Jake Ridley, CFP®

Table of Contents

Intro

What makes a successful investor?

Intelligence? Ice-water-in-your-veins risk taking? The part of town they grew up? Connections? All the above?

While there are undeniably many who have gotten wealthy because of these, you don’t need any of them to succeed.

As a matter of fact, never have the investing cards been as stacked in favor of the average person as they are today.

The ease of buying/selling funds, the ultra-low costs, the availability of information, etc. have all placed the power in the hands of the investor.

Unfortunately, this accessibility and proliferation of information have also created meme stocks, currencies created as a joke, and outright insanity in the investing world.

So, how do you take advantage of today’s environment and avoid the pitfalls?

Let’s look at five investing principles that, if followed, will set you up for a lifetime of investing success.

Investing Principle 1: Have Some Humility

The most important principle in investing is beginning from a place of humility; that you don’t know everything.

More money is lost by investors thinking they know better than the market than probably any other means.

Don’t believe me? Here are dozens of quotes from the world’s greatest investors speaking on the virtues of humility in investing.

Whether this lack of humility leads to trying to time the market’s ups and downs, picking individual stocks, trying their hand at crypto, or investing in actively traded funds, study after study highlights the underperformance created by investors (or managers) going against the market.

For example, an annual study of investor behavior showed that stock market investors in actively traded mutual funds (funds run by managers who are selecting stocks that they think will outperform) underperformed the overall market by 10% in 2021.

This year is another sobering reminder of how markets can humble investors.

So how do you invest with humility and avoid these scenarios?

Start with buying the market via low-cost, passive index funds.

As a reminder, all the ‘market’ really represents is the public’s consensus of what an investment is worth.

Think of the stock market as a really efficient information processing system via millions of daily buys and sells, like Zillow on steroids.

Also, just like Zillow, it’s really hard to find a deal. I’m not saying there aren’t ever any deals to be had, it’s just very hard to find them.

So, what kinds of funds track the market at low-cost?

Target date funds made up of index funds are a great place to start, particularly in your retirement accounts (not in your taxable account!).

Good target date funds, like Vanguard’s Target Date Series, are designed to track the market.

As you get more experience, you may develop stronger opinions and make some tweaks, but never stray too far from the market.

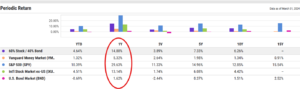

Funny enough, those that begin from this place of humility and track the market, usually end up outperforming the others – 90% of passive investments outperform their active counterparts over a 20-year period.

So, start your investing from a place of humility because the market will humble you if you don’t!

Investing Principle 2: Keep Things Simple

In investing, complexity is not your friend. For starters, the more complex a strategy is the harder it is to execute well.

The more moving parts there are to your strategy, the harder it will be to keep those plates spinning.

Plenty of investors overcomplicate their lives, and underperform, all because of the siren song of ‘sophistication’. Don’t confuse simplicity with a lack of sophistication!

The funds available to most investors today in a standard employer plan, like a 403(b), are incredibly simple and incredibly sophisticated.

Just take what is typically considered a ‘vanilla’ investment: The Vanguard Total Stock Market Index Fund (VTSAX).

This fund rarely makes changes, doesn’t pay gobs of money for fund managers to try and choose in/out of favor stocks, and simply tracks a basket of stocks representing the total U.S. stock market.

Through this investment you get to invest in over 4,000 unique stocks – basically the entire investable US stock market.

So, in essence, you can capture the growth of the U.S. Economy – the greatest wealth producing economy in the history of man – by investing in one mutual fund!

Given the availability of these simple, effective investments, you could gain exposure to the entire global economy by using 3-4 funds (or one with a Target Date!).

Your three-fund portfolio may not wow your friends, but the odds are your portfolio will outperform theirs in the long-run.

Don’t overcomplicate your life, keep it simple!

Investing Principle 3: Diversify

In Ecclesiastes, Solomon wisely states, “Divide your portion among seven, or even eight, for you do not know what disaster may befall the land.” (Ecclesiastes 11:2).

Warren Buffett similarly says, “Diversification is protection against ignorance.”

Notice the similarity, Solomon’s reason for diversifying is because, “…you do not know…” and Buffett’s is “…ignorance”.

