Jake Ridley, CFP®

Table of Contents

Intro

“I can’t wait to research church retirement plans!”, said no one ever.

Researching these probably sits between the annual budget meeting and filling out expense reports on the list of your favorite pastimes.

Making things more difficult are the various providers, plan options, investment options, and a myriad of pricing models, some more transparent than others. It can be completely overwhelming.

However, by understanding how these plans operate and are priced, you can turn your retirement plan from a necessary evil into a strategic advantage – potentially saving your employees thousands of dollars.

The goal of this guide is to be a transparent breath of fresh air, giving you the confidence to understand the “why” and offer the absolute best retirement plan for your employees.

Let’s get started.

Why Offer a Retirement Plan?

First, it’s best to begin with the end in mind; why do you want to offer a retirement plan?

There are many good reasons to offer one.

Maybe you want to use this plan as part of your church’s greater financial wellness strategy for it’s employees.

Or maybe you are hiring and the ‘retirement benefits’ question is being asked.

You might be wondering if your plan’s investment costs are prohibitively expensive.

Or maybe you just realized that there are actually church specific retirement plans with their own rules (read the section on church plans below!), and you aren’t even sure if your plan is a church retirement plan.

All of these are common reasons to evaluate or re-evaluate church retirement plans.

But before we get into the nitty gritty, let’s get a quick refresher on what a retirement plan is and why we go through so much trouble to offer them.

Retirement Plan Basics

In short, a retirement plan is a government approved savings vehicle, the most common being the 401(k) plan. Other common plan options are 403(b)’s, 457’s, and Deferred Compensation plans.

These plans began almost by accident in the 1970s and grew in popularity soon after as employers started phasing out pensions and shifting the retirement burden to employees.

They are the government’s way of incentivizing retirement savings for its citizens.

The plan is not an investment, it is simply the “wrapper” where the investments live.

Sounds simple, right?

Well, once we introduce tax savings into the picture, things get more complicated (i.e., you’ve got to play by the government’s rules to receive the benefit).

Then when you add the factor of “church” into the mix, things can get even more complicated. Even though the complexity can be frustrating, as we’ll see, the benefits are worth the costs.

Read This Before You Choose a Plan!

As we alluded to earlier, churches can actually adopt what is referred to as a Church Plan and avoid many of the rules created by the Employee Retirement Income Security Act of 1974 (ERISA). (Note: the IRS defines “church”, and what they consider a “church” could be an entire article in and of itself – we’re assuming you are a church.)

Church Plans are generally exempt from ERISA and tend to work differently than what most people are familiar with in the retirement plan space.

This exemption from ERISA can be a significant benefit for churches when it comes to administrative costs and flexibility.

The general rule here is if you are a bona fide church, you should probably have a Church Plan as opposed to a standard ERISA retirement plan.

As you vet different plan providers or advisors, you need to ask about their experience with Non-ERISA Church Plans.

Be very specific when asking about this as some providers will assume any 403(b) plan (what most non-profits adopt) will do, which is incorrect.

You want a ‘Church Plan’. Now that we’ve established what a Church Plan is let’s look at what type of retirement plan you should offer.

What Plan Type Should I Use?

There are a few different plan types that churches can choose from: 401(k)s, 403(b)s, Defined Benefit (known as a “pension”) and Deferred Compensation plans.

Without getting too far into the weeds, 403(b)s are the best choice for churches as they are widely available from multiple providers and offer more flexibility than other plans.

One example of the flexibility 403(b)s offer is the ability to avoid what’s called “non-discrimination and coverage testing.”

This testing is required in 401(k) plans and is the government’s way of ensuring the plans aren’t being used to solely benefit the top earners.

While meant with good intentions, this can create administrative complexity and costs, as well as potential compliance problems.

There are several other examples where the 403(b) proves to be less rigid than others, but the big takeaway is this flexibility makes them most suitable for churches.

How Much Does a Plan Cost & Who Pays for It?

Now that we’ve discussed different plan types and why the 403(b) is usually best, let’s get into pricing. There are two main questions to answer here: how much does it cost and who pays for it?

