Jump to a Section

What Is Biblically Responsible Investing?

Biblically Responsible Investing (BRI) seeks to align an investor’s faith with their investments.

It is an investment philosophy that attempts to screen (i.e., filter) securities (stocks, bonds, etc.) that do not fit the fund’s stated investment criteria and include securities that do.

Each fund has its own unique process and criteria, creating a unique risk and return profile.

These strategies are also commonly referred to as faith-based investing or values-based investing.

Biblically Responsible Investing is growing in popularity with estimated assets in the tens of billions of dollars.

Executive Summary: Analysis of Biblically Responsible Investing Funds

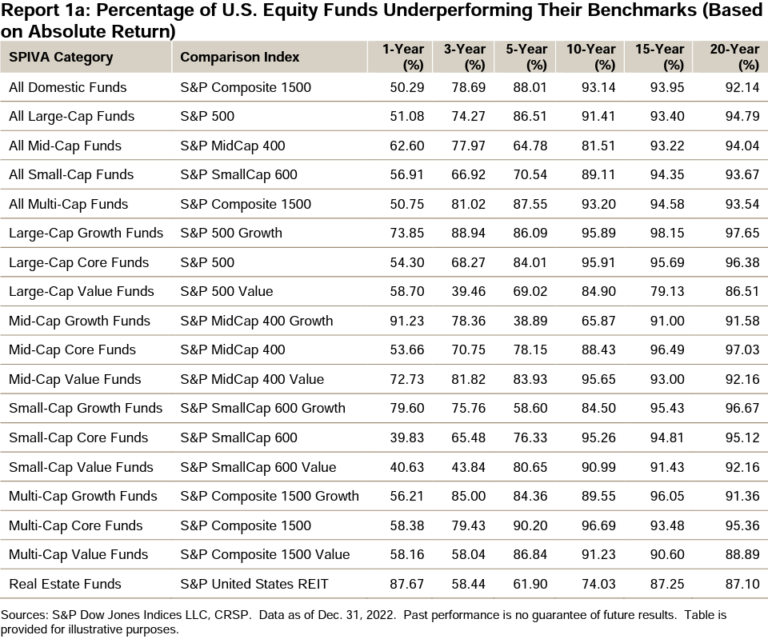

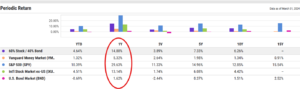

- BRI Funds are actively managed funds and are not immune to the performance challenges actively managed funds face (per the SPIVA study below, over 90% of actively managed funds underperform over the long-term).

- Faith-based investing is a matter of personal conscience (Romans 14) and is inherently subjective. Therefore, this decision should not be outsourced.

- An analysis of the holdings of BRI funds compared with the fund’s stated objectives reveals even funds with the most stringent screening criteria include securities that violate the fund’s restrictions.

Biblically Responsible Funds are actively managed funds.

Therefore, investors that have adopted a low-cost, passive index-fund investment approach will likely find themselves at odds with the active investment approach of BRI funds.

The performance challenges of active management are well documented.

According to the annual SPIVA study (chart below), over 90% of all actively managed funds underperform their benchmarks over the long-term.

After analyzing four popular BRI funds, they are not an exception to this rule.

Each fund analyzed has experienced significant periods of underperformance when compared to a U.S. Total Stock Market Index Fund (for the three U.S. stock funds) or a passively managed target date index fund (for the target date fund analysis).

In addition to the performance challenges, ensuring that an investor’s values are represented within the fund’s securities is just as difficult because the security selection decision is inherently subjective.

This becomes evident when reviewing the objectives and underlying holdings of each fund analyzed.

There is great variation of security selection within the funds, even when there are similar stated objectives.

Determining how much “sin” is too much varies widely across funds.

Some funds have a very narrow set of selection criteria and some more broad.

Even funds with the strictest screening criteria fall short, though, when their holdings are examined against the fund’s stated objectives.

All of these factors, I believe, highlight the fundamental problem of faith-based investing funds: This values-based decision is a matter of personal conscience (Romans 14).

And because this values-based decision is unique to each investor, investors who have this conviction are better suited using a direct indexing solution or by utilizing a brokerage window.

These options allow investors to tailor their portfolio to their exact values-based criteria.

However, keep in mind personal screening of securities is also a form of active management.

And investors who do take this approach of selecting and/or excluding individual securities should anticipate reduced long-term performance when compared to a passive market-cap weighted index fund.

In full disclosure, I have no money invested in any fund categorized as BRI and do not use direct indexing or brokerage windows.

How to Evaluate a Biblically Responsible Investing Fund

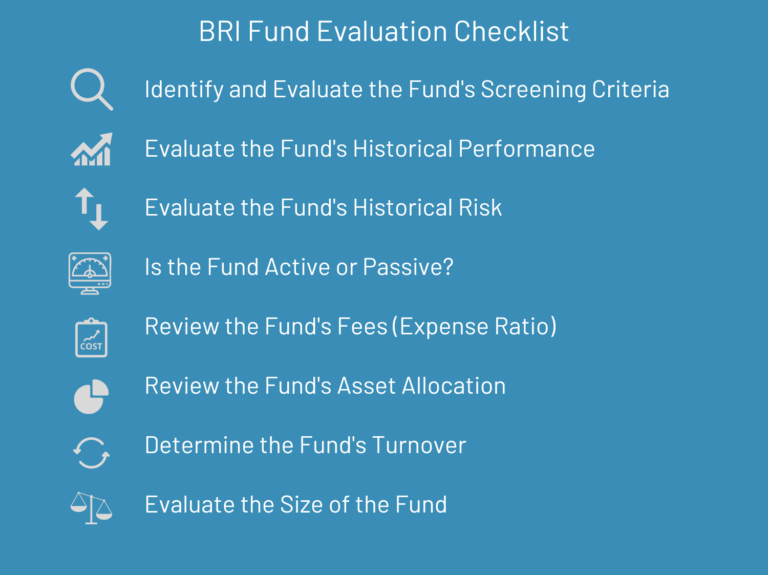

Investors considering Biblically Responsible Investing funds should carefully examine each fund.

To begin, investors should first review the fund’s prospectus.

This is located at the fund manager’s website.

The prospectus describes the overall goals and objectives of the fund.

Because the prospectus is the definitive source of the fund’s stated objectives, this is the best way to understand if the faith-based objectives are in alignment with an investor’s values.

This also gives the investor a baseline for which to compare the fund’s holdings with the stated criteria – is the fund doing what it says it will.

