Jake Ridley, CFP®

Jump to a Section

Was Rahm Right?

Barack Obama’s Chief of Staff, Rahm Emanuel, is famous (or infamous) for saying “Never let a serious crisis go to waste”. His point? Crises present political opportunities. As cynical as that view is, I do think there is a more positive, but similar investment view.

Investors shouldn’t let a good year go to waste. What do I mean by this? Don’t take it for granted when your investment fortitude pays off. The past year is a great example. Just think back twelve months. We had historically high inflation, bank failures, wars, and decades-high interest rates. There was a lot of uncertainty and fear. And for the first time in a long time, cash at 5% was a viable alternative to the scary market.

But for those of you who stayed the course or added to your portfolio, you get a high-five. You stayed the course. You didn’t panic. You understood your portfolio is there for the long-term. You knew the damage of missing out on the good times. Even better than a high-five, you were rewarded in your portfolios through higher returns. Don’t take these decisions for granted.

There will be tumultuous, volatile, scary times in the future as well. When those uncertain times come – and they will come – pull the last year from your memory bank when you are tempted to “jump”. Don’t let a good year go to waste.

Dang Markets, You Scary

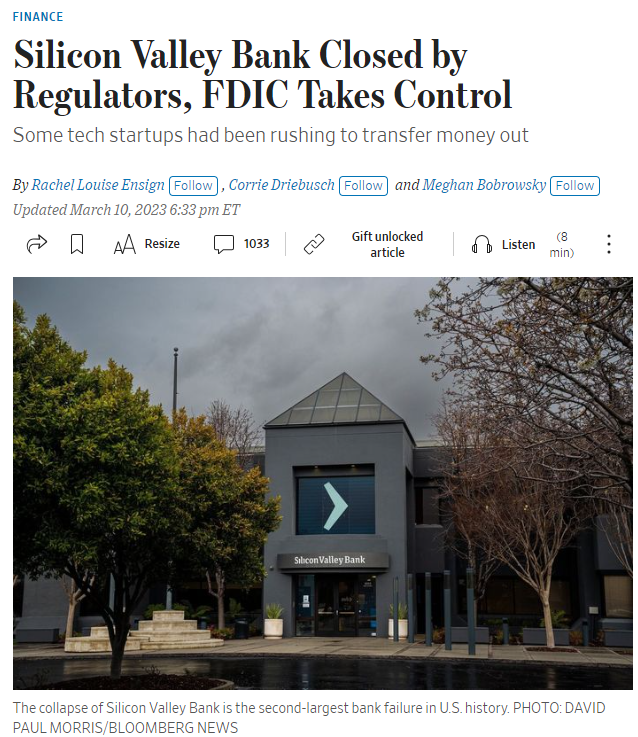

This time last year things were scary. In March of 2023, we had the largest bank collapse since 2008. Several more bank collapses followed, and no one knew if there were more to come.

This was all caused by the fastest interest rate increase in history due to inflation numbers we hadn’t seen in decades. And playing in the background was the War in Ukraine hitting its 1-year anniversary. Then to reinforce the fear, many were saying the worst was yet to come. Market bears that had thankfully disappeared, reappeared. The financial news is hardly ever your friend. But it’s especially painful when bad stuff actually comes to fruition.

With all this bad news, it’s hardly a surprise many decided to wait it out in cash. Unfortunately, the market doesn’t typically reward investors when things look better, quite the opposite. The Warren Buffet saying, “to be fearful when others are greedy and to be greedy only when others are fearful” applies here.

So, how did investors fare that leaned into this uncertainty?

What Actually Happened

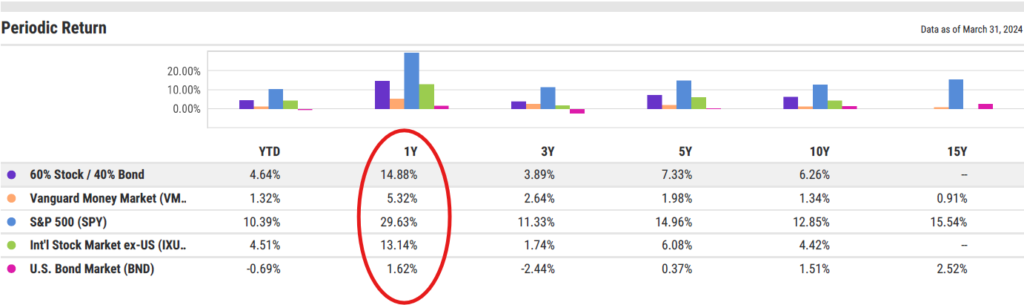

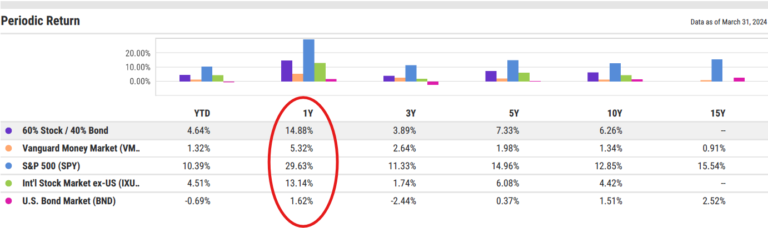

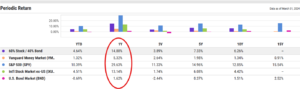

The major stock markets rallied significantly. According to the chart below, a well-diversified, 60% stock and 40% bond portfolio returned almost 15%. This is compared to a 5.32% return for cash. Almost 3x the return. With all the uncertainty, how did this happen?

