Jake Ridley, CFP®

Table of Contents

A Hidden Retirement Landmine

Ok, so you’re a pastor and starting to prepare for retirement.

Being the on-top-of-it-pastor that you are, you’re taking all the right steps in getting your financial house in order.

Health care coverage? Check.

Portfolio in order? Check.

Retirement budget? Check.

Then you get to the Social Security step.

You break out your neatly folded Social Security statement that you’ve been saving just for this moment.

Even though you opted out as a pastor, you paid in your 40 quarters before entering ministry.

So, you knew you’d receive something for that pre-ministry work.

You look at the statement and enter the amount into your retirement budget.

The budget looks tight, but that Social Security amount helps.

You sleep like a baby that night. Then…. KABOOM!!!

Little did you know that sitting right underneath your retirement feet is a landmine.

That landmine is called the Windfall Elimination Provision.

This little baby is a very confusing, not-easily-Googleable-for-pastors provision that can reduce the amount showing on your Social Security statement.

That’s right.

The amount you thought you would receive may not be real.

Some pastors will have their stated benefit reduced up to 50%!

What the heck!?

So, who exactly does this apply to and what can you do about it?

Let’s read below to find out.

Are Pastor’s Subject to WEP? (Correcting a Common Misconception)

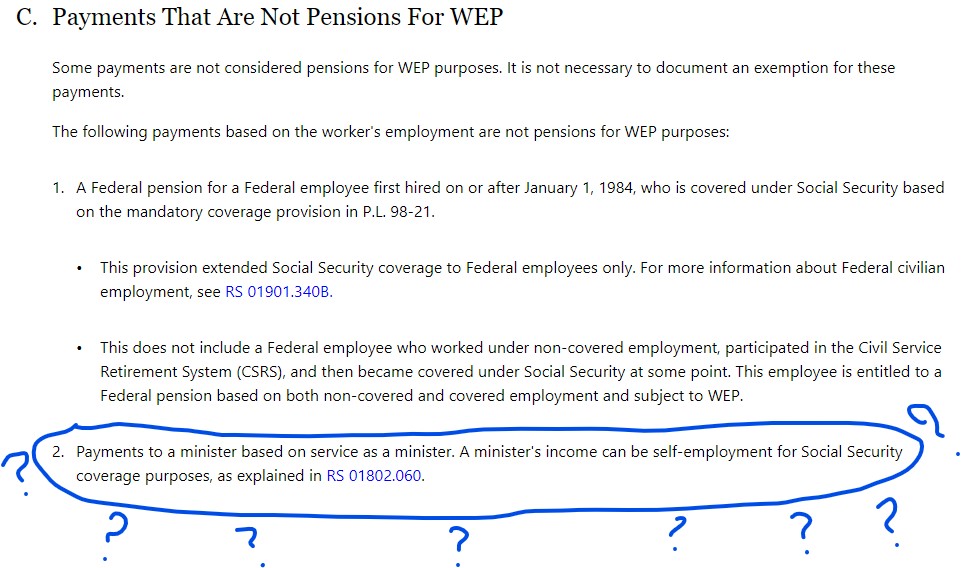

First, if you Google this, one of the first things that will pop up is the Social Security Manual. Then, under ‘Exceptions’ to the WEP you will find this sentence (snip below).

If you are like me, the first twelve times you read, it sounds straightforward that ministers are exempt from WEP.

And like me, you’d be wrong.

Shout out to my friend Daniel Hurley at Social Security Informed for the correction. Daniel, as well as several other Social Security experts, confirmed that this sentence is referring to pastors that did not opt out of Social Security.

See that little sentence at the end about, “minister’s income can be self-employment for Social Security purposes”?

That’s the hint that it’s referring to those that have not opted out.

If you are still paying into Social Security via self-employment taxes (i.e., you have not opted out), then your pension payments are exempt from WEP.

That’s why there’s that little hyperlink at the end.

If you click it – and one more hyperlink – you find your answer that this is not talking about ministers that have opted out – only those that haven’t.

Ok, so as confusing as this is, the bottom line is you can be subject to WEP if you have opted out.

So, who are the most likely to be in the WEP crosshairs?

Those Likely to be Subject to WEP (Assuming You Opted Out of Social Security)

You Entered Into Ministry After Working a Secular Job

You Left Ministry to Pursue a Secular Job

You Worked in Various Ministry and Secular Positions Throughout Your Career

Most pastors in the above scenarios likely contributed enough to receive their full benefit amount (40 credits – about 10 years of employment) BUT also worked in a ministry position where they did not pay into the Social Security system.

In addition, you must have contributed to your church’s retirement plan or receive a pension from that work.

In another confusing Social Security twist, ‘pension’ for their sake refers to a traditional pension (defined benefit) AND also a retirement account (401(k), 403(b), etc.).

So, if you contributed to a retirement account while employed in ministry and opted out, you are likely to have your stated benefit reduced.

