Jake Ridley, CFP®

Table of Contents

Pastoral Jiu Jitsu

Pastors have it tough. In addition to your many pastoral duties, you get to navigate the most complicated tax setup known to man.

Housing allowance, housing allowance in retirement, deciding to stay in or out of Social Security (stay in!), and the most confusing of all: dual tax status.

What the heck is dual tax status?

It means pastors are considered employees for income tax purposes and self-employed for Social Security/Medicare tax purposes.

You read that right, pastors act like regular old employees for income taxes but self-employed for Social Security and Medicare.

Confusing, right?

Before you start raining down curses on the IRS, jiu-jitsu that situation into your advantage.

How could you possibly turn this into a positive? Stay with me.

You can actually use this dual-tax status to make your life easier.

Let’s look how, using a 5-step process to pay those Social Security/Medicare taxes (known as SECA) using your W-4.

Step 1: Download your W-4

The first step is to download the most recent W-4 form.

This is where you are going to tell your employer exactly how much to withhold from your paycheck to pay your SECA taxes.

Normally, this form is meant to address income taxes.

But remember the point above about pastors having dual tax status?

Because of this, you can use the W-4 for your SECA taxes as well.

Once you complete Steps 1-3 related to your income tax, Step 4(c) “Extra Withholding” is where the magic happens.

This is where you are going to enter in exactly how much extra you want withheld.

How much should you withhold? Let’s move on to Step 2 to figure out how to calculate your SECA tax.

Step 2: Calculate Your Estimated SECA Tax

To calculate your estimated SECA tax, you want to use the formula below:

Total Income X 15% = Amount to Enter in Box 4(c)

Total Income INLCUDES your housing allowance! For SECA purposes, housing allowance is considered income. So total income is your salary PLUS housing allowance.

Housing Allowance is considered “income” for Social Security purposes but NOT for income tax purposes. Do I understand why? No, I do not.

Step 3: Submit Your W-4

Once you complete your W-4, submit it to your employer’s HR, Executive Pastor, Executive Administrator, etc. to update.

Step 4: Review Your Next Paycheck

After you submit it, make sure to review your next paycheck to ensure the appropriate changes were made. Don’t just assume they were!

Step 5: Revise As Necessary

Once you make these changes, you likely will need to make adjustments and refine the amount being withheld over time.

If this is your first time updating your W-4 you might withhold more tax than is owed.

This is because of the way the housing allowance is treated for tax purposes – not included as income for income tax but included as income for SECA.

Many pastors owe very little in income taxes when you remove the housing allowance and standard deduction from their income and then include dependent tax credits.

But your SECA tax will almost always be greater due to the treatment of housing allowance as income.

And because Social Security and the IRS talk to each other, all that matters is your total tax bill (Income Tax plus SECA).

So basically, if you are withholding 15 % of your total income some of that will likely be refunded to you due to your income tax being so low.

The key here is to use the W-4 to your advantage and refine the amounts withheld as you see fit.

Some people hate owing taxes at year-end and some hate giving the government an interest free loan in the form of a tax refund.

It’s completely up to you.

Wrap-Up

There is no doubt about it, pastors have a very confusing tax situation.

And pastors don’t sign up to be pastors because they are tax experts – they sign up to pastor!

But you can take advantage of this convoluted situation.

Ninja your dual-tax status to your benefit and use the W-4 to pay your SECA taxes!

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. Performance reported gross of fees. You cannot invest in an index. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

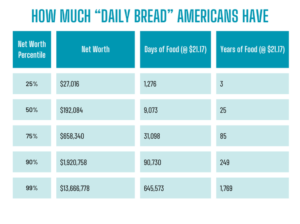

Most Americans have 25 years of “daily bread” stored up in their accounts. So, what does it actually mean for us to pray for “daily bread”?

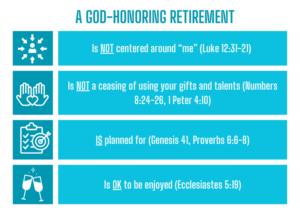

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

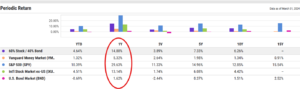

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

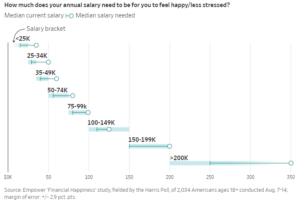

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

Pingback: Five Reasons Pastors Shouldn’t Opt-Out of Social Security - Church Fiduciary

Pingback: The Pastor’s Housing Allowance in Retirement - Church Fiduciary

Pingback: Should Pastors Use TurboTax? - Church Fiduciary