Jake Ridley, CFP®

Jump to a Section

The Ultimate Critics

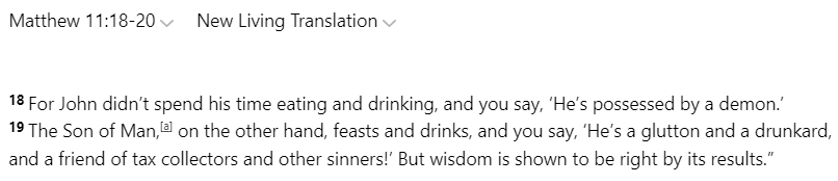

The Pharisees were the first century’s ultimate critics.

John the Baptist lived a life of abstinence, and so the Pharisees dismissed him.

They claimed he was demon-possessed.

Then Jesus comes on the scene, eating and drinking with everyone, and they dismissed him too.

They claimed he was a glutton and a drunkard.

You couldn’t win with them.

No eating or drinking?

Demon!

Eating and drinking?

Glutton! Drunkard!

Nothing was good enough.

Investing can feel similar.

The market is down? The critics say, “The end is ‘nigh; do not invest!”

The market is up?

Those same critics: “The bubble is about to pop; you definitely shouldn’t invest now!”

You can’t win.

Want to know a secret? It has always been and always will be this way.

We will never be “out of the woods”.

There will always be uncertainty.

Don’t believe me?

Let’s take a walk down memory lane to the longest market runup in history: The 2009-2020 Bull Market.

If there ever were a market where the critics might eventually go away, it would be this one.

But, as we’ll see, there were critics all along the way calling it a “bubble”.

And if you listened to them, you would have missed out on a significant amount of money.

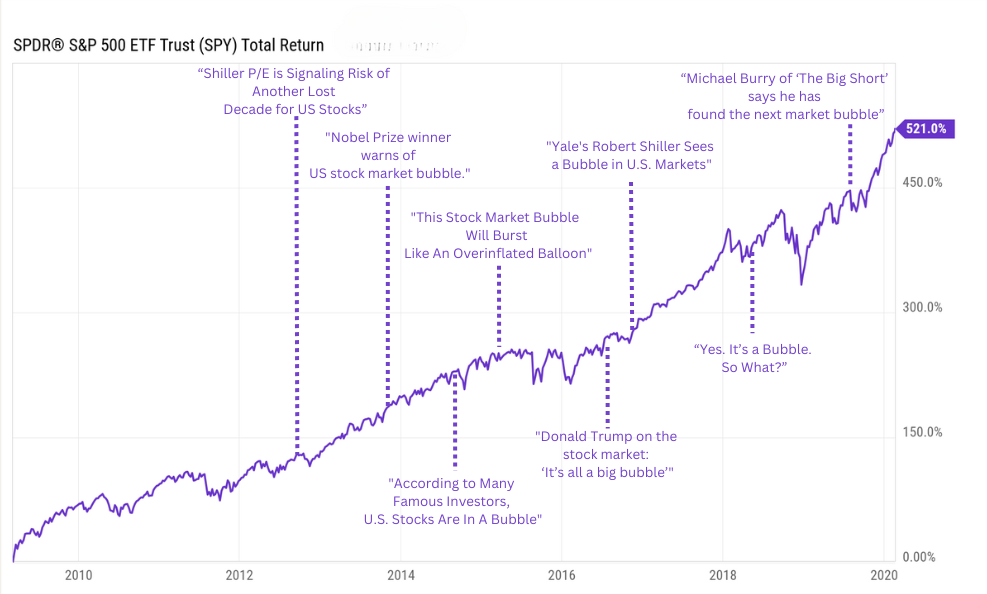

The Longest Bull Market in History: 3/9/2009 – 2/19/2020 (Total Return 521%)

Coming off the greatest financial scare since the Great Depression, it makes sense we were a little jittery.

It was a traumatic event to say the least.

So, to keep things fair, let’s start our research project in 2012.

Given the trauma of 2007-2008 it makes sense that we were skeptical of the runup in the early innings.

To research, I simply googled terms like “stock market bubble” or “the stock market is overvalued” and filtered by date range.

There was no shortage of results in any period selected, but I chose the most persuasive – either because of who said it or what they said.

