Jake Ridley, CFP®

Jump to a Section

Intro to the Retired Minister Housing Allowance

What if I told you the retired minister housing allowance could boost ministers’ savings by thousands of dollars?

It could allow ministers to retire earlier, live more comfortably today and in retirement, and extend the life of their retirement savings.

Most ministers are very familiar with the benefits of a housing allowance prior to retirement, but not as many are aware that they can continue to enjoy those same benefits after they retire, creating the potential for thousands of dollars in tax savings.

The goal of this article is to create awareness for pastors and church boards, understand its potential value, and then know how to take advantage of it.

By the end you should have a firm grasp of how important this benefit it is and be able to take the steps to plan for it.

However, before I go too far, a quick history lesson on the how the clergy housing allowance came to be will help understand its purpose and why it can be used in retirement.

A History of the Retired Minister Housing Allowance

The genesis of the clergy housing allowance goes back to 1921 when pastors were first allowed to exclude from their compensation the ‘rental value’ of their housing (“parsonage”) if it was owned by the church.

This law created in 1921 and expanded in 1954 lays the foundation for the clergy housing allowance in retirement.

The idea is wages earned while performing pastoral duties and used for housing should be excluded from income. It has been updated throughout the years and most recently in 2002, was limited to include the ‘fair rental value’ provision which placed boundaries on how much could be claimed.

More pertinent to this article, though, are Revenue Rulings 63-156 and 75-22 which further clarified/expanded the housing allowance to include ‘amounts paid as compensation for his/her past services’ as excludable to income (i.e., it could be claimed in retirement).

This important ruling has opened the door to this major tax benefit for pastors. However, as we’ll mention later, the housing allowance has not come without its detractors – particularly in recent times.

Estimating the Potential Tax Benefit of the Retired Minister Housing Allowance

Now that I’ve introduced the concept and its history, let’s look at what makes this provision so powerful.

First, being able to exclude this amount from your income in retirement creates what’s called a “triple tax benefit”.

The “triple” refers to the contribution, growth, and distribution of the funds.

Most retirement accounts are either taxed when you contribute (e.g., Roth) or when you distribute (Tax-Deferred / Pre-Tax).

Having a triple tax benefit, though, means the funds are not taxed when contributed, as the funds grow, or when they are distributed.

This means those dollars are NEVER taxed – a big deal! If you are asking yourself, “This all sounds pretty important but how much money are we talking?”, have no fear.

Below are two scenarios that will illustrate the value.

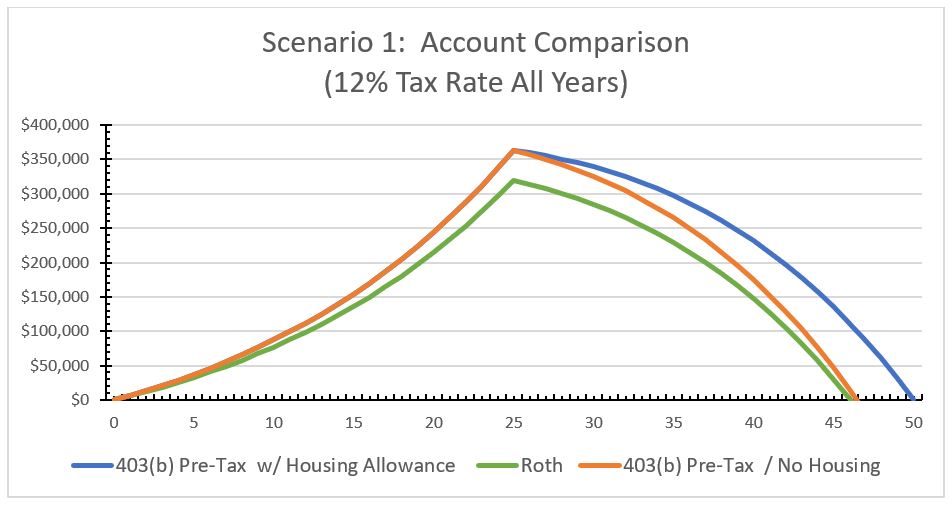

Retired Minister Housing Allowance Tax Savings: Scenario 1

Scenario 1 compares the three main account types pastors typically contribute to; pre-tax with housing allowance, Roth, and pre-tax without a housing allowance distribution.

The assumptions below are what were used for this scenario, followed by a graph comparing the account balances over the full 50-year time-period.