If you are thinking, “dang” (or another word) – I’m with you.

Before you start mentally slashing your benefit, though, there may be a chance you are an actual exception to WEP.

Common Exceptions to WEP

-

You Did Not Opt-Out of Social Security

This one is straightforward.

If you are a pastor and decided not to opt-out (click here to see why I think most pastors shouldn’t), you will pay self-employment tax.

This tax is 15.3% on your gross earnings – meaning your salary and housing allowance.

If you have not opted out, then you are paying into Social Security and the amount you will receive won’t be reduced by WEP.

-

You Have 30 or More Years of ‘Substantial Earnings’

This one is a little more complicated.

It typically applies to those pastors that worked in a secular career and entered ministry as a second career.

This is the bottom line: if you have thirty years or more of what Social Security calls ‘substantial earnings’ where you contributed to Social Security then you will be exempt from WEP.

Your benefit will not be reduced.

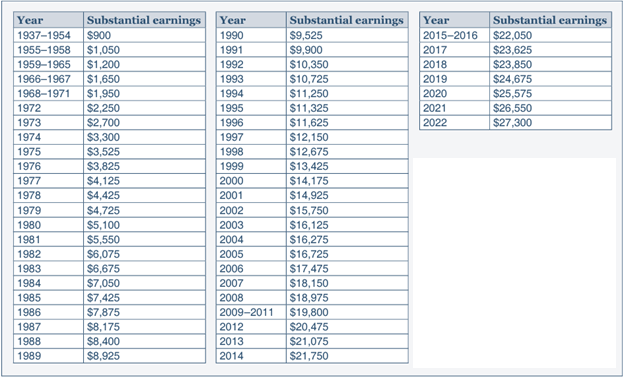

Refer to the chart below to see what is defined as ‘substantial earnings’ for each year or visit this link from Social Security.

-

You have 21-29 Years of Substantial Earnings

Like the above, if you have 21-29 years of substantial earnings, then your benefit will be partially exempt from WEP – meaning it won’t be reduced by the potential full amount.

Planning for WEP

If you think you will be subject to WEP, the simplest way to prepare is reduce your stated Full Retirement Age (FRA) benefit by 50% (located on your Social Security statement).

This is the maximum amount your benefit can be reduced by WEP.

The good news is that WEP cannot entirely wipe out your benefits.

If you want to get more precise in your benefits estimate, Social Security’s WEP calculator can help.

Note: You will need your full earnings history, not the consolidated history on your statement, to get an accurate projection.

To access this, go to your ssa.gov account and click the link “Review Your Full Earnings Record Now”.

This will give you your full earnings history that you can then enter into the calculator.

Then, you need to enter in the monthly pension amount.

For defined contributions plans (e.g., 403(b), 401(k), etc.), you need to divide the total balance by the amount specified in the table of section 4.

Once you enter in these fields, the calculator will produce an estimated monthly retirement benefit.

Also, a congratulations should be in order, as most do not dare to venture this far into the lair of the dreaded Social Security calculator.

Regardless of which method you use, you at least now have a more accurate estimate of your expected Social Security payment and can plan accordingly.

WEP’s Evil Twin – the Government Pension Offset

On a related note, luckily, pastors are not subject to the Government Pension Offset.

This guy can reduce your spousal benefit to $0, if you are a government employee.

So, practically what this means for many pastors is they will (or should) choose to receive their spousal benefit (50% of your spouse’s FRA benefit) rather than their own because the spousal benefit is larger.

This is good news for many pastors.

Even if you have opted out of Social Security, you can still take the spousal benefit.

Make sure you don’t inadvertently leave money on the table by not including this benefit in your Social Security calculations.

Wrapping Up

The WEP is a little-known gremlin that needs to be accounted for in a pastor’s Social Security calculation.

If you are one of the likely candidates, make sure you do your homework and prepare by more accurately estimating your benefit.

Then, you can do the full analysis to determine which Social Security strategy makes the most sense for you.

If you need a second opinion, work with a trusted advisor (CPA, Social Security Expert, CFP®) that understands this area of retirement planning.

Your future self will thank you for side-stepping this potential landmine!

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.

Hi Jake,

Great work on this article! In the years we have been a pastoral family, I have not seen this topic covered as thoroughly as you have covered it here. We came into the ministry when opting out of Social Security seemed to be a popular practice with ministers. Those who opted out did so, or were supposed to do so, because of their religious objection to ALL government programs including Medicare, Medicaid as well as Social Security. This option was not put in place as a means to escape self employment taxation. It is an irrevocable choice and pastors need to think carefully before choosing to opt out. Thanks Jake, for this article!

Thanks so much for the feedback, Naomi! There is definitely a lack of information (as well as misinformation) on this topic. I share your sentiment on opting out of Social Security. Unfortunately, there is a lot of bad information on this topic as well.

Pingback: Five Reasons Pastors Shouldn’t Opt-Out of Social Security - Church Fiduciary