Jake Ridley, CFP®

Jump to a Section

Worried About America?

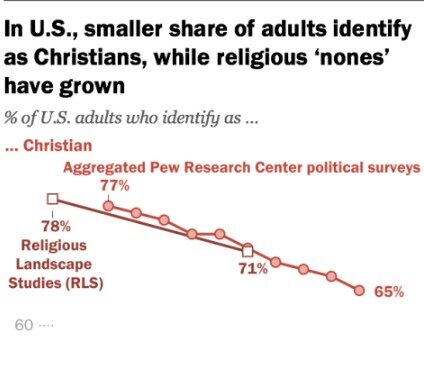

Are you worried about your investments in what appears to be a post-Christian America? Does watching the news just make your stomach hurt? I’m with you. Christianity in America certainly appears to be in decline. This Pew study indicates the “% of adults who identify as Christian” declined from 77% in 2009 to 65% in 2019. Whether it’s in our schools, jobs, military, or even where we shop, all facets of our life seem to be affected by this “post-Christian” worldview.

The effects of this decline can be scary to think about. And frequently this fear translates into real fear about our investments. After all, our investment portfolios represent a hopeful future (otherwise why invest?) and investment returns are driven by expectations about the future. And if that future is in peril, then our investments are too. So, how should Christians think about their investments when they are fearful of the future of America?

Acknowledge What You Can and Can’t Control

First, it helps to recognize what we have control over and what we don’t. Here’s a list of things we don’t have control over: The stock market, the weather, our favorite sports team, our least favorite sports team, the past, the future, and most other things in this world. In fact, the list of things we do have control over is pretty small.

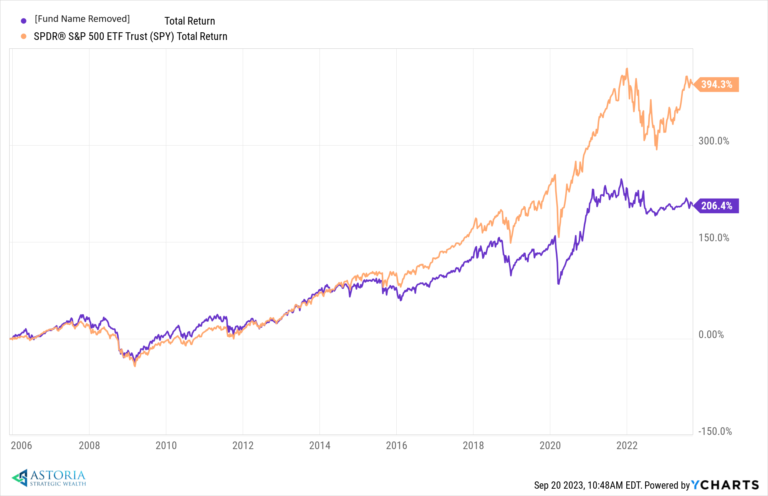

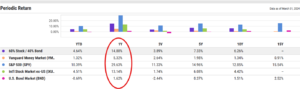

“But Jake”, you say, “I do have control. I can get out of the stock market now and get back in when things look better!” Sorry, but market timing is the investing equivalent of kicking against the goads – you are likely only harming yourself. Here is my obligatory comment that 90% of active managers (many trying to time the market) underperform the market. As an anecdotal example, the fund below attempts to time the market. They went to mostly cash during 2022, which worked. However, the hardest part of market timing is getting back in. This fund didn’t enter back into the market until July this year, missing out on almost 15% in returns. The result? Even though 2022’s losses were reduced, the performance still lags the S&P500 (ticker: SPY) by almost 3% when combining both 2022 and 2023. And its lifetime returns (almost 18 years) are roughly half of its S&P 500 benchmark. Trying to get in and out of the market in the name of control is just an illusion.

What can we do as Christians? First, we can pray for our nation, its leaders, our community and its leaders, our neighbors, and our own hearts. We can also practice loving our neighbors. God will not hold me accountable for the macro but he certainly will for how I love my neighbors. Lastly, and most importantly, don’t worry. Jesus makes it clear that worrying adds nothing to our lives. Please don’t translate your worry into changing your portfolio. It will likely lead only to more heartache (and more worry).