In addition to reviewing the fund’s screening criteria, investors should also review the fund’s asset allocation, management style, performance, risk, and expense ratios.

After reviewing all these factors, an investor will have a clearer picture of the fund’s expected investment experience.

To assist investors in researching the various funds, the below guide can be used as an evaluative framework.

Identify and Evaluate the Fund’s Screening Criteria

Review the Prospectus

The fund’s prospectus is the best place for an investor to understand the objectives of the fund.

The characteristics of the securities it attempts to exclude and include (i.e., screen), the fund’s benchmark, expenses, etc. are all found in this document.

To make this document less daunting, investors should focus on the screening criteria section given this is the heart of a BRI fund.

Once the criteria are determined, the investor can then evaluate whether the fund is delivering on those stated objectives.

Compare the Fund’s Objectives with its Holdings

The fund’s holdings are the individual securities included in the fund.

Remember, a fund is simply a wrapper that holds numerous individual securities.

Investors should first scan for any obvious contradictions to the screening process outlined in the prospectus (e.g., an alcohol screened fund that includes BUD).

Next, review each holding through a simple Google search.

Search for the company’s name with a screening keyword. For example: searching for “Coca-Cola alcohol brands” brings up Coca-Cola’s emerging alcoholic beverage business.

One other technique is to go to the security’s company “About Us” page to review their stance on various social issues.

Evaluate the Fund’s Historical Performance

The sole purpose of investing is to grow the investment.

Therefore, the performance of an investment is fundamental to its evaluation.

The longer the time horizon of evaluation, the better.

It is most helpful to see how the fund has performed in good times and bad.

Five or more years is ideal.

2022 was a reckoning for many funds and is a helpful year in evaluating the return and the risk.

Evaluate the Fund’s Historical Risk

Risk and return are highly correlated. There is no ‘free lunch’ in investing. Useful metrics include:

- Standard Deviation : A measure of an investment’s volatility. The higher the number, the bigger the variation in return (i.e., volatility). For reference, the S&P 500’s historical standard deviation is about 15%.

- Max Drawdown: This measures the investment’s largest drawdown from its peak. The S&P 500’s largest drawdown was over 56% in 2007-2009.

- Sharpe Ratio: This measurement helps an investor understand how much return they are compensated for per unit of risk. The higher the Sharpe Ratio, the better its risk-adjusted return is considered.

Is the Fund Active or Passive?

Actively managed funds attempt to outperform a selected index.

Passive funds try to replicate a selected index.

Biblically responsible investing funds are actively managed funds.

Historically, passive funds have generally outperformed active funds.

Understanding whether the fund is active, or passive is extremely helpful in setting return expectations.

The fund’s prospectus will help clarify the active or passive strategy.

The fund’s fees are also a good indicator.

The higher the fee, the more likely it is to be active.

Another tell-tale sign of an active fund is its turnover.

The higher the turnover, the more active the fund manager is in adding and removing securities.

Review the Fund's Fees (Expense Ratio)

One of the most important factors to consider in a fund is its fees, known as the expense ratio.

Fees are a necessary part of running a fund, but they do directly reduce gross performance.

For example, a fund with a gross return of 8% and an expense ratio of 1% leaves a net 7% return to the investor.

In general, lower fees correlate to higher investment returns when comparing similar funds.

Review the Fund’s Asset Allocation

The asset allocation of a fund is one of the largest overall contributors to its investment experience.

Understanding the fund’s holdings from a market capitalization standpoint, sector, percentage of cash, etc. can help an investor determine what type of investment experience to expect.

Determine the Fund’s Turnover

A fund’s turnover illustrates how often individual securities (stocks/bonds) are being added or removed.

The higher the percentage turnover, the more ‘active’ a fund is considered.

For example, a fund with a 25% turnover has replaced a quarter of its holdings in a given period (usually a year).

A passive fund will have a low turnover rate.

For reference, the Vanguard Total Stock Market Index Fund (symbol: VTI) has a turnover of 3%.

In addition, turnover also presents a unique problem to biblically responsible investments.

Specifically, investors will need to continually evaluate the holdings of a fund to ensure alignment with their values because the underlying companies are changing.

Evaluate the Size of the Fund

The size of a fund can be helpful in determining the popularity and longevity of a fund.

In general, the larger the fund, the longer its track record and greater ‘social proof’ it has.

For ETF funds, trading volume (how many shares are traded per day) is also an important metric to consider.

