Jake Ridley, CFP®

Table of Contents

Are You Someone Else’s Passive Income?

Passive Income: “…money you can earn without much ongoing effort”.

Sounds like a pretty good deal, right?

Sitting on the beach sipping your drink while the checks roll in.

But what if you and your savings are the passive income for someone else?

Probably not so good of a deal, huh?

Below are three common passive income traps that can choke your retirement savings AND three solutions to release them from those shackles.

Passive Income Trap #1: An Advisor You Never Hear From

I see this one all the time.

It usually happens like this: pastor opens an account with an advisor – usually a relative, “close friend”, or someone on the board – then they fund the account through contributions or a rollover, etc.

The account gets funded and then…they never hear from the advisor again.

Sure, they receive generic mailing list emails, but never from them personally.

Why is that?

They may have too many clients to realistically be able to serve all of them.

This is very common at large brokerages or firms.

A second reason may be the advisor doesn’t even work at that firm any longer.

Sadly, this is a common business practice for many firms.

The firm hires an enthusiastic, young new advisor, then tells the advisor to sign up their friends and family as clients, and – boom – they’re now locked in.

But, unfortunately for the advisor, those accounts don’t generate enough income for them to survive.

So, the advisor leaves the firm.

The friends and family’s accounts, however, stay at the firm and are generating fees – usually A LOT.

Now some other senior advisor makes a nice living at your expense.

No, thanks.

Whether the advisor is still at the firm or not, it’s clear that you aren’t receiving any value for this and certainly not justified to be charged ongoing fees.

How do you escape this trap?

Solution: Transfer the Account

To fix this, you can do one of two things: transfer your account or find a new advisor (who will transfer it into a new account).

The first option works if you discover that you are comfortable managing your investments yourself.

If so, you can easily transfer the account to a custodian like Vanguard, Fidelity, or Schwab.

This is, of course, the cheapest option.

If you aren’t comfortable managing things on your own, you can look for another advisor.

I’d recommend interviewing several different advisors to compare.

Key questions to ask are:

- How much do they charge?

- Do they receive commissions from any of the products they recommend? (Ideally, no)

- What experience do they have working with pastors? (Ask specific questions about their experience with housing in retirement, social security opt-out, etc.)

- How many clients do they personally manage?

- Do they manage investments or is it a one-time plan?

All these questions will help you gauge their experience and whether they will be working in your best interest.

The key phrase being “working in your best interest” not “doing as little as possible to generate as many fees as possible.”

Passive Income Trap #2: Old 401k/403b Plan (Especially Small Plans)

Raise your hand if you’ve got a 401(k) or 403(b) hanging out there at an old employer.

You are not alone.

I’ve never seen a client that doesn’t have one of these orphaned accounts.

And the old plan provider is keeping your savings in that account out of the goodness of their heart, right?

Uh, no.

That account is most likely being charged something.

Administrative fees, advisory fees, managed account fees, and fund fees are just some of the ongoing fees that could be charged to that little orphaned retirement account.

As a rule of thumb, the smaller the employer, the higher the fees.

Some of the worst offenders are charging 2% or more per year when you total everything (advisor fees, investments fees).

2% doesn’t sound like a lot?

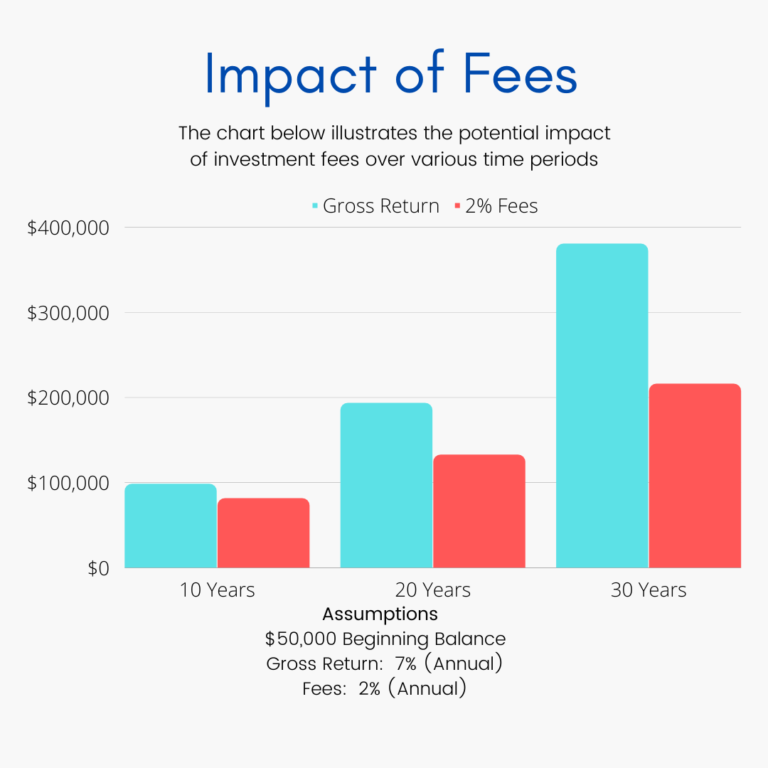

Check out the chart below.

At 2%, the difference in account balances is quite drastic. Over a 30-year period, the account with a 2% fee has almost $165,000 less than the account without those fees.

And this is just with a relatively modest beginning balance of $50,000.

So, what exactly are you getting for that 2%?

Nada.

How do you fix this one?

Solution: Roll the Account into an IRA or Your Employer’s Plan

Bring that little orphaned account back into the loving arms of his investment family.

How?

Through a direct rollover – either into an individual retirement account (IRA or Roth IRA) or into your current employer’s plan (401(k), 403(b), etc.)

