Jake Ridley, CFP®

Table of Contents

A Dose of Investing Humility

2022 presented us with a big ole heaping pile of……humility (this is a G-rated blog).

The inflation that wasn’t actually was, and the Federal Reserve decided to tighten the belt of the economy at its fastest pace in over 40 years.

The result was a very tough investing environment for most major asset classes.

2022 did, however, affirm and reinforce tried-and-true investment principles showing us diversification still works and getting rich quick doesn’t.

Let’s look at three examples where 2022 proved this true.

The Collapse of the “Covid Darlings”

Remember in 2020 when everyone declared the future of everything was virtual?

Virtual meetings, virtual doctor appointments, virtual exercise, virtual car buying…and then for fun everyone would forever stay at home and watch Netflix and chill?

And since that was our obvious future, the companies that would obviously thrive were Zoom, Teladoc, Netflix, Carvana, Peloton, and the gang.

So, everybody bought them.

And they appeared to be right – until 2022 came.

It turns out there is a little more to investing than throwing money at the latest fad.

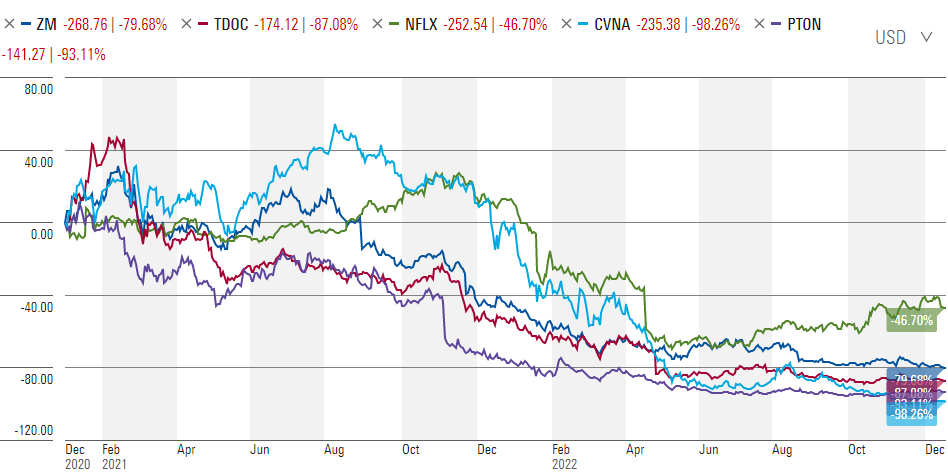

The chart below is one of the craziest you will see.

In the past 2 years, Carvana is down a face-melting 98%, Peloton 93%, Teladoc 87%, Zoom 80%, and Netflix a respectable 47%.

This means if you invested $1,000 in Carvana on Jan. 1st of 2021, you would now have $17.37.

My gosh.

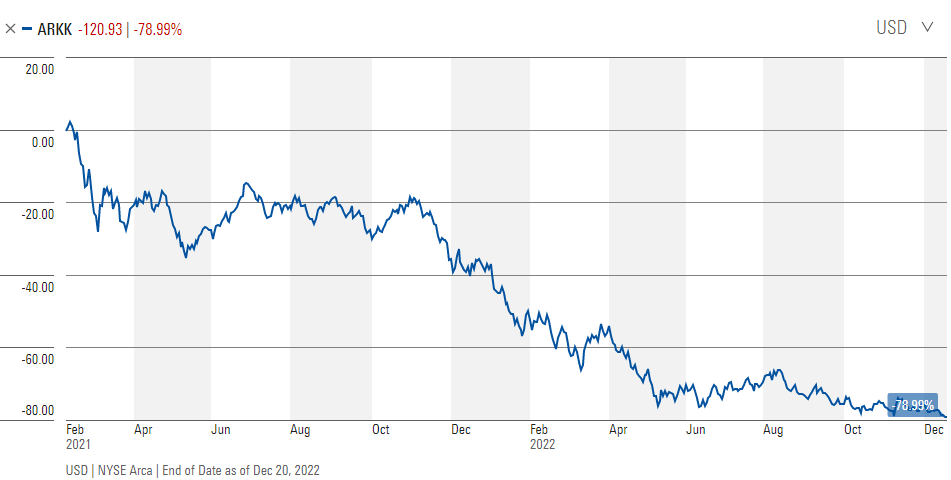

This euphoria made its way into funds as well.

Remember the “can’t miss” ETF of 2020, the ARK Innovation ETF (ARKK)?

