Jake Ridley, CFP®

Table of Contents

Paradigm-Shifters

There are those rare moments in life that forever change your view of the world.

The first time you met your spouse.

The first time you saw the Rocky Mountains.

The first time reading Isaiah 53.

Or how about the first time you got a hold of Ezekiel 23? Whew. Quiet time was NOT the same after that one.

Like these, there are also investment paradigm-shifters.

Once your eyes are opened by these, investing won’t be the same.

As a matter of fact, it will be much better.

You’ll sleep better at night.

No more trying to pick the best stocks.

No more trying to find someone to pick the best stocks.

Just an effective, cost-efficient ride on the greatest economy the world has known.

Now, come and let the scales fall from your investing eyes!

Fact 1: 4% of Stocks Created All the Market’s Wealth From 1926-2016

You read that right.

This means out of the 25,332 companies that have existed as publicly traded stocks (up to 2016), only 1,092 are responsible for the over $34.8 trillion in wealth created.

Holy cow.

Even more, 86 companies (.3%) are responsible for $16 trillion of that almost $35 trillion (almost 50%).

This is what our statistical friends like to call “positive skewness”.

This just means things don’t work out for most, but for the ones it does, it REALLY works.

This positive skewness is also how the lottery works.

But, unlike the lottery, we can be guaranteed a winning ticket by investing in a total market index fund.

No need to worry about finding the next Apple or Amazon, you will already own it.

That’s the beauty of diversification in a fund like this.

Another way to put it is, ”Don’t look for the needle in the haystack. Just buy the haystack!” (Jack Bogle).

You might also be thinking, why don’t we just buy the 4% and forget the 96%?

If only it were that easy.

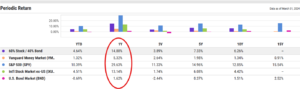

The folks that are paid good money to find the needles, overwhelmingly underperform the haystack(BRI funds included).

The bottom line?

Ensure you always capture that 4% by owning the whole market through a low-cost passive total market index fund.

Fact 2: 58% of Stocks Fail to Generate Any Wealth

The key here is “over their lifetime”.

Many of them will have their moment, but most eventually fizzle out and end up reducing wealth.

Again, the skeptic will say, “well just buy it when it’s low and get out before it crashes.”

And, again, if only it were that easy.

The folks that are paid good money to get buy low and sell high, overwhelmingly don’t.

Diversification is your friend here as well.

You willingly take the bad with the good because missing out on the good is what destroys your savings.

Don’t take that risk.

Invest in a low-cost passive total market index fund and let those superstar companies overwhelm the duds.

Fact 3: 40% of All Stocks Decline 70+% and Never Recover

JP Morgan’s study is a close cousin of the one by Bessembinder.

But, to make the case for diversification even stronger, they point out that almost half (40%) of all stocks since 1980 have a 70% or more decline and never recover.

70% or more is catastrophic, not just a hiccup.

And there is no waiting for that baby to come back, it’s dead.

Peloton is the norm, not the exception.

What’s the takeaway?

Do not tie up your savings in single company stocks.

The odds are it will go very bad.

So bad that you won’t be able to recover.

The answer? A low-cost passive total market index fund – surprise, surprise.

The Takeaway

Contrary to popular belief, most stocks reduce wealth.

There are a select few companies that have generated most of the wealth of the last 100 years.

The key to successful investing is making sure you hold those superstar companies.

And it’s almost impossible to identify those companies until after the fact.

The only way to ensure you hold them is by owning a diversified low-cost passive index fund – buying the haystack instead of looking for the needle.

So, change your investing paradigm and put your mind at ease and consider investing in the total market!

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

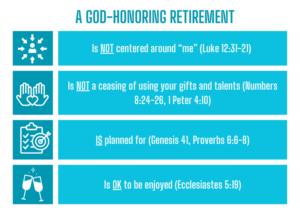

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.