Jake Ridley, CFP®

Table of Contents

Intro

Social Security gets a bad rap, a lot of it rightly deserved. But most people can’t do anything about it.

They pay the tax and get on with their lives.

Pastors are different, though. Pastors can actually make a decision to release themselves from the shackles of Social Security.

So, pastors can opt-out but should they opt-out?

You may be thinking to yourself, “An extra 15.3% in my paycheck sure would be nice. Plus, its mismanaged anyway, so of course!”

Not so fast my friend!

Read on to see five reasons I think it is short-sighted for most pastors to make the decision to opt-out.

Reason 1: You Have to be Conscientiously Opposed

Do you lie awake at night due to your participation in public insurance? Do you truly feel conviction against participating?

If so, then you may be a candidate to opt-out.

If not, then you shouldn’t.

It really is that simple.

Form 4361, the form used for pastors to opt-out of Social Security, states, “I certify that I am conscientiously opposed to, or because of my religious principles I am opposed to, the acceptance (for services I perform as a minister, member of a religious order not under a vow of poverty, or Christian Science practitioner) of any public insurance that makes payments in the event of death, disability, old age, or retirement; or that makes payments toward the cost of, or provides services for, medical care. (Public insurance includes insurance systems established by the Social Security Act.)

This is the only reason you are legally able to opt-out of Social Security. Opting-out because the extra 15.3% would help is not an option. (Note: Pastors are considered self-employed for SS/Medicare tax purposes and pay the employer and employee portions.)

Even opting out because you think Social Security is mismanaged (join the club!) is not a viable reason to opt-out.

I submit that this eliminates most pastors from being eligible to opt-out.

I have not met many (any?) who are genuinely opposed to Social Security based on religious grounds that it is wrong to rely on public insurance.

Reason 2: You Need to Save Twice as Much for Retirement

If you satisfy the first requirement, and you are morally opposed, then you’ve got some heavy lifting from a savings standpoint.

Social Security is usually around 50% of one’s total retirement income if they have saved adequately.

Given that the standard recommendation is to save 10-15% of your income for retirement (depending on age) you need to double that to replace Social Security.

So, unless you are willing and able to consistently save about a quarter of your income towards retirement, I would not recommend opting out.

Most pastors I’ve met consider this opt-out decision when they are young, and money is tight.

They see the extra 15.3% as relief on their budget and expect to get around to saving for retirement later.

Most don’t get around to saving until it’s too late, and certainly haven’t consistently saved the amount required to replace Social Security.

For these reasons, I do not recommend opting out if someone isn’t already used to saving aggressively.

Reason 3: Social Security Protects You from Outliving Your Savings

This is an often-overlooked benefit that Social Security can provide.

Most retirement plans assume an ‘end of plan’ age of 92 or 93. But what happens if you live longer than that?

What if the Lord doesn’t call you home until the ripe old age of 100?

The math looks A LOT different for your retirement portfolio to sustain past your early 90’s.

What Social Security can provide is an income floor that will always be there – increasing every year by an inflation adjustment – whether you live to be 92 or 122.

As an aside, if you haven’t opted out this is one of the reasons it usually makes sense to delay your benefits to age 70 and receive the maximum benefit available.

If you have opted out or are considering, you need to account for this scenario in your planning.

One tool that I would recommend considering for this is a Single Premium Immediate Annuity (SPIA).

Now, if you’re like me and shudder at the word ‘annuity’ , have no fear.

The SPIA is the way an annuity should work.

It’s simple to understand and can provide an income floor, very similar to Social Security.

You can even add a cost-of-living component – just like Social Security – if you want your payment (i.e., annuity) to keep up with inflation.

Without this Social Security replacement tool, though, you are exposing yourself to a potential unforeseen risk.

Reason 4: Social Security Provides a Disability Component

One of the lesser considered benefits of Social Security is the disability component.

If you are unable to work at all, Social Security does provide a level of safety for you and your family via its disability component.

Once you opt-out, though, you forfeit this benefit.

Most families should have some form of private or employer provided long-term disability coverage. If you have opted out, you really need to be sure you have a sufficient disability policy in place.

Reason 5: Increased Medicare Costs

2.9% of the 15.3% SECA tax goes towards Medicare insurance.

If you haven’t paid into the Medicare program, you don’t receive a subsidy for Part A.

This is not the end of the world, but it is an additional expense in retirement, in the neighborhood of a few hundred dollars per month per person who has opted out.

So, if you do opt out, like the other benefits you need to plan for this additional expense that otherwise does not normally get factored into most retirement plans.

Conclusion

The decision to opt-out of Social Security is a big one.

There can be long-lasting negative consequences if this decision is made flippantly.

First and foremost, opting out of Social Security is a decision of conviction and conscience not of convenience.

Second, if you do pass the conviction test (or if you’re a pastor who has already opted out) then you need to plan appropriately. Keep in mind, even if you have paid into Social Security through secular employment, the decision to opt-out could reduce your stated benefit.

You’ll need to save about twice what you normally should save (even if you continue to receive your housing allowance in retirement), you’ll need to make sure your life and disability coverages are adequate, and don’t forget to plan for the ‘what if’ scenario of living longer than your retirement portfolio can sustain!

So, make sure you really know what you are signing up for by opting out, because it can have long-lasting negative consequences if not planned for appropriately.

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. Performance reported gross of fees. You cannot invest in an index. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

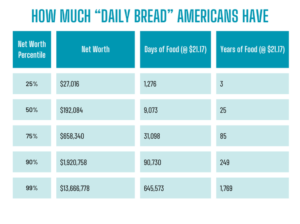

Most Americans have 25 years of “daily bread” stored up in their accounts. So, what does it actually mean for us to pray for “daily bread”?

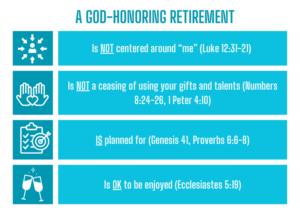

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

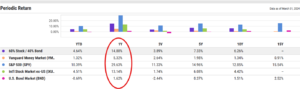

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

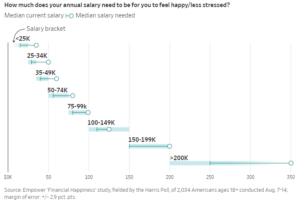

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

Pingback: Pastor Tax Hack! Five Steps to Pay Your SECA Taxes Using the W-4 - Church Fiduciary

Pingback: Should Pastors Use TurboTax? - Church Fiduciary