Jake Ridley, CFP®

Jump to a Section

A Great Question

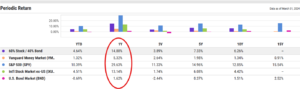

“Why should I invest in the market when I can get a guaranteed five percent right now?” What a great question. And with CD’s, money market accounts, high-yield savings, and T-bills all at their highest rates in over a decade, this question is being asked much more frequently.

Couple that guaranteed five percent with the growing fear caused by multiple wars, budget deficits, and a long-predicted recession, and it seems like a no-brainer to sit safely on the sidelines earning five percent. But like many “no-brainers” there is more to it than meets the eye. Let’s dig a little deeper.

The “Guaranteed” Can Be Short-Lived

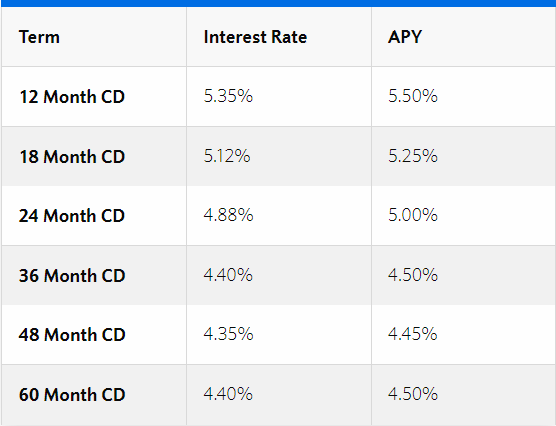

In the investment world, there is a thing called “reinvestment rate risk”. Investopedia defines this as, “Reinvestment rate risk refers to the possibility that an investor will be unable to reinvest…at a rate comparable to their current rate of return.” This just means that five percent likely won’t last forever. We can see this with CD’s right now. Here’s an example from Barclay’s Online CD’s.

If you were to invest in a 12-month CD, you’d get a solid 5.50% APY. Then, 12 months later the CD matures, and you get your initial investment back. What interest rate will you be able to lock-in 12 months later?

The rates advertised currently indicate Barclays expects them to be lower.

How?

The 18-month and 24-month CD rates are lower than the 12-month, meaning Barclays expects rates to be lower 18 months and 24 months from now than they are today. This is very counterintuitive, by the way. Shouldn’t you get more interest for having your money tied up for longer? Yes, you should, and this is a product of what’s called the inverted yield curve.

The inverted yield curve deserves its own post, but in short this signals the economy is not operating the way it’s supposed to. The market doesn’t think what the Fed is doing is sustainable and interest rates will have to be lowered (usually due to a recession).

Stated another way, these interest rates are likely to be short-lived. Yes, you will get a guaranteed five percent for 12 months, but when that CD matures the odds are interest rates will be lower.

This is reinvestment rate risk.

What Might Have Been (Opportunity Cost)

“But Jake” you say “I don’t care what happens a year from now. I’ll cross that bridge when I get there.” A fair point. Something to consider, though, is “what might have been”, more technically known as opportunity cost.

A concept explained back in 1993, when mullets reigned supreme, by the band “Little Texas”.

In short, that guaranteed five percent may not be as attractive when compared to alternatives. There may have been a better option.