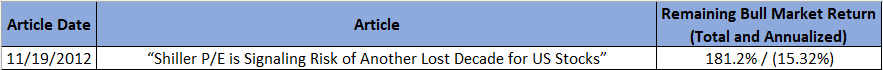

“Asness found that at current valuation levels, the average expected real stock market return over the next decade is a sobering 0.9% per year. The worst-case scenario is an annualized real return of −4.4% while the best case is a real return of 8.3%.”

I actually like Cliff Asness (the source of this article).

He is smart, not pretentious, and makes complicated topics easy to understand.

His argument also resonated with a lot of people at the time, especially with the backdrop of the easy money environment created by the Federal Reserve.

He even goes on to say that his projection is not to be used for market timing rather as a planning tool (i.e., save more or spend less to account for lower returns).

But did we face a second “lost decade”? Not quite.

His “best case” scenario undershot the 10-year period he references by almost 50% total (2% annualized).

His average-case undershot by double digit annual returns.

Not dunking on Cliff.

It seemed very reasonable at the time.

But investors that stayed the course were well rewarded for remaining invested during the uncertainty.

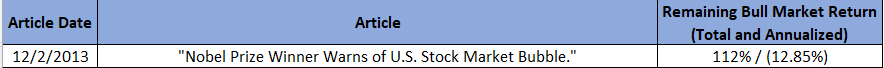

“I find the boom in the U.S. stock market most concerning,” Robert Shiller said in an interview with Germany’s Der Spiegel magazine published on Sunday…. He added that this was a key concern because the U.S. economy was “still weak and vulnerable”.

It’s hard to argue with a Nobel Prize Winner, right?

If he’s worried, then I should definitely be worried.

And again, in fairness, his reasoning makes perfect sense – especially for the time.

The Federal Reserve was in the middle of something that had never been done in the U.S. called Quantitative Easing.

What if you were watching this on CNBC at the time and said, “I’m out!” and got out of the markets?

You would have missed out on 112% in total return (12.85% annual) remaining in this bull market – more than doubling your original investment.

This is a life-changing amount. The difference in being able to retire or not.

Embrace the uncertainty.

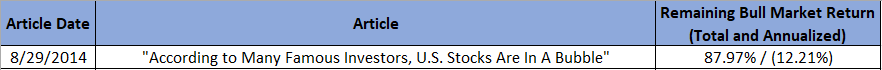

“If you ask Warren Buffett, Marc Faber, Bob Doll, Carl Icahn, and a host of others if the U.S. stock market is in a bubble, you’re likely to get answers that lean toward, “Yes.”

I chose this date specifically because it marked the exact mid-point of this bull market.

Unfortunately, we only know this in hindsight.

There was no halftime show. No pets doing trick shots. No marching band.

Once again, many investment luminaries are appealed to (gasp! – even Warren Buffett!).

Little did we know the market had another 88% in returns left in the tank (12.21% annualized).

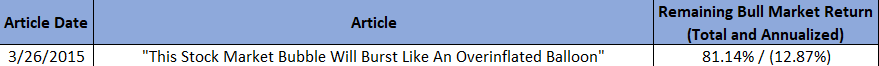

“The stock market is clearly in bubble territory right now, and like all bubbles in history, it will eventually burst…a good indication that the six-year bull market is nearing its end.”

These are the kind of articles that I don’t mind dunking on.

Definitive language like, “clearly” in bubble territory and a “good indication” the bull market is nearing its end scream to an investor, “get out, stupid!”.

The problem is it was just wrong – really wrong.

If you had listed to this author’s advice, you’d have missed out on an additional 81.14% in returns (12.87% annualized).

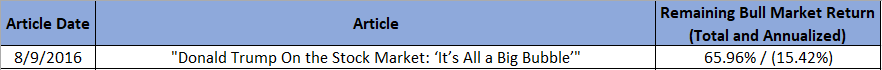

“The big problem, as Trump sees it: The low interest rate environment fostered by the Federal Reserve that has coincided with a 227 percent market gain since the financial crisis lows. “If rates go up, you’re going to see something that’s not pretty,” the billionaire businessman told Fox News during a Tuesday morning phone interview. “It’s all a big bubble.”

Once again, the message is, “the big gains that have happened are artificial and propped up by low interest rates.

Better get out now because the thing’s about to collapse.”

This was the message of the entire bull market.

Again, in fairness, low interest rates should positively affect stock market returns.