- Years Until Retirement: 25

- Annual Contribution: $6,621.70 (pre-tax) and $5,827.10 (Roth)

- Pre-Retirement Return: 6%

- Years in Retirement: 25

- Retirement Return: 4.5%

- Inflation in Retirement: 2%

- Marginal Rate: 12%

- Housing Allowance in Retirement: $20,000

A quick note on the assumptions. First, the assumptions used are meant to be on the conservative side.

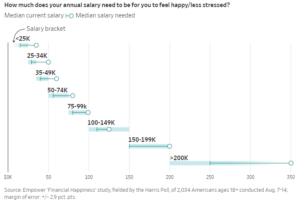

The reason is to be careful so as not to overstate the benefit. For example, on the tax front, the 12% marginal bracket is probably where most pastors reside currently.

However, this 12% is a historically low rate and there is a good probability tax rates will increase in the future.

Also, the return numbers being used are lower than historical averages.

Projecting future returns is a much-debated topic in the investment world, so erring conservatively helps prevent overstating the benefits.

When exploring the chart, the first thing to notice are the retirement balances.

Both pre-tax accounts have the same projected balance at retirement ($363,296.15) which is to be expected given neither are taxed prior to distribution.

Also, as expected, the Roth has a lower balance at retirement ($319,700.61) since its contributions have been taxed at the 12% rate.

So far so good. When we start distributing in retirement, though, you begin to really see the effect of the tax-free housing allowance.

Both the Roth and pre-tax / no housing accounts exhaust their funds around the same time (Year 46) because of their tax drag – either prior to retirement (Roth) or in retirement (pre-tax).

With the housing allowance distributions shielding the account from taxes, though, the account compounds (grows) at greater rates. This creates a “no-tax tailwind” that greatly extends the life of the account.

So great, in fact, that it creates more than $110,000 in additional spending or almost 4 years of housing expenses – a substantial amount of money!

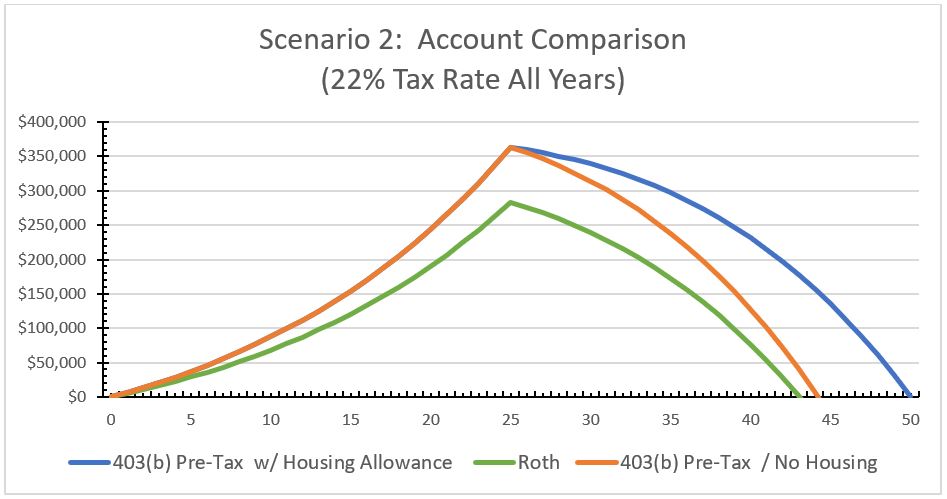

Retired Minister Housing Allowance Tax Savings: Scenario 2

Since the 12% tax rate may be increasing in the future, what happens to the balances if rates were to return closer to their historical average? Let’s look below at the updated balances in Scenario 2 if a 22% marginal tax rate is applied.

- Years Until Retirement: 25

- Annual Contribution: $6,621.70 (pre-tax) and $5,164.93 (Roth)

- Pre-Retirement Return: 6%

- Years in Retirement: 25

- Retirement Return: 4.5%

- Inflation in Retirement: 2%

- Marginal Rate: 22%

- Housing Allowance in Retirement: $20,000

Again, both pre-tax accounts have the same balances at retirement as Scenario 1 because the accounts have not been taxed.

The Roth, however, now has a balance of $283,371 at retirement ($36,329.61 less than in Scenario 1).

Again, this is because the contributions were taxed at the new rate of 22%.

During retirement, the pre-tax account without the housing allowance has its distributions taxed at the new 22%.

Now the Roth and pre-tax / no housing accounts exhaust their funds in years 44 and 45, respectively.

Not the housing allowance account, though. It continues chugging along without the tax drag for another 5-6 years and almost $180,000 in additional spending!

A Note on the Scenario Variables

As illustrated, the big takeaway is that the benefit of tax savings becomes greater the higher tax rates are.