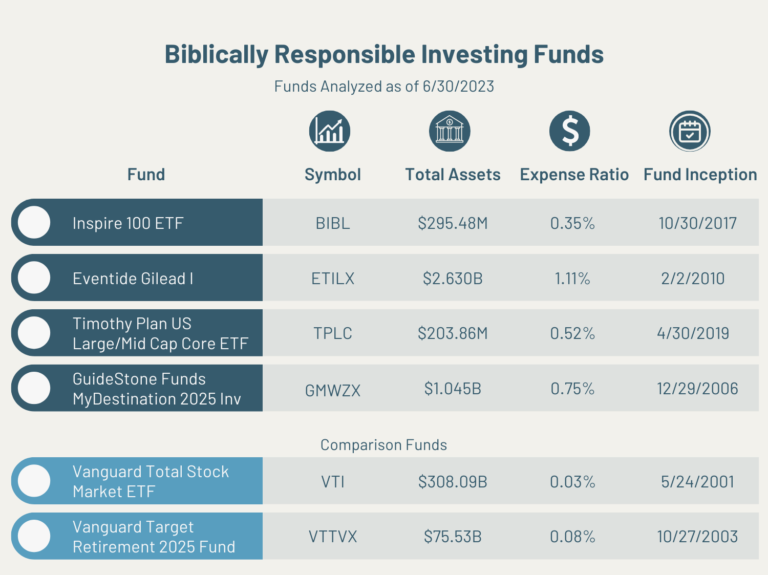

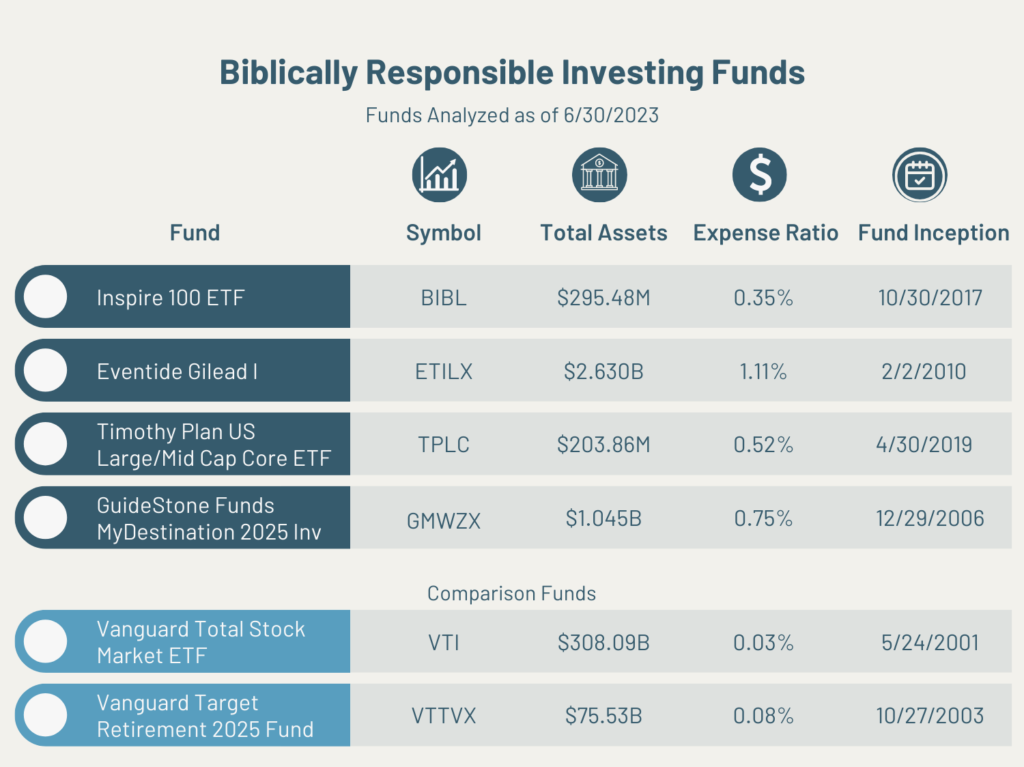

Evaluation of 4 Popular Biblically Responsible Investing Funds

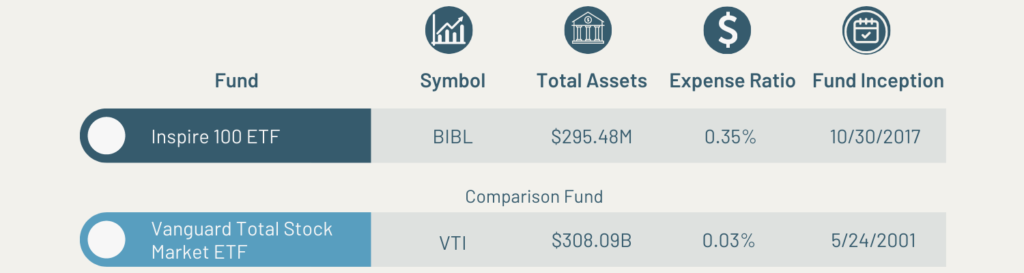

BIBL Executive Summary

BIBL sets a high bar for securities to be included in its fund’s holdings given its prospectus’ stated screening criteria.

However, this high bar ultimately proves unrealistic upon deeper examination into the securities included when compared with the screening criteria.

When securities are evaluated individually, a high percentage of them conflict with the fund’s stated objectives.

In addition, this aggressive screening creates a high level of active management which has historically created a significant reduction in performance when compared to a passive index fund.

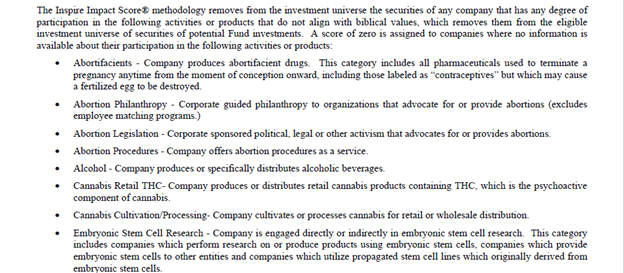

Reviewing BIBL’s Prospectus

BIBL uses its own proprietary screening methodology to determine which securities it includes or excludes.

There is a negative screening component and a positive screening component to BIBL.

Specifically, it seeks to exclude securities that have any “degree of participation” in products or activities that “do not align with biblical values”.

This is a high standard.

In addition, it seeks to include securities that “have a track record of acting in alignment with biblical values” across a defined set of categories.

Review of BIBL’s Holdings

Top 10 Holdings (as of 6/30/2023)

Comparing BIBL’s Holdings with Its BRI Objectives

BIBL appears to come up short on achieving its fund’s high standard of security inclusion.

7 out of the top 10 holdings (70%) have corporate initiatives in apparent conflict with the stated criteria of excluding “any company that has any degree of participation in the following activities…”.

By navigating to a company’s “about us” page investors will find company initiatives that are in contrast with the stated exclusionary criteria.

Here is an example from Intuitive Surgical’s website.

These companies simply highlight the difficulty of attempting to exclude securities with “any” degree of participation in non-biblical values.

In short, excluding companies that do not have any hint of non-biblical values is not realistic.

In addition to the more obvious violations, there is the challenge of determining “how much sin is too much?”.

Crown Holdings (Symbol CCK) is a good example.

While it makes up a relatively small percentage of the overall fund (.34%), one of its primary revenue sources are alcoholic beverage companies.

This begs the question: Is a manufacturer of alcoholic beverage containers just as culpable as the distributor?

Herein lies one of the fundamental problems of sin screening.

Obviously, the fund manager says, “no” hence its inclusion, but what about the investor?

In my opinion, this is a “matter of conscience” and can only be answered by the investor.

Some would say “yes” others would say “no”.

This does not even address the question of whether alcohol is inherently sinful.

These are examples of how this decision is ultimately a matter of personal conscience, addressed by Paul in Romans 14.

Performance

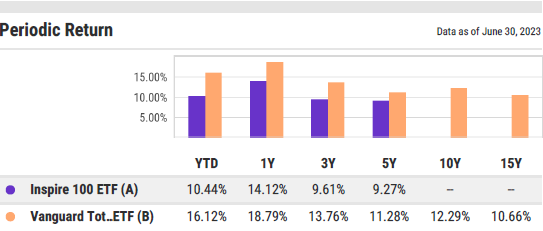

Historically, BIBL has underperformed the Total US Market Index fund (VTI) by a material margin.