As we’ll see, coming up with this answer is easier said than done if you don’t know the right questions to ask.

Types of Plan Fees

TPA (Third Party Administrator)

The first service charge is what’s called a TPA fee.

TPA stands for Third Party Administrator and these are the guys that help you stay in compliance.

They are responsible for drafting your pre-approved plan document (see note below), submitting it to the IRS for approval, and resubmitting/updating it to ensure it stays in compliance.

A good TPA will stay on top of legislation and communicate to you changes that may affect you. There is usually a flat annual fee for this service and can be paid for by the church or by the plan participants.

A Note on Pre-Approved Plan Documents

The plan document is what legally creates the guidelines under which your plan will operate.

A pre-approved plan is usually provided by your TPA and saves you the hassle of creating a plan from scratch (by an attorney) and then maintaining it (i.e., ensuring its continued compliance).

Again, most churches, particularly in the early phases, are trying to minimize administrative hassle, and this is just another way of doing so.

As you vet providers, ask them if they are a church plan volume submitter or if they have a church plan IRS pre-approved plan.

If you are a larger church, or association of churches, it may make sense to have your own plan document drafted as you may need to be more precise given the added complexity.

Recordkeeping

The second service charge is the recordkeeping charge.

The recordkeeper is the one who makes sure contributions are invested and applied to employees’ accounts, tracks contribution amounts relative to annual limits, reconciles individual’s balances within the pool of retirement plan assets, etc.

They are the back-end operations of the plan.

Recordkeepers also are responsible for the employee’s interface to the plan through their website. The recordkeeping fee can either be a flat-fee or an asset-based fee, or in some cases, a combination of both.

Flat fees are usually preferable as they stay fixed as the employee’s retirement account grows, as long as the fee is reasonable, of course.

This concept of fixed fees vs. asset based is important to grasp.

Fixed fees scale better for you and your employees as the costs remain constant regardless of account balances.

Asset based fees may be cheaper at lower account balances but will significantly outpace the fixed fee over time, without any additional value added (i.e., the same work is being done for an account with $10,000 as an account with $1,000,000).

For example: A fixed fee recordkeeping charge of $90 year per participant is .9% of an account with a $10,000 balance (a relatively high amount for recordkeeping) but is .09% of an account with a $100,000 balance and .009% of an account with a $1,000,000 balance.

On the other side, a recordkeeping fee of .15% is $15 for an account with a $10,000 balance, $150 for an account with a $100,000 balance and $1,500 for an account with a $1,000,000 balance.

You want the power of compounding to work for your employees, not against.

The recordkeeping charge can also be paid for by the employer or employee, or both.

A Note on Pastoral Housing Allowance in Retirement

An important feature of Church Plans is the ability for pastors to claim a portion of their retirement plan distribution as housing allowance in retirement.

When you are speaking with recordkeepers, make sure they are able to classify retirement distributions as housing allowance in their year-end tax reporting (known as a 1099).

Investment Expenses

The third type of plan expense to evaluate is the underlying expenses of the investments.

Rather than being charged directly as a plan expense, these expenses are embedded in the investments themselves and therefore paid by the participant, not the church.

Understanding these fees and selecting the best available investments is probably the single most important decision you can make when vetting retirement plan options.

The primary way these expenses are expressed is in the investment’s “expense ratio”.

The expense ratio of the investment is the cost that the investment fund charges to operate it.

Marketing costs, trading operations, analysts, portfolio managers, etc. are all wrapped into this fee and passed along to the investor.

This fee directly reduces the performance of the investment by its amount.

If an investment fund returns 8% one year (this is good!) and has an expense ratio of 1%, the net return for the participant is 7% (this is not as good!).

While 1% may not sound like a lot, this cost can add up to thousands of dollars, or more, over an investor’s lifetime.

For example, if you contribute $10,000 a year over 30 years and achieve an 8% annual return, your balance at the end of 30 years would be $1,132,832.

By reducing that 8% to 7%, the new balance would be $944,608 – a difference of over $188,224!

So, generally speaking, the lower the investment expense the better.

