Jake Ridley, CFP®

Table of Contents

Death and Taxes…

We’ve all heard the famous line from Benjamin Franklin, “Nothing can said to be certain, except death and taxes”.

But ol’ Ben never met a retired pastor.

Retired pastors have the opportunity to take the “certain” out of the tax equation.

Many pastors are well aware of tax savings while they’re employed, but retired pastors have even more tax reduction opportunities available to them.

These strategies can create a boost to their portfolio during the critical distribution phase of retirement.

Let’s explore three tax reduction techniques available to retired pastors and make those taxes less “certain”.

Housing Allowance in Retirement

Every working pastor knows the housing allowance is their best friend.

It takes a significant portion of a pastor’s income and shields it from income taxes.

The even better news for retired pastors?

That friend follows them into retirement as well.

How?

Through revenue rulings 63-156 and 75-22, distributions that come from a pastor’s retirement account are considered ‘amounts paid as compensation for past services.’

This means the IRS considers distributions from a qualified retirement plan (more on this below) as a form of compensation for past ministerial services.

Therefore, these funds can be eligible to be classified as housing allowance (i.e., tax-free for income tax purposes).

This is a very powerful tax-benefit unique to retired pastors.

To take advantage of this, though, there are several very important steps that must be taken.

- The funds MUST be distributed from a qualified church plan (i.e., not rolled into an IRA). Before rolling your 403(b) over into an IRA, make sure you account for this important factor.

- You must have the housing allowance approved by a church governing body (usually the church you retired from or your denominational board).

- You must be “retired”, usually defined as at least 59.5 years of age.

- The source of the distribution must be pastoral earnings. Be careful about mixing non-ministerial funds (e.g., money earned before you were ordained) with ministerial funds.

- The housing allowance must be the lesser of the fair rental value of your home, your actual housing expenses, or your requested allowance amount (the same as pre-retirement).

If you meet all the above criteria, then claiming the distribution as housing allowance can keep these from being classified as taxable income.

Qualified Charitable Distributions

Qualified Charitable Distributions (QCD’s) can be a powerful tool to avoid taxes on your Required Minimum Distributions (RMD’s).

As a reminder, RMD’s are the government’s way of making you distribute from your tax-deferred account (i.e., not Roth) so that you pay taxes on the income.

It’s basically them having you hold up your end of the tax-deferred bargain by realizing the funds as income.

Fortunately, you can satisfy all or a portion of your RMD through a Qualified Charitable Distribution.

The QCD is a distribution from your IRA sent directly to your charity of choice.

And because it is sent directly to the charity – not you – then it is NOT considered income. How do you take advantage of this strategy?

- You must be at least 70.5 years of age.

- The gift must be less than $100,000 (can’t say I’ve ever run into this one).

- Let your custodian know where the check from your IRA should be mailed. Make sure the check is made out to the charity and not you.

- The gift must be to a ‘Qualified Charity’.

The bottom line is QCD’s are great because they satisfy the RMD requirements AND aren’t counted as income.

This means you don’t have to itemize your deductions to be able to take advantage of them.

Most importantly, these distributions are shielded from the highest tax rates of ordinary income.

If you are over 70.5, take advantage of them!

Gifting Appreciated Securities

Do you have a brokerage account?

If so, you might have a significant charitable gifting opportunity at your disposal: gifting appreciated securities.

It starts with gifting actual shares of stocks you hold to your charity of choice (or your Donor Advised Fund).

If those shares have grown in value since you first purchased them, you will pay tax on the appreciated value if you sell (i.e., a capital gain).

But, if you give them directly to a charity, you don’t pay any capital gains tax.

Even better, you know who else doesn’t pay any capital gains tax?

The charity that receives them!

And then the cherry on top, you also receive a deduction (if you itemize) for the FULL value of the stock.

It’s a triple tax benefit: you avoid capital gains taxes, the charity doesn’t pay capital gains tax, and you get to deduct the full value of the stock if you itemize.

Below are key variables in deciding if this strategy is right for you.

- Estimate your capital gains rate. If you are in the 0% capital gains bracket, the lack of tax savings may not warrant the time required to process.

- Select securities with LONG-TERM gains (not short-term) in your brokerage account. It must be a brokerage account, not an IRA.

- Ensure your intended charity accepts stock donations. (If you have a Donor-Advised-Fund, it generally works best to give directly to this rather than the charity.)

- Keep records showing the estimated fair-market value of the gift to help substantiate for taxes. The charity should provide this information as well.

Gifting appreciated securities can be a great tool to have in your tax-minimizing toolbelt.

Keep this tactic in mind before you write a check to your favorite charity.

Give Your Retirement Savings a Tax Tailwind

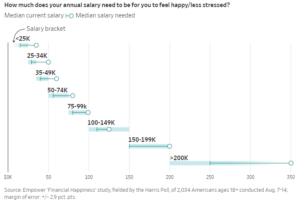

Making sure your retirement savings last throughout your lifetime are objectives 1, 2, and 3 for retirees.

Taking advantage of the housing allowance in retirement, utilizing qualified charitable distributions, and gifting appreciated securities can all provide a nice tax-minimization tailwind towards that goal.

So, take advantage of these unique opportunities, give your accounts the boost they deserve, and make that “death and tax” thing less “certain” on the tax side!

Is the American dream of retirement actually a tragedy? Let’s look at what the Bible has to say about it.

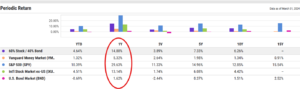

Don’t take it for granted when your investment fortitude pays off. Store it in your memory bank and build that resilience muscle for when (not if) the next downturn comes.

Why I am a fee-only advisor in Round Rock, Texas (the best town in America).

These two verses in Acts describe one of the most inspiring stories of generosity in the Bible.

Can a Christian enjoy money? Much has been (rightly) written about the dangers of money. But what about enjoying money?

2023 taught us several important investment lessons. Let’s take a look at three.