Jake Ridley, CFP®

Table of Contents

Should Pastors Use Tax Filing Software?

There is no pain quite like that of a pastor trying to fix a tax filing mess.

If you’re a pastor who has used tax software (TurboTax, HR Block, etc.) and experienced this unique level of agony and frustration, you know.

It is not fun.

You feel alone.

Not even Google can help.

Should all pastors, then, avoid tax filing software like TurboTax, HR Block, or TaxAct?

The answer is: it depends.

Let’s look at three scenarios where it is best to avoid tax filing software. And be sure to read to the end for several CPA alternatives to tax software.

Newly Ordained Pastor

Going from a secular job into the world of pastoral taxes can be a shock to the system.

Sorting through housing allowance, opting out of Social Security, SECA, etc. can all be so confusing.

Not to mention, you didn’t get into ministry because you love doing taxes.

As a new pastor there are several potential pitfalls that tax software may not pick up, and it can be very costly to fix them.

One scenario I’ve seen involves underpaying the pastor’s self-employment taxes (if they haven’t opted out of Social Security).

For example: a newly ordained pastor shows some Social Security and Medicare withholdings on their W-2.

This could be because the pastor was ordained mid-year (i.e., they shifted from employed to self-employed).

Because there is something in the Medicare/Social Security box, the software assumes the correct amount has been withheld.

In reality, more needed to be withheld or contributed once the pastor becomes ordained. The “why” is complicated but addressed in this post on SECA.

The bottom line is the IRS doesn’t receive enough to cover the pastor’s self-employment taxes.

The problem is the IRS doesn’t usually catch this until years later.

Then when penalties and interest accrue, the amount owed can potentially be double the original tax bill.

Because of this new and unique tax complexity, I generally do not recommend new pastors file their own taxes through TurboTax, HR Block, or TaxAct.

Bi-Vocational Pastor

Pastors’ taxes are already complicated enough.

If you add in another source of income things can just get even messier.

Let’s say you are: 1) working full-time at a secular employer, 2) work part-time as the pastor of the church you are launching, 3) have opted-out of Social Security for your ministry employment (you can only opt-out of social security for ministerial earnings not secular), 4) receive a housing allowance, and 5) do some weddings on the side as a contractor.

There are a lot of potential landmines that you want to make sure are avoided with all these different income sources and tax status.

That can potentially be a lot to throw at software if you don’t know what you are doing.

I recommend using a CPA to file your taxes if you are bi-vocational.

Recently Retired

This seems counterintuitive.

Doesn’t complexity decrease when you retire?

For pastors it may actually increase. How?

For starters, pastors can continue to claim the housing allowance when they are retired.

This is a unique benefit only available to pastors.

Since you have to distribute it from your 403(b), some 403(b) providers (recordkeepers) process the annual 1099 (the tax document that records the account distributions) differently.

Some providers choose to withhold 20% from the distribution automatically while others do not.

Some providers mark the distribution as ‘taxable amount not determined’ while others may mark it ‘taxable’.

You want a CPA that can catch these potential differences to ensure the amount allotted to your housing allowance is not taxed.

In addition to the housing allowance in retirement, there may be opportunities for classic retirement tax savings strategies like partial Roth conversions, capital gain harvesting, etc.

Having a CPA can help you make sure you are participating in and maximizing these potential savings opportunities.

CPA Alternatives

Who are these wonderful CPA’s that understand pastors’ taxes?

And how much can you expect to pay?

Read below for two services I have personal experience with.

Note: I receive NO compensation for recommending either of these services.

There are several others if you google “minister tax prep”.

Costs for tax filing vary, but a good starting point is $600 for return preparation and will increase based upon your complexity.

Kevin Aderholt and ChurchBiz services over a hundred churches from a bookkeeping/payroll standpoint and they also help pastors with their personal tax returns.

So, they know how the church works from the inside and out.

Disclaimer: I’m biased because I used to work there!

Corey Pfaffe has decades of ministry tax experience and has been a great resource for me at Church Fiduciary.

Closing Thoughts

TurboTax and other software can be great tools.

However, they can miss some critical pastor tax situations.

And this can cause quite a lot of pain.

The three scenarios above are when I would recommend using a CPA instead.

So, avoid the pain and use someone who knows pastors and their tax quirks!

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

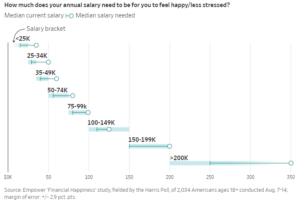

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.

Pingback: 3 Tax-Savings Strategies for Retired Pastors - Church Fiduciary

Pingback: Retired Minister Housing Allowance [Potential Tax Savings]