Jake Ridley, CFP®

Table of Contents

A Forgotten Friend

The lowly emergency fund is often forgotten about, ignored, and neglected for more exciting corners of personal finance.

Stocks, bonds, return rates, Roth accounts, taxes, the economy, etc., etc., all have their day in the personal finance spotlight – everyone except the emergency fund.

The emergency fund doesn’t mind, though.

Deep down the emergency fund knows the others’ fame wouldn’t be possible without him.

Besides, who needs fame and fortune when people like Warren Buffet understand your importance?

Let’s give the emergency fund the recognition it deserves and look at four reasons you should have one and how much should be in it.

Reason #1: It Turns Financial Catastrophe into Financial Annoyance

The primary goal of the emergency fund is to protect against financial uncertainty – duh.

There are all sorts of potential uncertainties: your car breaks down, your A/C unit breaks, or you lose your job.

All of these could be financially catastrophic without an emergency fund.

But with an emergency fund? These are merely financial annoyances.

Yes, it still stinks if any of the above happen, but the emergency fund allows you to fund the above emergencies and continue to live your life.

The alternative – credit card loans, payday loans, retirement account loans – are no bueno and can do some serious long-term damage to your financial well-being.

So, turn those potential catastrophes into annoyances with an emergency fund!

Reason #2: It Allows Your Investments to Grow

Are you more or less likely to lose your job during an economic downturn? (Answer: more likely)

Are your investments more or less likely to have lost value during an economic downturn? (Answer: more likely)

The odds are if you’ve lost your job, your investments are probably down too. And if you don’t have sufficient cash (i.e., an emergency fund) to fund your life without a job you are likely to turn to your investment accounts to fund those shortfalls, which are likely down.

Selling your investments when they are down is a financial double-whammy.

You are taking money out of your growth accounts at the worst time, as they won’t be able to participate in their recovery.

This doesn’t even account for potential penalties, interest payments on loans, etc.

A well-funded emergency fund is like a castle wall protecting your investments on the inside and allowing them to do their thing – grow.

Reason #3: It Gives You Flexibility in Life

What’s the #1 reason modern couples delay having a child? Money.

What’s the #1 reason people stay in a job they hate? Money.

A fully funded emergency fund can remove those obstacles and give you financial flexibility.

Now I know technically those aren’t emergencies, but the same principle applies.

When you remove the ‘money’ problem it gives you incredible flexibility in some major life choices: Where should I live? When should I start a family? What if I want to be a stay-at-home parent?

Give yourself options and flexibility in life by having sufficient cash to fund them!

Reason #4: It Helps You Sleep at Night

The fourth reason to have an emergency fund isn’t quantifiable but boy is it important: the sleep at night factor.

When your A/C starts making that weird noise at night, the emergency fund is like a cool pillow calmly giving you permission to go back to sleep.

You can cover the expense if something happens.

On the other hand, sleep does not come as easy when a major, unexpected expense threatens.

There is already enough to worry about.

Don’t add unnecessary worry to your life by neglecting your emergency fund.

Sleep better at night by funding it.

How Much Should You Have?

The emergency fund is a foundational piece to a sound, thriving financial life.

But just how much should you have? The standard answer is three to six months’ worth of living expenses.

First, knowing the answer to the ‘three to six months’ question is a great exercise in understanding where your money is going.

Simply understanding that number goes a long way in taking control of your finances.

Second, the origin of the rule comes from protecting against the threat of losing your job.

It generally takes three to six months to find a new one.

It also assumes both spouses work (if married).

The implication is that there are very good reasons to have more than three to six months’ worth of expenses: if you’re self-employed, if one spouse stays at home, if your A/C is on its last leg (ours is, hence all my ‘A/C’ examples).

All of these are scenarios where it makes sense to have more than six months’ worth of expenses.

If you are self-employed and your spouse stays at home, you probably need about twelve months’ worth of expenses.

On the other side of that, if both spouses work and you live well below your means, you may only need three months.

The bottom line is three to six months’ worth of expenses is a good baseline and you can adjust higher or lower based on your situation.

And don’t forget about the sleep at night factor!

Summary

Funding your emergency fund should be at the top of most people’s financial priority list.

Those that have one take it for granted (until it’s needed) but those without one don’t.

Start with three to six months of living expenses and tweak higher if needed.

Your future financial self will thank you when – not if – that emergency comes.

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

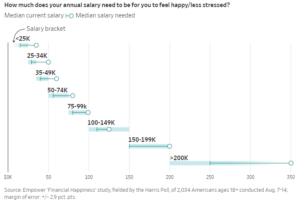

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.