Call the plan provider (usually located on a statement) and ask them to do a direct rollover of the funds.

They’ll either send a check directly to your institution of choice or send you the check (made out to the institution) for you to mail directly to them.

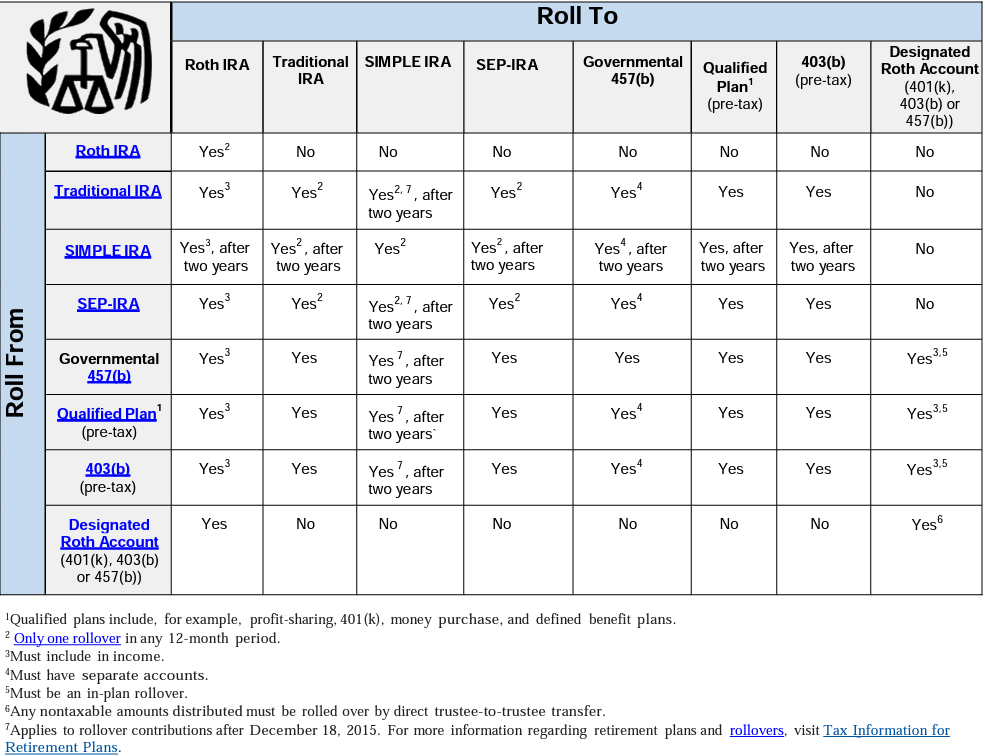

The rollover rules can be a little tricky, so refer to the chart below on what accounts you can/can’t roll into.

Also, compare the fees of your current employer’s retirement plan vs. an individual account to make sure you don’t roll yourself into our third and final passive income trap.

Passive Income Trap #3: Current 401k/403b Plan with High Fees

I’m particularly sensitive to this one because of the outrageous fees I’ve seen in the church plan 403(b) world.

401(k)s and standard 403(b)s certainly aren’t immune either, but church plans can be some of the worst offenders.

This is a shame considering they are for, you know, CHURCHES.

But have no fear, they will serenade you with “Just as I Am” while you’re on hold.

I could go on.

Being held hostage by these fees because you don’t have a choice is frustrating.

To understand your plan’s fees, ask your plan’s administrator (Executive Pastor, HR, Elder Board, Finance Deacon, etc.).

Be sure to ask them for all plan associated fees which can include recordkeeping fees, third party-administrator fees, advisory fees, and managed account fees.

They can reach out to the plan provider if they aren’t sure.

Another thing to keep in mind is the default plan investment option, known officially as the QDIA.

This QDIA is another way fees can get snuck into the mix when the plan provider’s proprietary options are used.

The provider knows that most people use this option.

So, they funnel people into their fund that is more expensive for you but more profitable for them.

All these fees can be choking out your returns without you even knowing it.

Unfortunately, small employer plans can be easy targets for these fees, especially church plans.

What can be done about this?

Solution: Lobby the Executive Pastor, HR Director, etc. for a Cost-Effective Plan

If you do discover your plan is being charged these fees and you are receiving no benefit (e.g., you’re paying advisory fees but have never seen or heard from an advisor), talk with the person responsible for the plan (Executive Pastor, HR, Elder Board, Finance Deacon, etc.).

They may not even be aware.

Show them the effect of those fees on your savings and lobby them to research other plan options.

Also, show your coworkers.

Many plans have been changed because the employees say, “enough” and a better plan is implemented.

We’re always happy to help you research those options here at Church Fiduciary.

Another option is to contribute to an individual retirement account rather than your employer plan.

This is a last resort of sorts.

If your current plan has no match, you can sufficiently fund your retirement through the individual max amount ($6,500 for 2023 or $7,500 if you are over 50), and you understand you won’t be able to distribute those funds and claim a housing allowance in retirement.

As you can see, it’s way better to have an employer plan that works for you.

Sometimes, though, it may make sense to simply use individual retirement accounts to avoid egregious fees.

Come Into the Light!

The financial world can be tricky to navigate where hidden fees are the norm.

The three scenarios above are certainly not an exhaustive list but are a good start to making sure your savings are working for you, not someone else.

Expose those fees to the light and stop being someone else’s passive income!

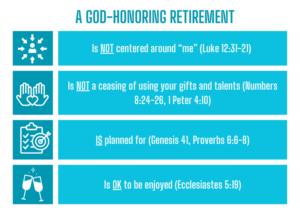

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.