Risk

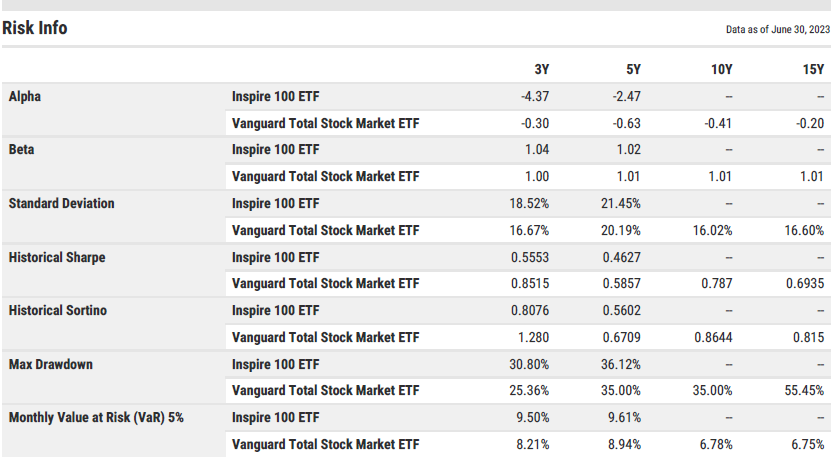

Historically, BIBL has taken slightly more risk evident in the higher standard deviations and greater drawdown.

However, investors have not been rewarded on a per unit of risk basis evidenced in the lower Sharpe ratios.

In short, historically BIBL has experienced higher volatility (risk) but lower returns than the total market index fund.

Active or Passive?

BIBL technically employs a passive screening process, but the high turnover makes this an active fund.

Fees

BIBL has a relatively low expense ratio of .35% compared to other actively managed funds.

Allocation

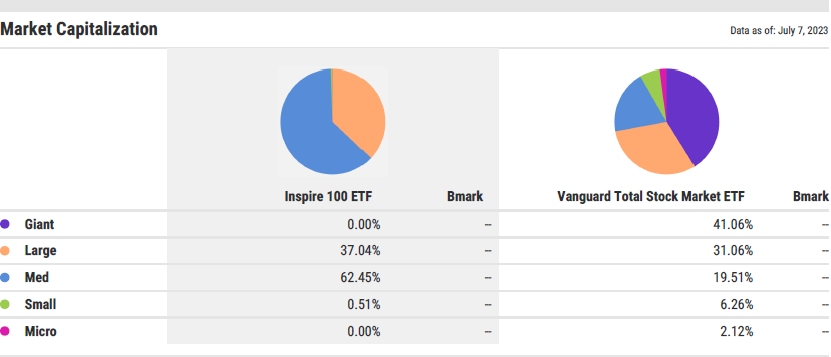

BIBL currently has a much higher allocation to mid-sized companies and no exposure to the largest U.S. companies.

This will likely lead to a different investment experience than a pure market-cap weighted U.S. total market index fund which is evidenced by its historical return differences.

Turnover

BIBL has a relatively high turnover rate of 28%. This is highlighted by the fact that BIBL only has 23 securities (out of 102 total) remaining from their lineup in 2018.

From a tax standpoint (in taxable accounts), it does help that BIBL is an ETF rather than a mutual fund.

Size (and Trading Volume for ETFs)

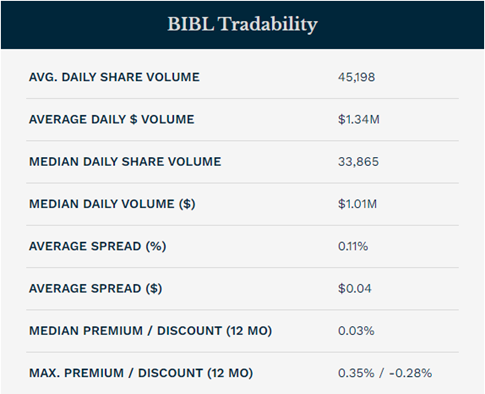

BIBL is a small fund compared to other popular ETFs. It also has a lower trading volume which may result in larger orders moving the price, which can reduce an investor’s net performance.

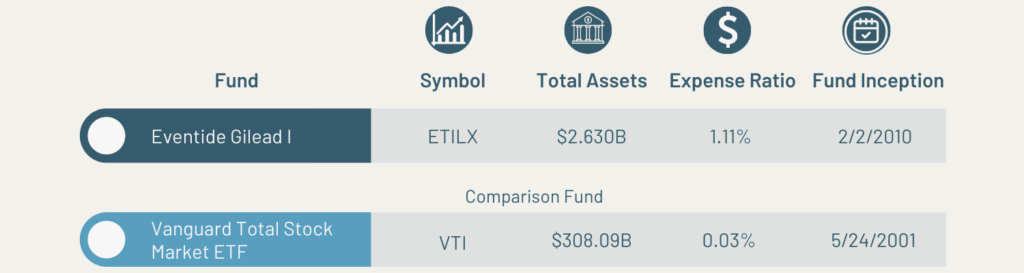

ETILX Executive Summary

ETILX appears to use its values-based screening to increase returns rather than solely for removing “sin” securities.

The fund has a broader and more principle’s-based investment selection criteria coupled with traditional fundamental analysis.

This creates less obvious screening violations but also a very high degree of active management, highlighted in its higher expense and turnover ratio.

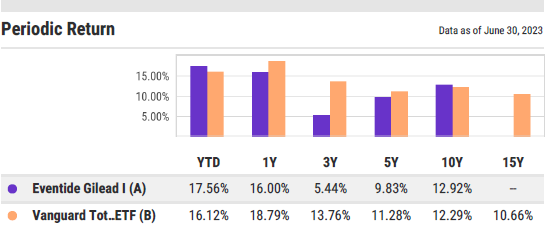

ETILX has suffered from the same performance challenges as most active funds as it has underperformed the passively managed U.S. Total Stock Market index fund (VTI) over significant periods.