Not having to pay taxes helps – who knew?!

Keep in mind, though, there are A LOT of unknowable variables at play here that can have a large impact on the ending balance.

Housing inflation, housing costs in retirement vs. pre-retirement (e.g., no mortgage in retirement), property tax caps in retirement, future tax rates, future returns, SECA exclusions, etc. are just some of the variables that can make a difference in the calculation.

The goal here is not to project things to the penny as much as it is understanding the major variables at play and making decisions using reasonable judgements. Don’t fall into paralysis by analysis!

How Do You Take Advantage of the Retired Minister Housing Allowance?

Now that the power of the retired minister housing allowance has been illustrated, let’s discuss the criteria that must be followed to receive it.

There are some key rules that must be met and, if they are not, the ability to use the clergy housing allowance in retirement could be forfeited.

You Must Be Retired

First, you must be at least age 59 ½ when you distribute the funds to qualify. This is the age that the IRS considers you ‘retired’ and eligible to distribute from retirement accounts penalty-free. Any age after this is generally considered ‘retired’.

The Account Must Have Ministerial Earnings

Second, the money being contributed to the account (employer or employee contributions) must have been earned performing pastoral duties as an ordained pastor.

This means if you are not ordained, you are not allowed to use funds contributed during this period for future housing allowance.

Distribute From a Church Plan (403(b), 401(k), etc.)

Check with your Finance Director, HR, Executive Pastor, etc. to ensure your 403(b) is a Non-ERISA Church Plan and not simply a standard ERISA non-profit 403(b).

The Plan Document (the retirement plan’s governing document) will indicate whether it is or is not. Additionally, this means you cannot distribute funds from an IRA and claim them as housing allowance.

One common mistake advisors not familiar with pastors will make is recommend a complete rollover from their 403(b) to an IRA upon retirement – a common and normal procedure in the secular world. Unfortunately, this will disqualify any distributions being claimed as housing. A better strategy is to keep some of the balance in the plan for future housing allowance.

However, you CAN roll funds from a Church Plan 403(b) into an IRA and then back into a Church Plan 403(b) because what matters is where the funds reside when the distributions are made.

Receive Approval From a Governing Body

Fourth, upon retirement, you need housing allowance approval from a governing body, just like you do prior to retirement.

If with a denomination, the retirement/pension board usually issues this.

If with a non-denominational church, the church board will need to approve it, ideally annually.

In retirement the housing allowance request works just like in pre-retirement, namely you don’t want to undershoot your actual housing expenses as the IRS only allows you to exclude from income the lesser of the requested amount, your actual expenses, or the fair rental value.

Use a CPA Familiar with Retired Clergy

As you are vetting CPA’s (if you do not already have one) you should ask for their experience specifically with pastors.

Consider mentioning the housing allowance in retirement to ensure they have experience in that area as well. If they aren’t aware of this, it’s probably best to look elsewhere.

Will the Housing Allowance Be Around at Retirement?

Before closing, I would be remiss if I did not touch on the future viability of the housing allowance.

While a very strong case can be made to contribute a percentage of your total retirement contribution amount to your pre-tax 403(b) for housing allowance in retirement, it is important to know the housing allowance has recently come under threat.

This made the housing allowance safe for now, but the fact that this almost 100-year-old provision came under threat is a sober reminder of the growing animosity to religious establishments.

This point is not meant to dissuade or scare but it may be a consideration as you are determining how much to contribute for future housing allowance.

As I’ve mentioned throughout the article, it is still recommended to at least plan for some amount of housing allowance in retirement but becoming aware of its threats is prudent.

Conclusion

In closing, the retired minister housing allowance is an incredibly unique and powerful tool.

Understanding just how powerful this provision is should motivate ministers and church boards to become aware of its power and plan accordingly.

As illustrated, this one simple decision can potentially add thousands of dollars (or more) to ministers’ retirement accounts and years to their longevity, so take advantage of it!

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. Performance reported gross of fees. You cannot invest in an index. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.

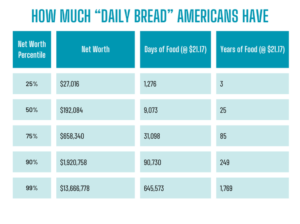

Most Americans have 25 years of “daily bread” stored up in their accounts. So, what does it actually mean for us to pray for “daily bread”?

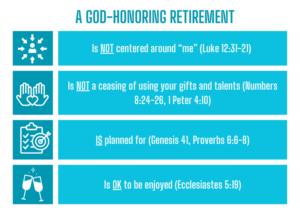

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?