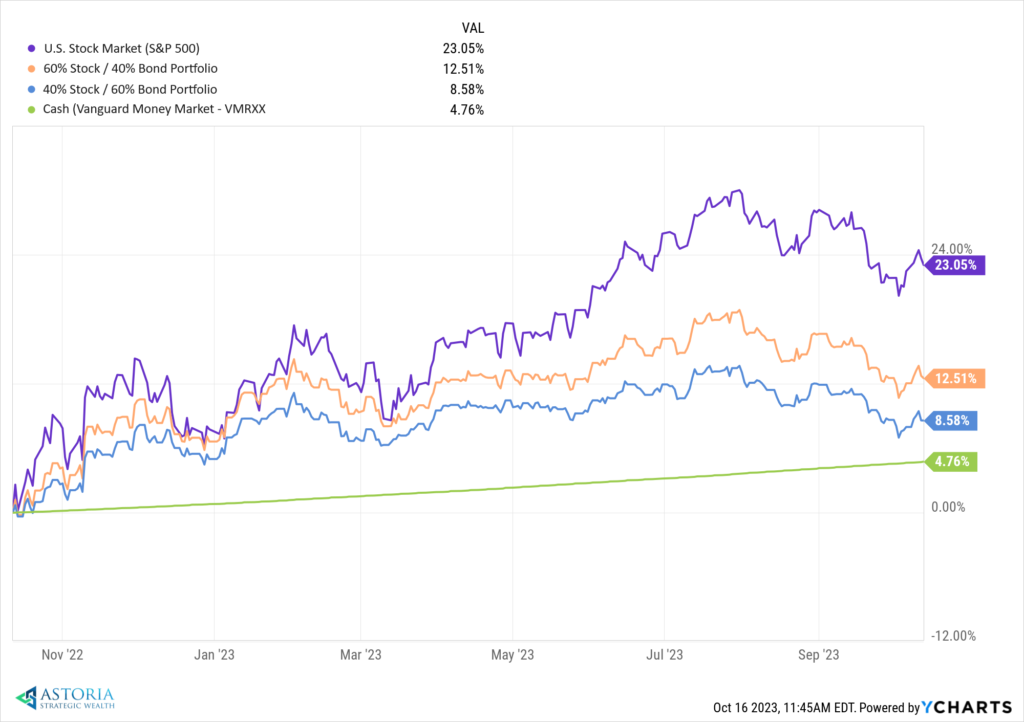

Here were three potential alternatives:

- 100% stocks (S&P 500),

- 60/40 portfolio (60% stocks/40% bonds)

- 40/60 portfolio (40% stocks/60% bonds)

For the time-period, let’s go back to October 12th, 2022, the market bottom. This was a time of heightened fear and uncertainty (i.e., an ideal time to wait things out in a money market fund).

As you can see, cash did return a solid 4.76%. You can also see there was no volatility (it doesn’t zig and zag). However, even a relatively conservative 40% stock and 60% bond allocation returned 8.58%. The 100% stock portfolio returned almost five times the amount of cash at 23.05%.

This is opportunity cost.

Hindsight is 20/20, though, right?

Of course, we can always look back in history and think “what might have been”. Another very fair point.

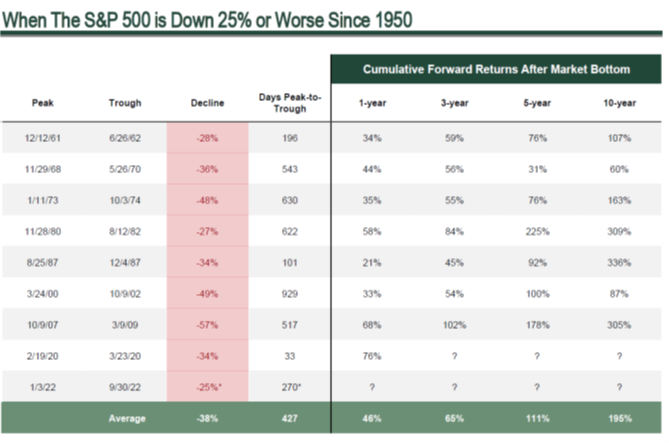

However, what happened in the past 12 months was not unprecedented. It’s actually the norm. How do I know? The chart below is one our firm (Astoria Strategic Wealth) has been referencing for the past year.

It shows that when the market has bottomed historically, the returns for the next 1,3,5, and 10 years have been very strong. Funny enough, on a 1-year basis, the lowest subsequent 12-month return was 21% (1987), pretty close to our current 23%.

The bottom line? There are no guarantees in investing. There is a reason we must disclose everything with a “past performance is no guarantee of future results.” Because it’s true.