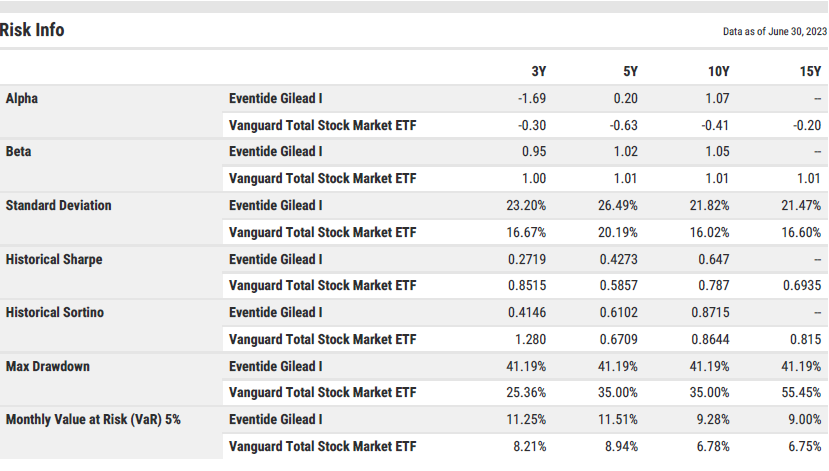

In addition, any historical outperformance is due to an increase in risk.

This is evidenced by the fund’s higher volatility (standard deviation) but lower per-unit-of-risk return (Sharpe ratio).

Investors in this fund should have a high tolerance for risk (volatility).

Given its idiosyncratic portfolio allocation, this fund is not likely a good fit as a core portfolio holding (i.e., a large percentage of one’s portfolio).

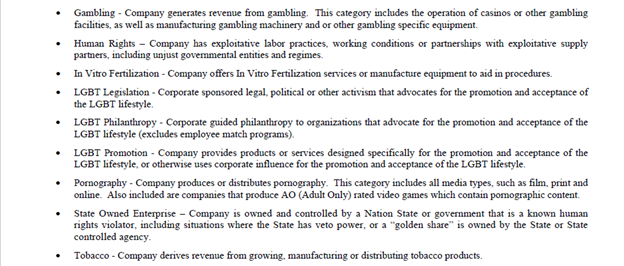

Reviewing ETILX’s Prospectus

ETILX screens for securities that are both fundamentally attractive and have alignment with the fund’s stated screens.

ETILX’s language does seem to have a more realistic (in my opinion) approach to screening as it clearly states, “there is no guarantee that the Adviser will be able to successfully screen out all companies that are inconsistent with the following principles…”.

In addition, the stated values are more focused on principles than specific “sins”.

This creates a broader group of possible securities to include without violating their stated screening objectives.

However, these broader criteria may allow securities to be selected that are not in alignment with an investor’s values.

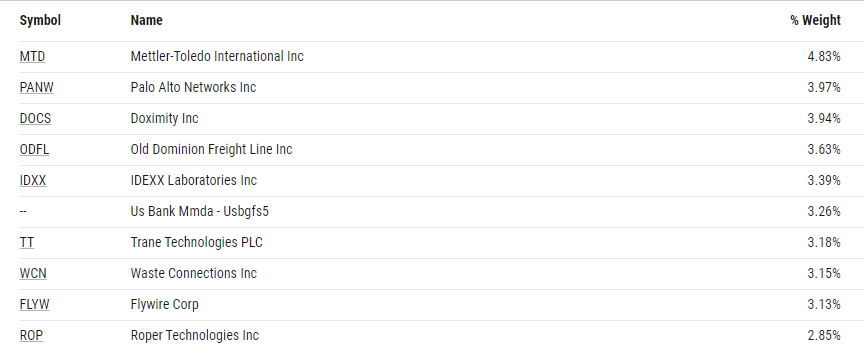

Top 10 Holdings (as of 3/31/2023)

Comparing ETILX’s Holdings with Its BRI Objectives

There are no immediate violations of the fund’s specific screening criteria.

This is partially due to the broader screening criteria as several companies have initiatives that may be considered “non-biblical” by some investors.

This may also be due to a presumed more active human element in the screening process which could explain its higher fund expenses.

Overall, though, the fund does seem to generally adhere to its stated objectives in screening.

Performance

ETILX has outperformed on a 10-year basis when compared to the U.S. Total Market Index Fund (VTI).

However, it has materially underperformed VTI on a 1, 3, and 5-year basis. Investors that have been with the fund 5 years or less have likely experienced significant underperformance.

Risk

Historically, ETILX has been a very volatile investment with larger drawdowns and a significantly higher standard deviation than the Total Market Index (VTI).

In addition, the Sharpe ratios are lower than that of VTI, even on a 10-year basis when ETILX outperformed VTI from a gross-returns standpoint.

In short, investors have not been rewarded for bearing the additional risk when compared to a passive market index (VTI).

Active or Passive?

ETILX is an actively managed fund as it looks for investments that are fundamentally attractive and fit the fund’s values-based screening criteria.

Fees

ETILX has a relatively high expense ratio of 1.11%. It should be noted that ETILX’s Class C Share fund (ETCGX) has an expense ratio of 2.11%.

There are fewer investors in this share class but still a material amount at over $217 million in Assets Under Management.

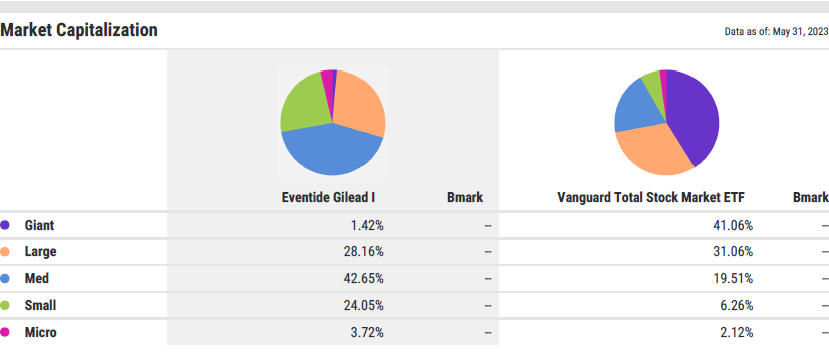

Allocation

ETILX has a large tilt to mid-sized and small-sized companies. Investors should expect a different investment experience than with a passive, U.S. total market, cap-weighted index fund.

Turnover

ETILX has a higher turnover ratio at 27%. Because ETILX is a mutual fund, this turnover ratio can create tax-consequences for investors that hold this in a taxable (i.e., non-retirement) account.

Size (and Trading Volume for ETFs)

ETILX and its share class siblings have a sizeable $3.7 billion in total assets.