This ETF was basically a basket of these types of companies (hence the name “Innovation”).

If you invested at the height of its can’t-missedness, you are down almost 80% today from those highs.

What’s the takeaway? Don’t get caught up in the latest investing fad.

As Warren Buffett is fond of saying, “When the tide goes out, you find out who is swimming naked.”

There was a lot of investment skinny-dipping in 2020/2021 and 2022 exposed them.

What’s the alternative? A diversified total market fund.

They are low cost, elegantly simple, and still give you exposure to “fad” companies – just in the right proportion (i.e., small).

If the fad has staying power, the companies will grow, and you will gain more exposure to them if they grow – along with hundreds of other companies.

Because of this diversification, a fund like VTI is up a little over 1% over 2-years as of the time of this writing.

Not an earth-shattering return but way better than being down 98%.

Value Outperforms Growth

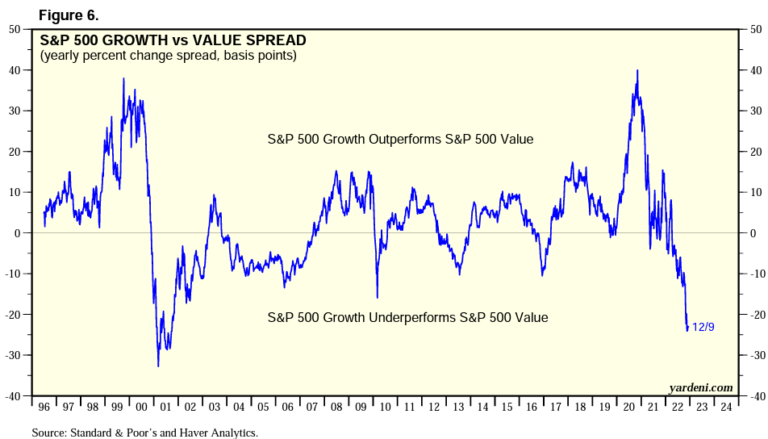

There hasn’t been a more maligned investment strategy than value stocks over the past decade.

High-flying growth stocks (think Amazon, Tesla, etc.) have ruled since 2008 and seemingly KO’d value stocks in 2020-21.

Not in 2022, though.

Value picked itself up off the mat and outperformed growth by over 20%.

Per the chart below, this is the largest outperformance of value over growth in the last 20 years.

One big reason is growth stocks are much more sensitive to interest rate changes, which we’ve obviously had in spades this year.

This is precisely why you diversify across investment factors (i.e., growth and value).

Every asset class has its day, you just don’t know when that day will be.

Rather than putting all your eggs in the investment with the most recent outperformance, hold both!

You will never have the highest return but also never the lowest. Diversification continues to be your friend.

Crypto Collapse

This is the story of 2022.

The crypto craze was everything balled into one – it was the fad investment of the post-Covid era, the get-rich-quick stories were endless, it allowed you to stick it to the “man” by going off the monetary grid, and investment luminaries such as Tom Brady, Steph Curry, and Shaq were pumping it – what could go wrong?

Turns out A LOT.

Some folks lost everything in the collapse of the currency exchange, FTX, which cratered after a tweet caused a run on the bank – yes a tweet.

Billions of dollars evaporated in about five days. As more details come to light, it gets even more embarrassing.

What does a multi-billion-dollar currency exchange use to keep track of its incredibly complicated book of business?

The same thing your local pizza joint uses. Good grief.

Even if you dodged the FTX fiasco the most popular cryptocurrency, Bitcoin, has lost almost 65% of its value this year and 75% since its November 2021 highs.

This is exhibit A of why crypto stinks as a currency – also known as a store of value. It stores value about as well as the Cuban peso or Zimbabwean dollar.

Remember how it was supposed to be a good inflation investment hedge, though?

Turns out it stinks at that also.

Don’t invest based on your FOMO and don’t invest in things you don’t understand. Invest based on actual sound investing principles.

If you just can’t help yourself, please keep the investment small (i.e., don’t bet your retirement on it).

2023 and Beyond

2022 has been a tough year for most investors.

But it was really bad for those that shunned long-standing investment principles.

There will always be shiny object investments that claim to be the “next internet.”

Don’t be lured in by their siren song.

When you feel your investment FOMO ratcheting up, look back to these charts of 2022 and stay the course.

Your future self will thank you!

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.

Pingback: Pastors: 3 Paradigm-Shifting Investment Facts - Church Fiduciary