Understand What You Are Really Invested In

Here is a harsh reality: there is no portfolio that will protect us from an economic collapse. No amount of diversification will save us if an actual global economic meltdown happens. I’m not talking about a crisis (e.g., The Great Recession, The Dot-Com Bust, or even the Great Depression). I’m talking about Armageddon, which is really what people fear. When you understand this, it’s actually quite freeing and creates investment clarity. Here’s how it has for me.

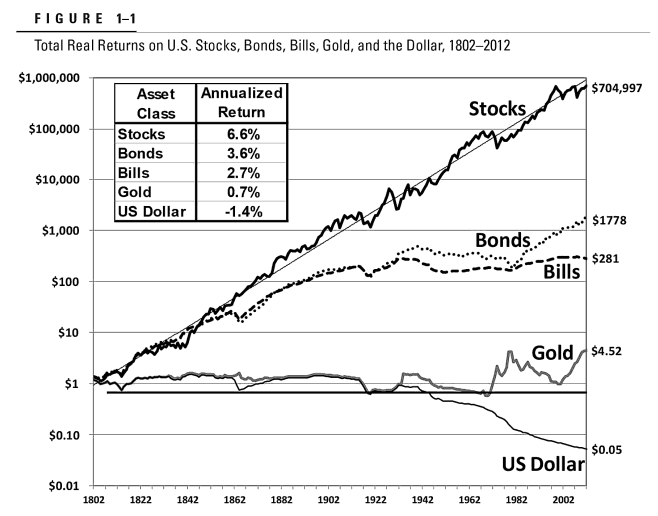

My investments allow me to participate in the profits of almost every public company in the world – basically the growth of the global economy. For the last several centuries, that has been a winning formula (not without some serious turbulence) because companies in the global economy – especially in the US – have become more and more productive and profitable. If that changes (i.e., the global economy collapses) then I am going to have more important things to worry about than my portfolio – seriously. Survival skills (and maybe physical gold) is what’s needed for that scenario, not a retirement portfolio.

There is no portfolio positioning to protect against a collapse. The bottom line for my investments? If the global economy continues to grow as it has for the past few hundred years, I will participate. If it doesn’t? There will be more important things to worry about.

There is Nothing New Under the Sun

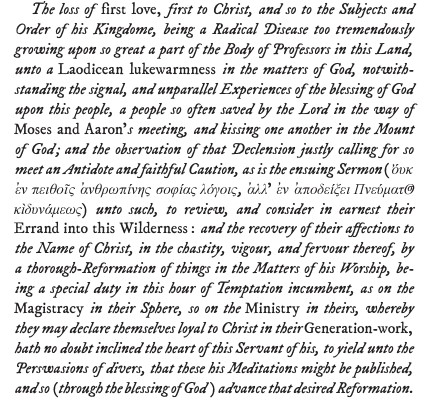

At the risk of sounding like the “everything is fine” dog, I would like to point out that the “decline of America” has been pronounced since quite literally the beginning. In fact, by the 1670’s the second generation of Puritans were already lamenting the decline in its culture and longing for the days of yore (see the snip below). This rhetoric even has a name: jeremiad – named after the prophet Jeremiah. Pastor Matt McCullough sums up the problem with the jeremiad here: The problem with jeremiads is that they often compared the best parts of a former generation with the worst parts of their own. Neither the past nor the present got a fair treatment.

Here’s the point, from the beginning of time each generation has lamented the future of the subsequent generations (and vice versa). And at some point they will be right. However, it won’t be because they offered a novel take on society. Older generations tend to get nostalgic (i.e., forget about the bad stuff) and are too pessimistic about the future. And newer generations dismiss (or cancel nowadays) those in the past while being unrealistically optimistic about the future. This will always be the case. Don’t make portfolio changes based on “this time is different.”

What You Can Do

Things are definitely changing, there is no doubt about that. But making a drastic shift in your investment portfolio based on fear for America’s future is not the answer. Remembering the things you have control over, who is ultimately in control (hint: God, not us), understanding exactly what your investments represent, and having a measured view of our past will go a long ways in easing your worries and preventing potentially harmful changes to your investments.

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.