Biblically Responsible Investing [A Comprehensive Guide and Fund Analysis]

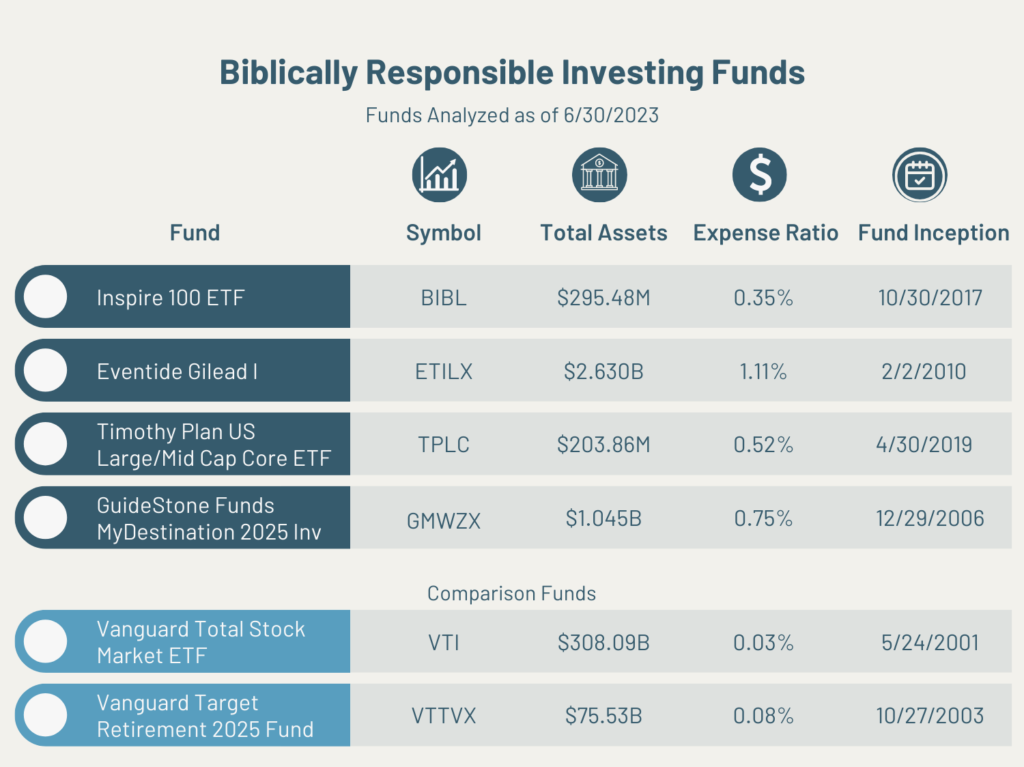

Biblically Responsible Investing (BRI) seeks to align an investor’s faith with their investments. This analysis provides an objective, Christian-based analysis of these funds, including reviewing their underlying holdings, faith objectives, and performance.

Biblically Responsible Investing [A Comprehensive Guide and Fund Analysis] Read More »