be excluded by the fund.

If you’re interested in a fund, do your due diligence by looking at the underlying companies inside of the investment fund. Don’t just take the fund’s word for it, because frequently what they promise is not being delivered.

Fundamental Flaw 2: Fund Turnover

Fund turnover is the term used to describe how often a fund adds/removes its underlying investments.

For example, a fund with 100% turnover means all the investments inside of the fund were replaced with other investments.

Turnover typically happens when one investment goes out of favor and is replaced by another that the manager views as in favor.

Most of the funds I’ve reviewed in the faith-based space have higher than average turnover, some as high as 60%.

That creates a problem for the faith-based investor.

First, if they invested with the fund because they reviewed and agreed with the underlying investments (because they read # 1 above!), well, those have changed – potentially substantially for a fund with a 60% turnover (meaning more than half of the investments have been replaced).

Second, if the preceding funds were removed, doesn’t that beg the question of why they were originally included?

Were they not actually moral companies to begin with?

Did they turn immoral in that period?

Are there really a whole other group of investments that were now found to be moral?

The takeaway here is to review the fund’s turnover before investing.

If it has a high turnover (most do) then that raises a flag, in my opinion.

Fundamental Flaw 3: Guilt Marketing

This one raises my blood pressure.

The number of funds that ratchet up their guilt in the name of Jesus, and just happen to have the solution for said guilt (their fund!) is frustrating. It may not be full out Martin Luther (the OG) style indulgences, but it’s close.

Look, I get that they are passionate about their product. There is nothing wrong with that.

But a line gets crossed when you start implying God’s disappointment or God is upset that someone may have an immoral investment somewhere in their portfolio.

Please stop the guilt marketing.

There is no investment fund without sin, including faith-based options.

The Lord would not be pleased (how about that guilt Jiu-Jitsu move?).

What’s Your Personal Conviction?

Investing in and of itself is amoral, neither good nor bad. However, what we invest in (i.e., profit from) can, of course, be moral or immoral.

We don’t need a Bible verse to tell us getting rich by selling drugs is wrong. We also know there is no sinless investment. Somewhere, someway, somehow, some company in your portfolio earned a penny immorally.

The problem is the gray area in between the obvious extremes.

I believe this gray area is where personal conviction comes into play.

Paul’s guidance to the Romans in Chapter 14 (Romans 14:1-12) is appropriate for these types of gray area decisions.

The backdrop is that there seems to be a quarrel that has broken out among the believers in Rome about what they can or can’t eat. Some are convicted that their Christian liberty allows them to eat whatever they want. Others were convicted that they should abstain from eating certain foods.

So, who’s right? Paul wisely points out that, “each should be fully convinced in his/her own mind”. There is no black and white answer. It is a personal decision based on one’s conscience enabled by the Holy Spirit.

The same principle applies in investing. What you define as ‘sin’ or too much ‘sin’ is a personal conviction.

If you want to exclude the Costco’s of the world because they sell alcohol, that’s fine.

If you want to include the Costco’s of the world because they pass your personal screening process, that’s fine too.

There is no right or wrong answer in this gray area.

If you are passionate about the way companies do business, then do it to the best of your ability and research them yourself.

The odds of finding a fund manager that aligns with your beliefs is small, and the fund will change (see point #2)!

It’s too personal of a decision to outsource your morality to someone else. Now, guilt be gone!

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.

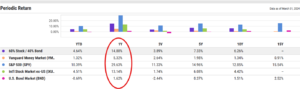

Should you invest in the market at all when CD’s, money market, high-yield savings, and T-bills are all at their highest rates in over a decade?

Pingback: Faithful Investing – Retirement Stewardship

This is a well thought out article on faith based investment options. I have often thought about but never pursued an answer to this and am grateful to have stumbled here via Chris Cagle’s article on Faithful Investing. Thank you Jake!

Thanks for the kind words, Nicole! Glad it was helpful!