Jake Ridley, CFP®

Table of Contents

Feeling the Stress of Today's Events?

There’s no getting around it, this has been a very tough year for investors.

Almost all major investment classes are way down.

Global stocks have entered a bear market.

Even bonds, typically an investor’s warm security blanket in times of market trouble, have been walloped – some say their worst year since 1931.

This means everyone is feeling the pain of the downturn; young and old, aggressive, and conservative.

People are not only feeling it in their portfolios, but bad news seems to be permeating almost all facets of life.

Putin is threatening to end the world, a Category 4 hurricane just unleashed devastation in Florida, inflation is at 40-year highs, and, worst of all, Auburn’s football team is hot garbage.

What the heck are we supposed to do with all of this? Run screaming?

Before you do, let’s look at a better way.

Here are three things that will help you navigate today’s turmoil.

History Does Not Repeat Itself, But It Rhymes

One of the best ways to calm our nerves is to look back through history at the market’s resilience.

While each market downturn is unique, all downturns share a heightened sense of uncertainty.

So, how often have we experienced this type of uncertainty?

In all, the U.S. Stock Market has experienced 22 bear markets (a decline of 20% or more) since 1928. That’s one roughly every 4 years.

Not exactly a rare occurrence but just enough outside the norm to ‘forget’ what it feels like.

Plus, we’ve been relatively sheltered from downturns since 2008.

So, what has happened since 1928?

A Great Depression, World War II, The Cold War, The Korean War, The Vietnam War, multiple pandemics (not just Covid), civil unrest of the late 60s, the energy crisis and stagflation of the 70s, inflation of the late 70s, Black Monday in ’87, The Gulf War, the dot-com bust, 9/11, the Great Recession, Covid, and now our current struggles.

Phew! That’s a lot of uncertainty.

Now, go back and look at news articles from each of these events. You’ll see many predictions that this time is different.

With those events in mind, what investment return do you think the market generated?

Would you believe even with these declines, the market has returned almost 10% per year?

Meaning if you invested $100 in 1928 it would be almost $700,000 today.

Here’s the kicker though – you had to stay invested. The numbers decline dramatically even if you were only out of the market (i.e., you sold) a few days.

Staying invested throughout the downturns has paid off because of the resilience of our economy.

The next time you’re ready to wave the white flag and get out, look at the chart below and remind yourself what we’ve been through.

Control What You Can

So, if our investment takeaway is basically “Don’t just do something, stand there!” – what can we do in times of market turmoil?

Control what you can.

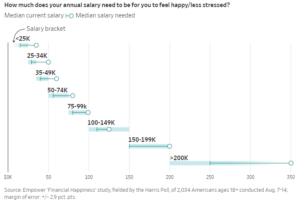

You can’t control the markets. But you can control things like spending.

Living within your means gives you the margin to be able to withstand a portfolio downturn – particularly in retirement.

Control your return expectations.

If you have aggressive return expectations to reach your goals, you are going to sweat each downturn.

I would argue even the historical 8-10% return numbers are too aggressive. I would suggest somewhere in the 5-7% range depending on your stock/bond mix.

When your return expectations are lower, you don’t tend to sweat a downturn because you’ve already baked in those downturns (and then some) into your assumptions.

You can control things like your investment costs. The lower your investment costs are, the more likely you are to achieve your investment goals.

Control what media you consume. It’s no secret that bad news sells, and awful news sells even better.

Don’t get pulled into that trap.

Sound investing is boring. It’s done consistently over long periods of time.

Don’t get stressed about things you have no control over (i.e., the economy).

Focus on the things you can control.

Where Are You Placing Your Hope?

Having a historical perspective and controlling what we can is good, but what if the markets and the economy don’t recover?

God has provided many wonderful promises to his creation, but an eternal, always-up-and-to-the-right stock market is not one of them.

He’s actually promised the opposite – that one day the current earth will be replaced by a ‘new heaven and new earth’ that’s far better than the current.

When your portfolio and lifestyle are threatened, how do you respond?

I know for me it depends on the day, but I am certainly prone to placing my hope in temporal things.

I try and see this as God’s grace in revealing my heart’s true desires.

He wants to conform me into the image of Christ, which will require some pruning!

I’ve always loved Paul’s take on dealing with life’s uncertainty:

Paul learned the secret of contentment.

He fully understood that nothing happens outside of God’s will – not even a sparrow falls to the ground apart from it.

And if the God that loved him to the point of not sparing his Son is directing his life, then he is content in whatever situation God has him – “whether it is with a full stomach or empty, with plenty or little.”

I don’t know about you, but if I could get to that place I’d be set.

And I certainly wouldn’t be worried about the stock market.

Trusting in God’s love – really trusting – is the only path to true peace and contentment.

Closing Thoughts

No doubt we are living in some tumultuous times.

But we’ve lived through some even more tumultuous times and our economy continued to thrive.

Even more, we really don’t have control over it.

Focusing on the things we can control can be a great way to mitigate the negative effects of a downturn.

Even more than these, though, is having an eternal perspective that allows us to be content whatever the circumstances.

And being content allows us to focus on the things that really matter – like Auburn football.

Hopefully you will join me in prayer for our upcoming coaching search because we can’t afford to mess this one up.

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.