Jake Ridley, CFP®

Table of Contents

The word “budget” can send shivers down the spine of even the most disciplined among us.

If there were a Mount Rushmore of Feeling Guilty, budgeting would sit right beside prayer (who sits between diet and exercise).

It’s one of those things that everyone knows they should do, but very few actually do it.

Why?

First, like any other discipline it takes time and energy. But also, like other disciplines, the fruit is not often seen immediately.

As a financial planner I get to see first-hand the unfortunate results of not being in control of your finances (i.e., budgeting) in all different life/career-stages.

In my experience, each phase has its budgeting challenges but, more importantly, opportunities to gain control.

Let’s explore each major career phase and why it’s so critical to exercise your budgeting muscles in each. Then, let’s look at some practical steps to get started – or refreshed – on creating and maintaining a budget.

Early Career

When you are just beginning your career, budgeting is usually down towards the bottom of the list of things you care about.

Many career-starters live it up when those first paychecks start rolling in, and quickly develop the habit of spending everything they make.

This happens for a variety of reasons: they were never taught to save, the culture tells them to spend everything they make, they plan on getting to it ‘later’ when they are older, etc.

Regardless, society isn’t set up for twenty-somethings to budget (or any age-group for that matter).

However, the dividends paid by learning to budget early in your career cannot be overstated.

Avoiding bad debt (car loans, credit cards, etc.) by learning to live on what you earn is the foundational personal finance principle.

Nothing else matters if you can’t learn to live within your means. Even more, you learn to leverage the greatest wealth building tool you have – your income.

Make your income work for you by catching a ride on the compound interest train – also known as the “eighth wonder of the world.”

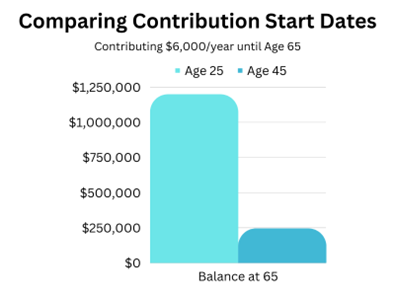

Don’t know what all the fuss is about? Take a look at the chart below comparing savings starting at age 25 vs. 45. Each contribute $6,000/year and get a 7% annual return.

Saving at 25 creates almost five times more than delaying until 45!

How do you take advantage of this you ask?

The easiest way to save is by contributing to your employer’s retirement plan.

Consider contributing 10% of your pay and invest in the target date fund that’s closest to your retirement date.

If you develop this habit, your future millionaire self will thank you!

Mid-Career

As you progress through your life, complexity starts creeping up on you.

Kids come onto the scene, job responsibilities increase, financial obligations increase, church and community involvement increase, and they all put a crunch on your time and your finances.

Having bigger budgeting needs but less time to do it creates a problem.

Things can then quickly spiral out of control, causing you to lose track of what you are spending.

Don’t let the chaos destroy your financial stability! Your budget gives you a ‘true north’ to help you understand if a course correction is needed (i.e., you need to spend less!).

Also, during this period, your income likely increases. Expenses increase too, though (hello kid’s braces).

You want to make sure you don’t spend all that new income and set-aside some for your future self.

Remember the part about compound interest in the last section?

Make sure you don’t get too far behind in saving that it will be painful to catch up.

Learning to save as life gets more complex is crucial!

Approaching Retirement

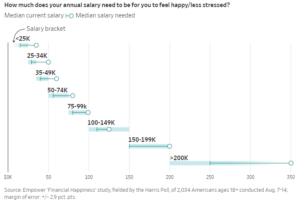

I can’t stress how important it is to gain control of your expenses as you approach retirement.

You can’t answer the question of ‘how much do I need to retire?’ without understanding what your expenses are.

There is no retirement planning without this.

Just as important, you are preparing yourself for life in retirement – meaning no employment income.

You do not want to plan on figuring out the budgeting thing after you cut the employment cord.

That is a recipe for some serious stress and potential catastrophe.

Then to add fuel to the stress fire, what if we have a serious market downturn and your primary source of money (i.e., your portfolio) drops 25%?

You may need to make some adjustments in your spending as your portfolio recovers.

If you’ve never gained control over your expenses and can’t adjust, irreversible damage can be done.

Don’t learn this lesson the hard way. Gain control over your spending before you retire, so you can sleep well at night regardless of the market’s whims.

Budgeting Tips

For those of you that made it to this point in the article and managed to survive the barrage of budget guilt, congratulations!

You’re now rewarded with some practical tips on how to create and maintain a budget.

There are plenty of different ways to skin the budget cat.

The key is to find the one that works for you. Try out some of the budgeting tips below to help you flex your budgeting muscles.

Write Down All Your Income and Expenses

This one is the most manual, but if you are just starting out or need a budget rejuvenation, this can be incredibly powerful.

- Download your bank/credit card statements

- Categorize and label your expenses as either ‘fixed’ (e.g., mortgage, utilities, insurance, savings, taxes, etc.) or ‘variable’ (e.g., hobbies, travel, entertainment, etc.).

- Subtract your fixed expenses from your take-home pay.

You’ll quickly see how much wiggle room you have after your fixed expenses are paid.

This is a sobering exercise in my household. Don’t recommend doing this prior to a date-night – trust me.

Rank Your Expenses from Largest to Smallest

If you are trying to get control of your spending, ranking your expenses from largest to smallest is really helpful.

Once you rank them, then work through the expenses that will have the largest impact first.

Most people find their Starbucks is not the problem, its things like their 84-month car payment (<— Don’t do this!!!).

Leverage Software

There are tons of good budgeting apps that make this exercise easier.

Just a word of wisdom, I wouldn’t recommend these until you’ve at least done one round of pen/paper.

There’s no substitute for writing things down line by line.

Once you’ve done that, though, apps like the ones below can make the process much easier.

Monitor Regularly

Finding a time weekly/monthly to monitor your spending vs. your expected budget is important in maintaining awareness.

You Made It to the End!

Budgeting is the most important component of your financial well-being.

Each phase of your career presents opportunities to grow in the management of your finances.

And gaining control of your money in each phase will lead to less stress and more freedom.

So, break out that pen and paper (or spreadsheet) and grab control of your money!

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. Performance reported gross of fees. You cannot invest in an index. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

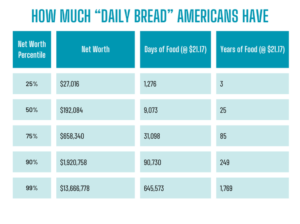

Most Americans have 25 years of “daily bread” stored up in their accounts. So, what does it actually mean for us to pray for “daily bread”?

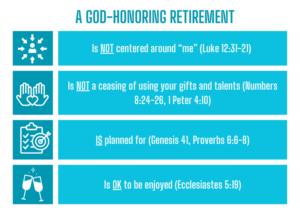

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?