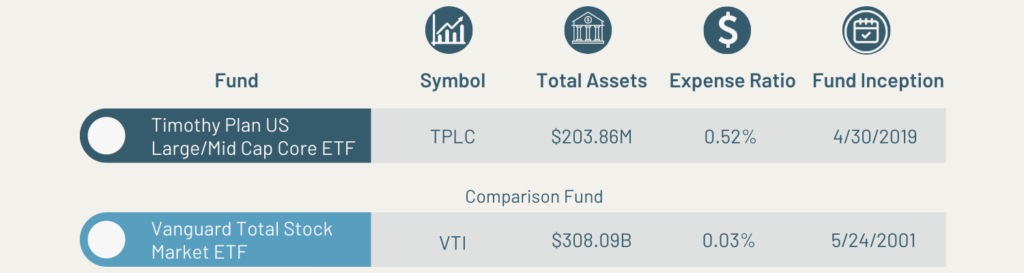

TPLC (Timothy Plan US Large/Mid Cap Core ETF)

TPLC Executive Summary

TPLC effectively screens securities with direct involvement with the fund’s prohibited activities.

However, there are challenges with effectively screening securities “whose practices can be found offensive to basic, traditional Judeo-Christian values”.

Specifically, it is left up to the fund to decide how much prohibited activity is too much.

In the end, an investor is outsourcing this subjective decision (i.e., a matter of personal conscience) to the fund managers.

Additionally, there is a separate investment screening component.

When combined with the faith-based screening process, TPLC is an actively managed fund.

This is highlighted by its high turnover rate of 26%.

Like most actively managed funds, it has historically underperformed a passive U.S. total stock market index.

Reviewing TPLC’s Prospectus

Timothy Plan works in conjunction with a sub-advisor (i.e., another investment manager) to construct the fund lineup of TPLC.

The sub-advisor’s role is to include securities deemed attractive from an investing standpoint.

In addition, Timothy Plan removes securities that do not satisfy the fund’s faith-based screening criteria.

The faith-based component includes a relatively high standard of inclusion into the fund by stating it will exclude, “any company involved in the production or wholesale distribution of alcohol, tobacco, or gambling equipment…” and excludes securities whose practices “can be found offensive to basic, traditional Judeo-Christian values”.

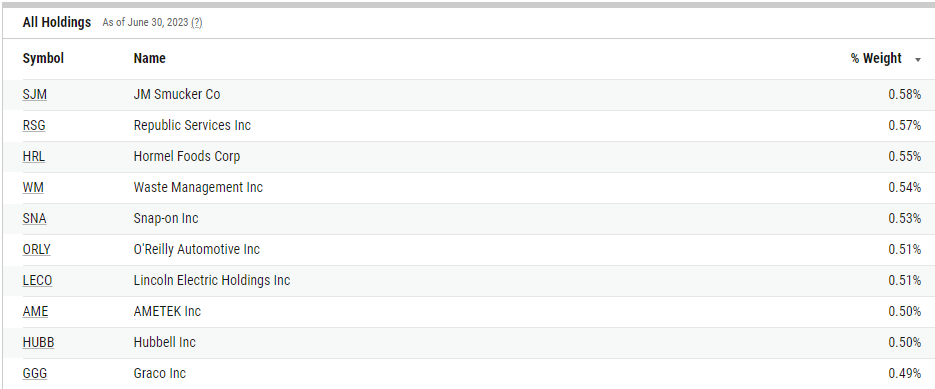

Review of TPLC’s Holdings

Top 10 Holdings (as of 6/30/2023)

Comparing TPLC’s Holdings with Its BRI Objectives

TPLC does effectively screen companies directly involved in prohibited activities as defined by the prospectus.

However, like other funds with more stringent screening standards, the challenge is determining how much involvement with prohibited activities is too much.

Almost every security in the top 10 holdings have employee initiatives that would traditionally be considered as indirectly promoting “non-biblical lifestyles”.

Ultimately, in my opinion, this “how much is too much” can only be answered according to the conscience of the individual investor (Romans 14).

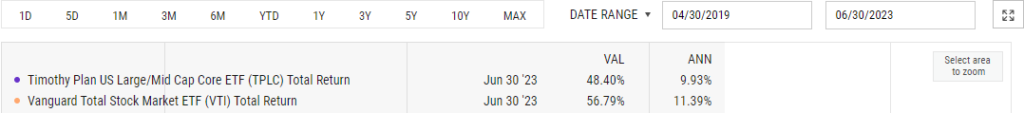

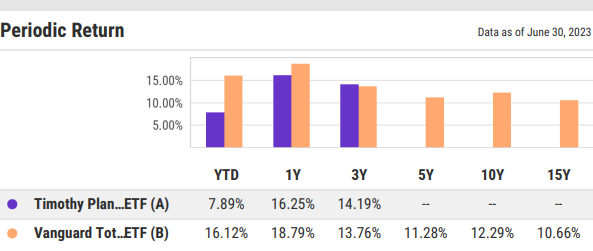

Performance

TPLC was launched April 30, 2019, and therefore has a relatively limited track record.

Since its inception the fund has underperformed the passive U.S. total stock market fund (VTI).

However, it has outperformed on a 3-year basis but lagged on a 1-year basis and YTD.

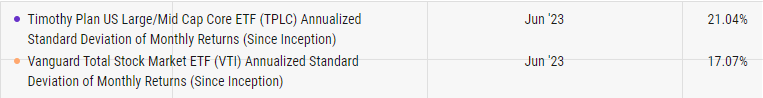

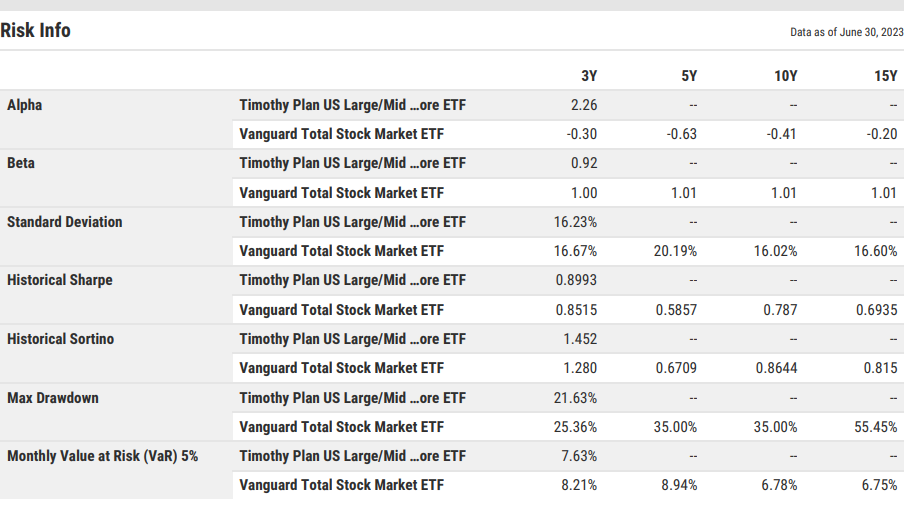

Risk

Historically, TPLC has a very similar risk profile to the passive U.S. total stock market fund (VTI).

