Jake Ridley, CFP®

Jump to a Section

2023 Was a Rollercoaster

2023 has been an investment rollercoaster.

- We started the year certain a recession was on the horizon.

- Then some important banks failed.

- But, then, AI saved the day and markets rallied.

- We were headed for a hard landing, then no landing, then soft landing.

- But then we had a correction in October that brought the Doomers back out front (they never go away).

- Now, inflation seems to be ‘fixed’, and the question is just how far and fast the Fed will cut rates.

- But the market may be pricing in too many cuts.

And with all that, where is the market now? As of today (12/18/2023), the S&P 500 is up over 25% year-to-date and close to getting back to its January 2022 highs. But it has been anything but a smooth ride in between.

With 2023 providing many investing life lessons packed into one year, what were its most important lessons?

Lesson 1: Get Comfortable Being Uncomfortable (No Pain, No Gain)

2022 was painful.

We experienced a severe 30% decline and most forecasters expected 2023 to be more of the same – or worse (see the chart in lesson 3).

On top of that, we heard the siren song of 5% interest rates calling out, “come hither and escape that big, bad market.”

This was the first time in a long, long time there was a viable, safe alternative to the market.

But investing is like exercise: no pain, no gain (thanks Jane Fonda). There is no return without risk.

This year truly required some fortitude. You had a prolonged downturn (it didn’t bounce right back like during Covid) and there was a nice, safe alternative in 5% interest rates. But if you decided to embrace the uncertainty and invest, you were rewarded.

The technical, investment nerd term for this is the ‘equity-risk premium’. It just means the market provides an excess return over safety BECAUSE of its risk. It’s not an accident.

And if you were one of the select few that chose to embrace that uncertainty rather than shy away from it, give yourself a high-five. You earned that money this year.

And make sure you remember this year and file it away for future use when tempted to waive the white investment flag.

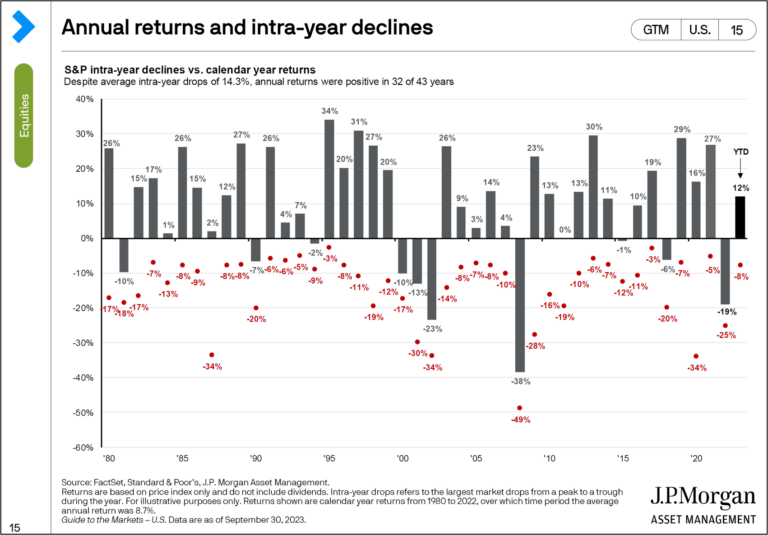

Sometimes I think downturns can be minimized by advisors, me included. Those downturns are relatively small when compared to the overall market growth, but they are very painful! Some more than others.

Investing despite that pain should be commended – and rewarded!

Lesson 2: History Sure Was a Helpful Guide This Year

I love history.

I especially love it when history grants a unique perspective on current events.

And I really love it when that unique perspective leads to positive outcomes.

2023 was one of those years.

There were all sorts of narratives out there and most were pessimistic. Stagflation had returned. The next recession. Higher for longer. The next Great Depression. The Magnificent Seven bubble.

And on and on.

But counter to those compelling negative narratives was actual history. And history presented a very compelling argument that the next several years would have higher than average returns.

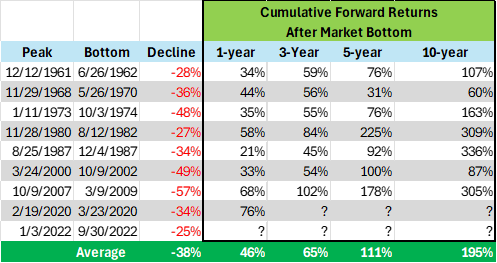

Here’s an example. Just about everyone I’ve met within the last 12 months has seen this one.

But that’s because it’s so good.

This is what the chart looked like in September of last year.

See that ‘?’ in the 1-year numbers after the 9/30/22 downturn?