First, while the investing world was focused on interest rates, an explosion in AI interest fueled a rally in U.S. stocks, especially those exposed to AI. For example, the flagship AI stock, Nvidia (NVDA) almost QUADRUPLED its size in one year. It grew from being 2% of the S&P500 to over 5%. This is an enormous amount of growth in one year. An entire blog post could be devoted to this one stock alone.

One big investing takeaway from last year is: You can’t be a single variable investor. What’s a single variable investor? The entire investing world was focused on interest rates at the time. The conventional wisdom was high interest rates were bad for stocks. And we had interest rates at a multi-decade high. So, stocks should have done poorly, right? Not so fast. The AI boom came out of nowhere and gave fuel to a remarkable stock market rally, even with stocks competing with attractive interest rates for the first time in decades. The world is a lot more complicated than one variable.

In addition to the AI boom, there were small signs that inflation might be waning. The market interpreted these as signs of hope that the Federal Reserve was almost done raising its rates.

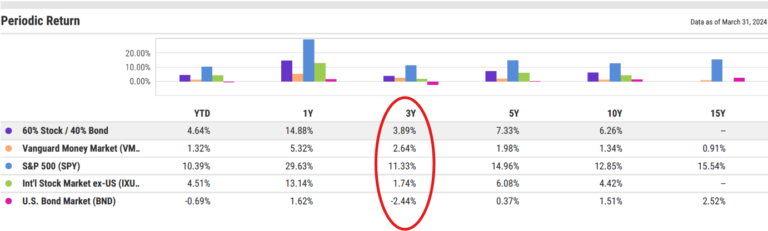

Also, it’s important to note that anything can happen in a one-year period. As a long-term investor, one-year is noise. And if you look at the three-year return numbers, they are actually closer to the cash return numbers. This is because the market priced in the Fed’s aggressive interest rate cuts mostly back in 2022. So, if you were investing based on that “signal” in 2023, the market had already priced it in and moved on.

The last critical observation from the chart below is the importance of diversification. On a 3-year basis, the 60% stock / 40% bond portfolio outperforms cash by a little over 1% and it gets exponentially better the longer the time period. However, only one of the three major asset classes (U.S. Stocks) outperformed cash over that period. At Astoria, we are fond of saying, “every asset has its day in the sun, you just never know when”. The 60/40 is simply a mixture of those 3 asset classes.

Here’s the deal. By staying invested or adding to your portfolio you did the thing. You stayed the course when things were bleak. If you added to your portfolio, you weren’t just playing defense, you went on the offensive. You jiu-jitsued the market’s fear into an opportunity. Nice job! Now, use this for future use when (not if) things get uncertain again.

What Next?

The problem with investing is we don’t know the future; hindsight is 20/20. How should you invest today with markets at all-time highs, multiple wars, a tumultuous election upcoming, and all sorts of other uncertainties? Take the wisdom you gained from 2023 and put it to use. Here are some practical tips.

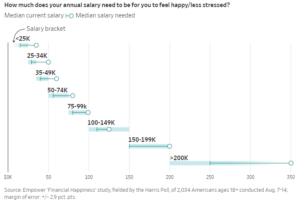

First and foremost, clearly define the objective of all your funds – including your cash. Prior to retirement, your emergency fund should be fully funded. Any anticipated taxes due should be in a separate fund. Vacations, home remodels, car purchases, etc. should also be in their own funds. All these short-term goals are GREAT places to take advantage of higher interest rates via high-yield savings accounts, CDs, or money markets. Your short-term obligations should be fully funded before you consider your long-term investing goals. That cash acts as a protective moat around your long-term investments.

When considering your long-term portfolio, don’t try and get out and back in. That’s a mortal sin in the investing world. What about new cash? Assuming your short-term needs are funded, contribute to your portfolio in one of two ways: lump sum or dollar-cost-averaging. Remember the purpose of the money, its time horizon (long-term), and then let the market take care of you. The key is to invest and stay invested. Each year brings a new batch of uncertainty. Just like 2023 did. Don’t forget!

Don’t Forget

It’s important to file these investment memories for future use. Write them down. Put a marker in your portfolio. Whatever you can do to remind yourself of the uncertainty and the subsequent recovery. Then when your portfolio sees another downturn, you can look back and remember the last time your portfolio declined but recovered. These valuable investment experiences will only serve to strengthen your resolve the next time it happens – an especially critical muscle to develop in retirement. Don’t let a good year like last year go to waste!

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.

Should you invest in the market at all when CD’s, money market, high-yield savings, and T-bills are all at their highest rates in over a decade?