The slightly higher Sharpe ratios of TPLC compared to VTI indicate investors in that period have outperformed on a risk-adjusted basis over 3 years but underperformed since inception based on the since inception standard deviation.

Active or Passive?

TPLC is an actively managed fund with an active investment screening component and active faith-based screening component.

Fees

TPLC has a moderate expense ratio of .55%.

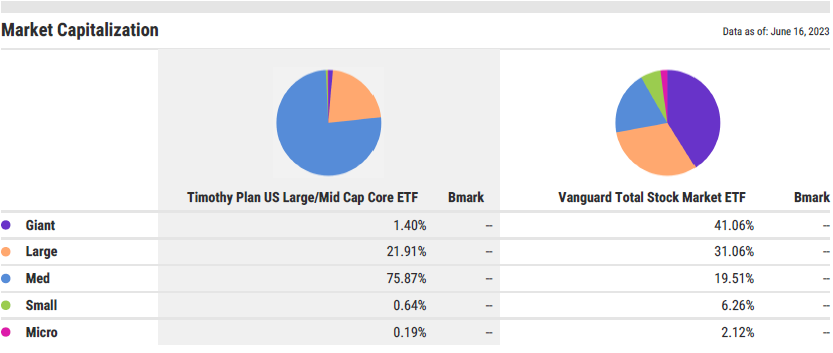

Allocation

TPLC has a large mid cap component and almost no mega-cap exposure when compared to VTI.

Turnover

TPLC’s has a high turnover ratio of 26%. It does help that TPLC is an ETF given ETF’s relative tax efficiency when compared to mutual funds (for taxable accounts).

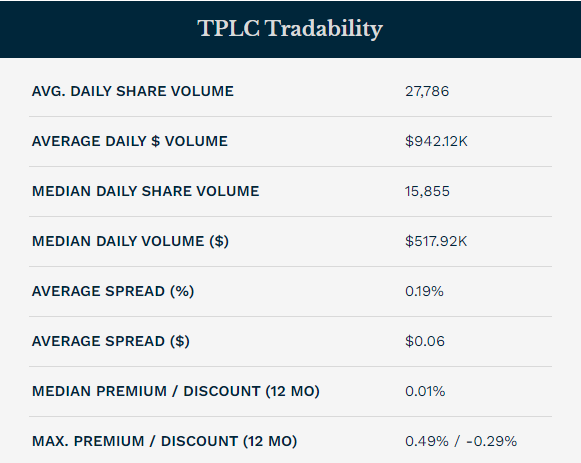

Size (and Trading Volume for ETFs)

TPLC’s relatively small size ($202 million) and lower trading volume may result in larger orders moving the price, which can reduce net performance.

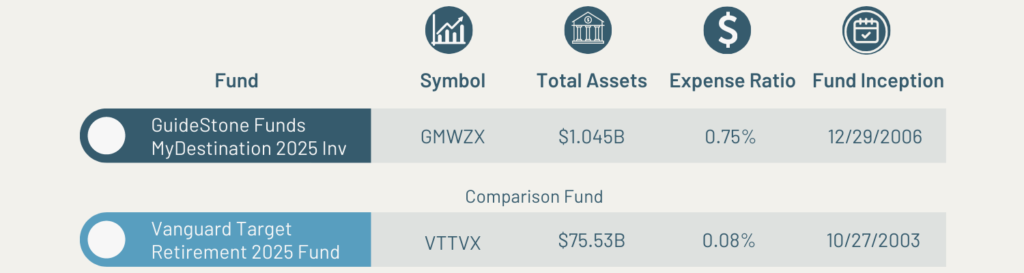

GMWZX Executive Summary

GMWZX is more lenient with what is allowed into the fund’s lineup than other BRI funds.

For example, only 19 of the over 500 companies in the S&P 500 are removed from GMWZX’s largest U.S. equity component (GMWZX also contains international, bond, and real estate components).

This less active approach does lend itself to an investment experience more like a cap-weighted market index fund (i.e., non-screened).

However, when compared to a similar target date fund (VTTVX), it consistently underperforms.

This is likely due to its higher expense ratio (.75%) and higher than typical cash allocation (i.e., cash drag), in addition to other factors.

Faith-based investors that are looking for an aggressively screened fund should examine the fund’s holdings given its more inclusive process.

Reviewing GMWZX’s Prospectus

GMWZX has a less stringent screening criteria than the other BRI funds.

The language in the prospectus allows for more leeway in which companies are excluded.

There is also no positive screening aspect to this fund’s holdings, only negative.

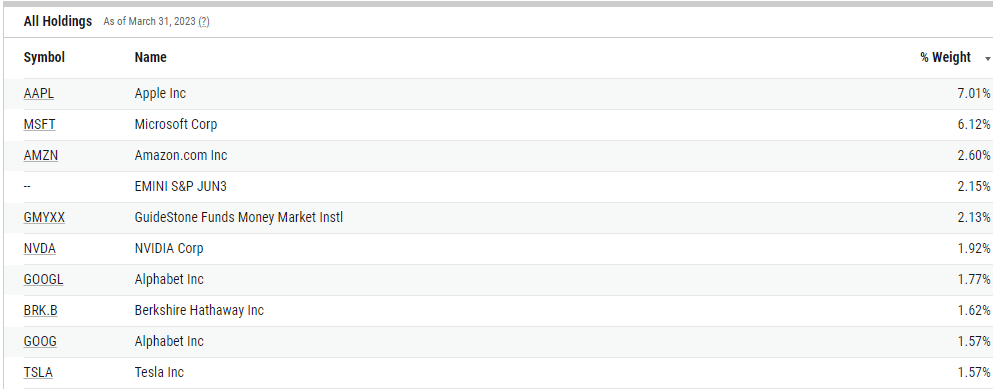

Review of GMWZX’s Holdings

GEQYX’s Top 10 Holdings (Largest U.S. Equity Component of GMWZX)

Comparing GMWZX’s Holdings with Its BRI Objectives

This fund does exclude securities that are the most obvious violators of their criteria (e.g., Caesar’s Entertainment, Phillip Morris, Molson Coors Beverage Company).

However, this approach only removes 19 securities out of the over 500 securities included in the S&P 500 (excluded companies listed below).