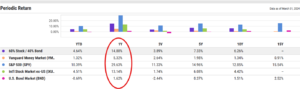

You want the majority, if not all, of the investments included in the plan to be index funds. Most index funds have expense ratios in the .02%-.08% range with target date index funds having expense ratios in the .10%-.15% range.

To get an idea of what funds are offered, ask the plan provider for a sample investment lineup. As you review them, you want to make sure there are enough index fund options for your participants to create a solid, low-cost investment strategy.

A Note on Annuities

403(b)s have been notorious for using annuities as a major part of their investment lineup.

Annuities are really insurance products with an investment component and are poor at both. They are incredibly expensive (in the 2-3% annual range) and are not optimal investment options.

You want to steer clear of any company that is offering these as an investment option.

Managed Account Fees

Another potential additional investment charge is called a ‘managed account’ fee.

This is a participant paid fee (almost always an AUM/basis point) for allowing a third-party, usually affiliated with the advisor, to make investment decisions for the participant.

The participant is delegating their investment decisions to whomever is managing the account. For most participants this is unnecessary.

In reality, if participants are not comfortable making investment allocation decisions, they can choose a target retirement date fund.

A good lineup of Target Date index funds will usually be much less expensive and accomplish the same goal.

Additional Investment Questions

As investors have gotten savvier regarding expense ratios over the years, some plan providers have gotten more creative trying to funnel participants to more profitable, usually proprietary, options.

Including funds labeled as “biblically responsible investing” funds.

One question to ask is if you can choose the fund investment lineup (rather than using their proprietary options) AND that there is no additional recordkeeping charge to do so.

What some companies will do is increase your recordkeeping fee if you do not use their proprietary funds.

Another question to ask is if the default Target Date funds can be changed.

Because most participants invest in whatever the plan defaults to when they pick a retirement date, companies take advantage of this by making you keep their funds as the default selection.

You want to have the freedom to offer whatever default investment option you think is best for your employees and not be handcuffed.

Advisory Fee

The fourth potential service charge in a retirement plan is an advisory charge. This is usually optional and can be paid by the plan sponsor or the participants.

The plan advisor typically assists with employee education, plan pricing, investment monitoring, plan changes, etc. They are usually your first point of contact when questions arise about the plan.

This charge is normally asset-based but fixed-fee or flat-fee advisors are becoming more common.

Given the nuances and complexities of church plans and pastors, if you do decide to have an advisor, make sure he/she is familiar with these types of plans and participants.

Last Word on Fees

As you can see, there are various layers of services and charges in a retirement plan. Understanding them is a crucial step in choosing the best plan for your church.

The general guidance is to choose a flat-fee structure built with low-cost index funds in the investment lineup. It is recommended to vet at least three different providers to get an understanding of the service offerings and associated fees.

Once you determine the best fit, it’s now time to determine who pays for the plan.

Who Pays for It?

Now that we have a process to compare different providers’ services and fees, the next question to answer is, “who pays the fees?”.

Investment costs are paid by the participants but the recordkeeping, TPA, and advisor fees can either be paid by the church or the plan’s participants.

Be aware some plan providers will advertise that they can offer your church a plan at no cost.

This is usually an indicator that they are shifting the costs to the employees, typically through expensive investment options.

Keep in mind the saying, “there is no free lunch”. Someone is paying those costs and if it’s not the church then it’s the participants of the plan.

While it may be tempting to pass the costs to the employees, this decision could be short-sighted.

Do not lose out on this opportunity to gain your employees’ trust.

In some cases, you can save them thousands of dollars over their investing lifetimes, and if you do, show them!

In addition to growing your employees’ trust in the church, there are other practical reasons it may make sense to pay for some or all the plan’s costs.

One, you become more aware of the actual costs and benefits of the plan when it appears as an expense in the church’s budget.

If passed along to the employees, it can become ‘out of sight/out of mind’ while the employees’ retirement accounts are carrying the burden of the costs.

In addition, employees have become much more sensitive to fees as access to investing information is becoming more widely available.

If you are passing all the costs to the employees, it can make for some difficult conversations. If your church is not in a financial position to pay for a plan, at least re-evaluate every few years.