The problem was the market just kept chugging right along.

From this point to the end of the bull market, there was a gain of 65.95% (15.42% annualized).

“In the United States, yes, there is [bubble]”.

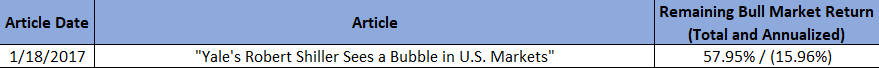

This headline was really a click-bait article to get you to think the Nobel-Prize-Winning Yale Economist is predicting a bubble.

He really spoke about other things for 4 minutes and only spent a few seconds discussing the market.

And even then, he hedged that it’s incredibly difficult to predict.

Nevertheless, if this headline and interview was enough to scare investor into getting out, they would have missed out on 57.95% of returns left in the bull market (15.96% annualized).

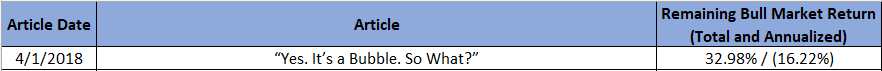

“The relentless rise in the US stock market since its low in 2009 has been dramatic. US stock market valuations now exceed all historical valuation levels, except for those hit at the peak of the dot-com craze. This raises an obvious question for investors: Today, in early 2018, and has been the case over the last year, is the US stock market in another bubble? Yes.”

Things are going great, too great in fact.

And, according to the author, we’ve seen this story before in the tech bubble of ’99 and ’00.

The takeaway?

“You definitely don’t want to experience what we did in ’99 again, so start making preparations now by investing in less bubbly stocks – like emerging markets” (economies like China).

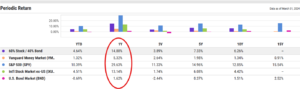

So, how did the U.S Stock Market compare to an Emerging Market Index in that timeframe?

The U.S. Market returned 32.98% compared to -3.69% (yes, negative) for the remainder of the bull market. Oof.

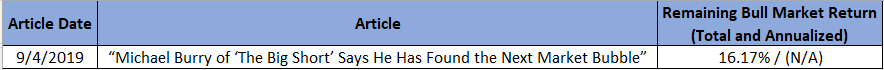

“Passive investments are inflating stock and bond prices in a similar way that collateralized debt obligations did for subprime mortgages more than 10 years ago, Burry told Bloomberg News.”

Michael Burry is famous for spotting the subprime Mortgage Crisis that sparked the Great Recession in 2008-09.

So, anything he says from now on will make headlines. Including this one, espousing index funds are causing a similar, catastrophic bubble.

How did the U.S. Market (an index) do until the end of the bull market caused by Covid (not by a bubble in index funds by the way) only a few months later in 2020? 16.17%.

The Current Bull Market

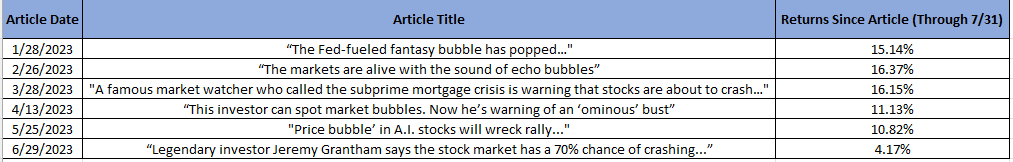

That brings us to the current bull market which started on 10/13/2022.

Unfortunately, today, we don’t have the benefit of hindsight. We are living it.

And there are no guarantees that we won’t experience a lower drawdown than before.

Remember the bit about uncertainty?

However, history has shown again and again that, no matter the environment – up or down – there will be no shortage of people calling for the end.

Here’s a short summary of what we’ve seen since October 12th.

I am by no means saying we are not in a bubble and things will never go down. I am simply pointing out that no matter the market conditions, up or down, critics will be there. Just like the Pharisees couldn’t be pleased, neither can the market critics.

They have always been there and always will be.

Because there is always uncertainty.

Just remember, we aren’t out of the woods yet…nor will we ever be.

Until Jesus returns, of course.

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

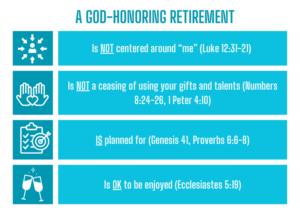

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.