The reason we diversify is because we don’t know the future. If we did know the future, there would be no need to diversify – you’d simply put all your eggs in the basket of the investment that will go up the most!

So, understanding you don’t know the future, your best bet is to spread your risk among many investments.

If that isn’t enough to persuade you to diversify, look at these three astounding facts from a JP Morgan study:

- Since 1980, roughly 40% of all stocks have suffered a permanent (i.e., they didn’t recover) 70% decline from their peak values.

- Two-thirds (66%) of all stocks underperformed vs. the stock market index (Russell 3000)

- 40% of all stocks had an absolute negative return

So, the next time you are tempted to buy into the next hot stock tip, remember the odds are stacked against you.

Given the dismal numbers of each company, you’d think the entire index would fare poorly, right?

Actually, the index had a staggering 11.43% annualized return for the same 35-year time period – meaning a $10,000 investment would turn into over $441,000.

Diversification is your friend!

Investing Principle 4: Minimize Fees

News flash, the financial world is full of opaque, hidden fees. Investment fees directly reduce the return of your investment.

For example: if the underlying investments of a fund generate 8% return each year and the fees of the investment are 1%, you get to take home 7%. That 1% may not sound like a lot, but when you compound it over an investor’s lifetime, it is an enormous amount.

The table below illustrates:

- Assumptions

- Years to Invest: 35

- Gross Return: 8%

- Contribution: $10,000/year

$340,799.25 is a lot of money!

Jack Bogle famously put it, “In investing, you get what you don’t pay for.”

Keep more of your money by understanding and minimizing the costs of your investments.

Investing Principle 5: Stay the Course

Last but not least, long-term investors must stay the course. This is a close cousin of the first principle on humility.

As an investor, you will experience downturns.

There is no sugar-coating that during your investing lifetime there will be some periods where your accounts are losing money.

However, the worst thing you can do is jump off by selling out of the market. Not only is it very difficult to figure out when to sell, even more difficult is deciding when to get back in.

You must be right twice to time the market correctly.

Most investors think about the first half of the equation and forget that they also must get back in at some point.

The first part is hard to do, the second part is really, really hard to do. Think about it: you already were scared enough to throw up the white flag and get out of the market, so how much harder emotionally is it then going to be to then get back in?

If in fact it does feel safe to get back into the market, the odds are the market has already recovered substantially or otherwise it wouldn’t feel safe! You’ve basically just sold low (when the market declined) and bought high (when the market recovered).

Not a good investment strategy!

As an investor you can mentally prepare yourself for the downturns by looking back historically at what devastating events the market has recovered from, like two world wars, a great depression, multiple pandemics, civil unrest, a financial crisis, etc.

Our economy is incredibly resilient. Take advantage of this by staying the course.

If you are in the contribution phase of your investing career, continue contributing to your accounts.

This has been a winning formula for over a hundred years.

Conclusion

In summary, becoming a successful long-term investor is simple but not easy.

Abstaining from the number of shiny objects being thrown at investors today requires some discipline.

But, if you begin every investment decision from a place of humility, keep your investments simple and effective, diversify, minimize investment fees, and stay the course, you will look up one day and be pleasantly shocked at the value of your investment accounts.

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. Performance reported gross of fees. You cannot invest in an index. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

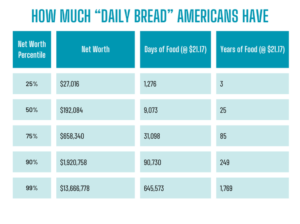

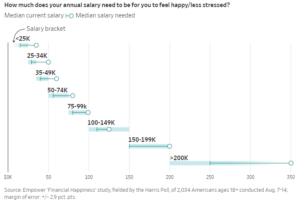

Most Americans have 25 years of “daily bread” stored up in their accounts. So, what does it actually mean for us to pray for “daily bread”?

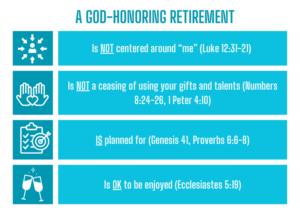

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

Pingback: Pastors: 3 Paradigm-Shifting Investment Facts - Church Fiduciary