Who Runs the Plan?

Ok, so we have established what a retirement plan is, the different types of plans, the different services and costs associated, and finally how those costs are paid.

Now, we need to think about how the plan gets administered at your church.

If you have an administrative brain, you’re probably thinking, “how much work is involved with managing a plan?”. Great question! Let’s break it down into two different phases: start-up and ongoing.

Start-Up Phase

Most of the work for the plan is done on the front-end, particularly if you are starting from scratch.

Once you choose a plan provider, you’ll work with the TPA in drafting your plan document. As mentioned previously, you will most likely select a plan that has been pre-approved by the IRS and you simply need to select which features of the plan you desire (e.g., matching contributions, vesting, etc.).

Keep in mind, the more features you add, the more administrative work will be required to execute. Also, given that church administrators tend to have shorter tenures, someone needs to be able to communicate those to new administrators. Simplicity is your friend for many different reasons here.

After the plan document is drafted, the plan provider will gather employee data, and an investment lineup will be selected. With investments, keeping it simple is a good idea as well.

Remember, choosing the investment lineup is not just a one-time event. The investment lineup will need to be monitored to ensure your employees have a good investment selection for their accounts.

Once the plan has been drafted, employees have been set-up in the system, and investments selected, everything is now ready for the employees to set-up their contributions.

Having an introductory plan meeting is a good idea so that the church’s employees are aware of the plan, understand how to navigate the website to set-up their contributions, why saving is a good idea, etc.

This is a great opportunity to communicate your plan’s advantages and build trust with your employees.

Again, if you have saved your employees thousands of dollars by doing your homework, they should know! When employees know the potential growth their retirement plan can provide, it creates motivation to save.

Ongoing Support Phase

The plan is established, and employees are aware of and equipped to use it, now, you will need to provide ongoing support of the plan.

This support includes tasks like uploading payroll data to the plan provider so that contributions are applied correctly, questions about the website, how to contribute, etc.

You as the plan sponsor are the first place employees will go to have their questions answered.

A plan advisor or plan provider can provide support here as well, but you are usually the first line of defense.

In addition, there are annual reporting requirements. Luckily, though, the Non-ERISA Church Plans are exempt from the more cumbersome annual form 5500.

Establish an Investment Committee

To oversee and monitor the investments, it is a best practice to establish an investment committee. This is typically made up of board members, executive pastor/CFOs, finance directors, HR directors, staff members, etc.

The goal is to have a group of individuals that are reviewing the investments’ expenses, performance, etc. to ensure the investments provided to the employees are optimal.

Having a staff representative is a good idea as well to ensure the employees voices are being heard. This committee usually meets annually to review.

Closing Thoughts

Now you are off and running! You’ve selected the best plan, implemented it, have a plan for administering it, and created an investment committee to monitor the plan.

The hard work is done and now it is a matter of maintaining things. As you get comfortable with the plan, you’ll start to see it as a tool in your benefits strategy toolkit.

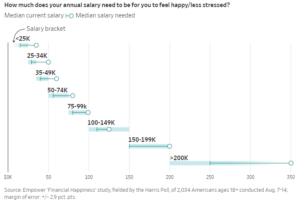

Keeping your eyes on items like participation rates (i.e., are employees using it?), contribution amounts, which funds are being used, etc. will help you get a feel for what’s working and what can be improved. It’s no secret that finances are one of employees’ top stressors, churches included.

Using this plan as a way to help your employees address those issues can be a huge win.

In closing, choosing a retirement plan is a true exercise in stewardship as the employees are reliant upon you to select the best plan.

By understanding how church retirement plans work, you can be a tremendous steward of your church’s and employees’ finances.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.

Should you invest in the market at all when CD’s, money market, high-yield savings, and T-bills are all at their highest rates in over a decade?

Pingback: The Pastor’s Housing Allowance in Retirement - Church Fiduciary

Pingback: 3 Tax-Savings Strategies for Retired Pastors - Church Fiduciary

Pingback: Pastors: Don’t Let Your Savings Be Someone’s Passive Income! (3 Ways It Could Be and How to Escape) - Church Fiduciary