Well, now we can fill it in.

The S&P 500 returned 24.32% 1 year from the market bottom of 10/12/2022.

Just like every other significant downturn (25% or more drop) since 1950, the next 12 months were really good for performance. Remember the Warren Buffett line, “be greedy when others are fearful and fearful when others are greedy”? This is exactly what he’s talking about.

October of 2022 was full of fear.

And investing in the face of heightened fear is well, scary.

To make it even harder there was that nice, safe guaranteed 4-5% to be had in cash.

It was a genuinely hard decision to make, especially if you were deciding what to do with your cash. And here’s the thing, there is no immutable law that says the market must go up after things get bad.

There are no guarantees in investing.

That’s the point, though! If you flip that uncertainty on its head and embrace it, historically that has worked out really well.

Let’s hope the rest of this recovery plays out like the other periods in the chart.

There are absolutely no guarantees that it will, BUT that’s a good thing.

See lesson 1 above: Get comfortable being uncomfortable.

Lesson 3: Don’t Invest Based on Short-Term Predictions

I could probably copy/paste this paragraph every year. Short-term market predictions are almost always wrong.

They are usually painted with a brush influenced by the time of their writing – also known as recency bias.

Now, I’m sure these predictions are probably done at gun point as the analysts forced to make them aware of their abysmal track record. But man were they off this year.

Here are two examples. First, the below chart was made in December 2022 after polling all the major banks (i.e., the really smart finance people who are paid a lot of money).

Past performance is no guarantee of future results

As of today (12/18/2023), the S&P 500 sits at 4,740.46. Everyone was off. Anywhere from 25% to 5%. Most sit somewhere in between. It’s fair to say they missed it, some really badly. Don’t make investment decisions based on short-term forecasts.

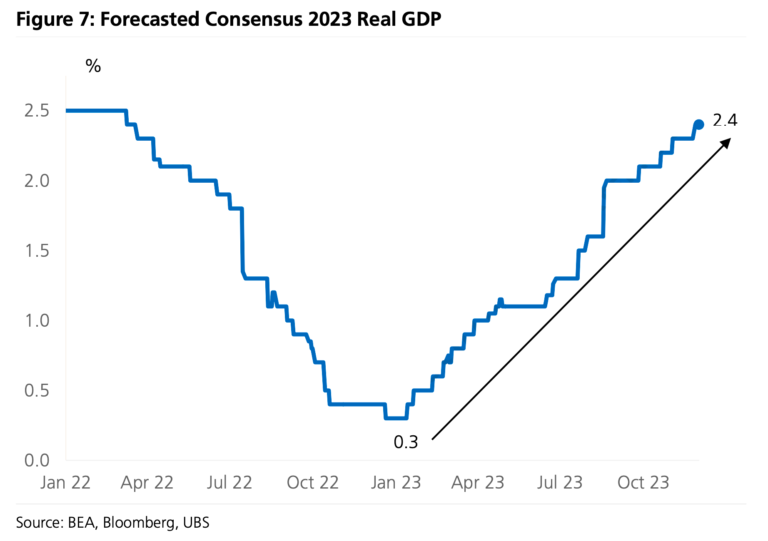

Wall Street had a tough go but what about super smart economists? Yeah, no. The chart below shows their GDP forecast revisions for the past 2 years. They forecasted 2.5% real GDP in January 2022, revised it down to .3% GDP in January 2023, and now back up to 2.4% GDP in October 2023. Again, in fairness, it’s not that they are dumb. It’s just super hard to predict these things and the information changes daily. Don’t make investment decisions based on short-term forecasts, even if they are super smart economists.

Looking into 2024

2023 was a roller coaster for sure. We saw interest rates rise to levels not seen in decades.

Inflation come in higher than expected and then lower (for now at least).

Major banks failing. Ai take off. Some large companies rallying more than 70%. And to top it all off, the S&P appears to be on the cusp of all-time-highs.

How should this impact our 2024?

Investment-wise, we should never get too high or too low. Don’t fall into either trap.

The most important thing is to file these lessons away in our collective memories for when (not if) this happens in the future.

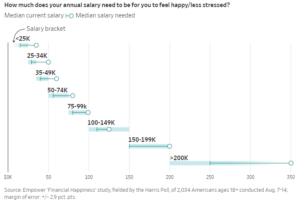

So, as we move into 2024, I’ll leave you one last chart.

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.

Should you invest in the market at all when CD’s, money market, high-yield savings, and T-bills are all at their highest rates in over a decade?

Pingback: Three Important Investment Lessons of 2023 – Astoria Strategic Wealth