Other perhaps less obvious violators do not get filtered out.

For example, Coca-Cola has an alcoholic beverage presence.

Costco receives a material amount of its revenue from alcohol distribution.

Berkshire Hathaway owns a portion of one of the largest alcoholic distributors in the world.

Again, this begs the question of what is defined as being in the “alcohol” industry and what is not.

Investors looking for a more aggressive screening process may be surprised at what is included in the fund when examined.

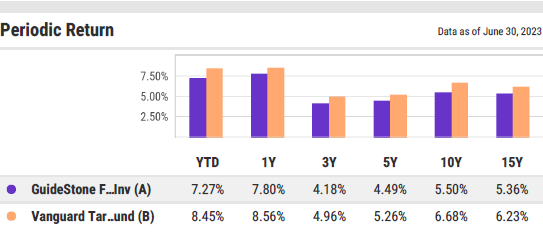

Performance

GMWZX has underperformed the Vanguard Target Date 2025 Index (VTTVX) on a 1, 3, 5, 10, and 15-year basis.

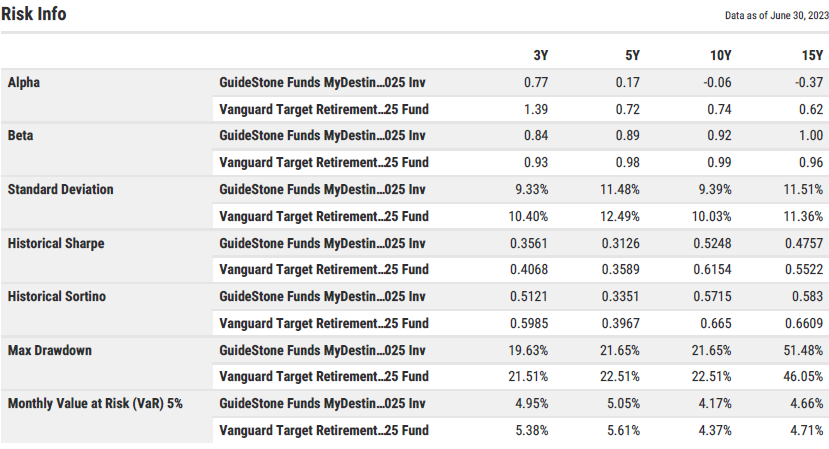

Risk

Historically, GMWZX has taken slightly less risk than the comparable VTTVX.

However, at every period the Sharpe ratios are lower than that of VTTVX indicating VTTVX still outperforms on a risk-adjusted basis.

Active or Passive?

GMWZX is stated to be a passively managed fund but there is still a small active component given the removal of certain screened securities (examples above).

Fees

GMWZX has a moderately high expense ratio of .75%.

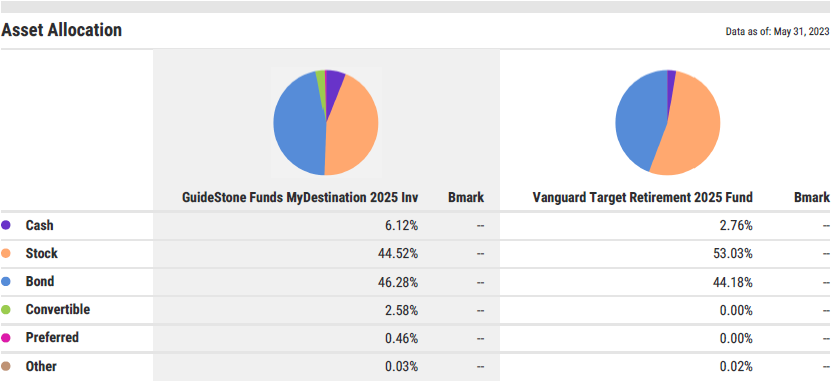

Allocation

GMWZX has a large cash allocation which likely explains some of the underperformance (and slightly less risk) when compared to VTTVX.

Turnover

GMWZX’s turnover ratio at 14% is average for a target date fund.

Size (and Trading Volume for ETFs)

GMWZX and its Institutional class sibling (GMWYX) have over $1.7 billion in assets.

In addition, Guidestone’s MyDestination lineup (i.e., its entire target date lineup) has over $5.7 billion in assets, making it one of the largest values-based investing providers.

Suggested Alternatives to Biblically Responsible Investing Funds

Direct Indexing

Direct Indexing is a relatively new development in portfolio management.

It allows investors to tailor an index (i.e., set of securities) to their specific screening criteria.

In short, investors can include or exclude whatever securities they want.

Typically, the average cost to use direct indexing is around .4%.

In my opinion, if investors are truly concerned about their portfolio’s securities being in alignment with their values, this is the only way to ensure that.

Be forewarned though, as demonstrated above, the more aggressive an investor is at removing certain companies and including others, the more likely they are to underperform.

Brokerage Window

Brokerage windows are options for investors with employer retirement plans (401(k)s, 403(b)s, etc.)

A brokerage window simply allows the investor to choose almost any security in the investment universe, including individual stocks and bonds.

This option allows the investor complete control over the selection of what is included in their account.

The potential downside is the manual labor involved in selecting and trading individual securities.

Given the commitment to trade and monitor, it is likely not for the casual investor.

And investors are still faced with the high likelihood of reducing their portfolio’s performance when they actively include or exclude securities.

Biblically Responsible Investing Conclusion

Biblically Responsible Investment funds are a growing segment of investments.

However, their performance has historically lagged when compared to passive index funds.

Even investors who are not as concerned about performance may find themselves surprised at what securities are included in a fund’s holdings.

Investors should, at a minimum, review the underlying holdings of a fund to determine if their values are aligned with the securities included.

However, because this decision is a matter of personal conscience, I believe investors would be better served applying other methods (e.g., direct indexing or a brokerage window) to include or exclude securities to attempt to align the investor’s values with their portfolio.

I personally do not invest in any of the securities listed above or any security labeled as “Biblically Responsible” because of the conclusions of this analysis.

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. The author has money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

Jake Ridley, CFP®

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.

Should you invest in the market at all when CD’s, money market, high-yield savings, and T-bills are all at their highest rates in over a decade?

Pingback: Three Fundamental Flaws of Faith Based Investing Funds - Church Fiduciary

Pingback: A Guide to Church Retirement Plans - Church Fiduciary

Pingback: Five Principles to Become a Successful Investor - Church Fiduciary

Pingback: Pastors: 3 Paradigm-Shifting Investment Facts - Church Fiduciary