But historically, when the stock market has had a large drawdown, subsequent months and years have experienced strong returns, particularly when compared to cash and CD rates.

Define the Relationship (DTR)

This brings us to the final and most important point. Reinvestment risk and opportunity cost are important. However, they only matter in the long-term.

This is why defining the purpose of your money is the most important thing you can do; what is the money for?

For example, your emergency fund should be in a different place than your retirement savings. In your emergency fund, you need fast access to it (liquidity) AND it can’t lose value (no risk). Reinvestment risk and opportunity cost don’t matter here. What matters is that the money is there and available in an emergency. This is an ideal place for that guaranteed-five percent through a money market or high-yield savings account.

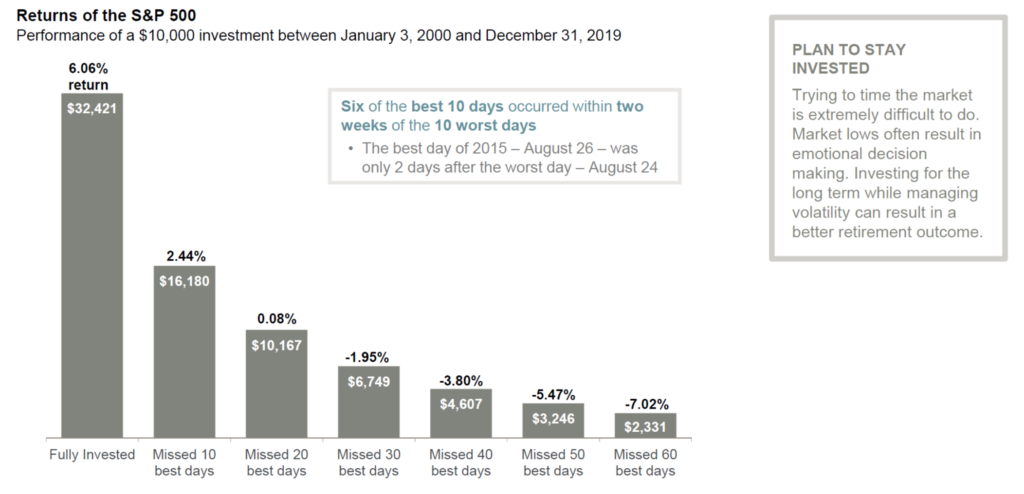

On the other hand, your retirement portfolio needs a return to outpace inflation. You can’t afford to miss out on the market’s best days (see the chart below). Significant long-term damage can be done if you sell out at the bottom (or just choose not to invest) and miss out on the subsequent rebound, like we experienced last year.

That’s why the most important factor in all of this is to have a purpose and objective for each dollar. Only then can you determine its highest and best use.

Summary

Interest rates have not been at these levels in a very long time. And it is tempting to avoid the market’s fluctuations altogether and be satisfied with the rates offered by CD’s, money markets, etc. However, keep in mind you may be subjecting yourself to risks not immediately apparent, namely reinvestment rate risk and opportunity cost risk.

More important than this, though, is having a plan and concrete objective for your funds. Only by defining the objectives of your funds can you then determine their best course of action.

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. Performance reported gross of fees. You cannot invest in an index. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

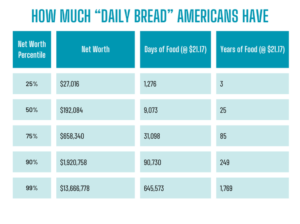

Most Americans have 25 years of “daily bread” stored up in their accounts. So, what does it actually mean for us to pray for “daily bread”?

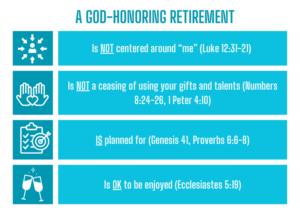

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

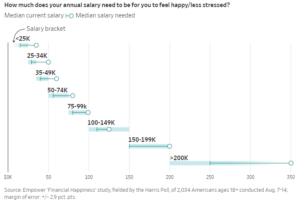

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?